PGT Innovations, Inc. (PGTI,

$15.35): “Closing a Window”

By: Jordan Luczaj, AIM Student at Marquette

University

Disclosure: The AIM Equity

Fund currently holds this position. This article was written by myself, and it

expresses my own opinions. I am not receiving compensation for it and I have no

business relationship with any company whose stock is mentioned in this

article.

Summary:

·

PGT Innovations, Inc. (NYSE:PGTI) manufactures and sells both impact

resistant and non-impact resistant windows and doors. They have three brands

that they use to sell their impact resistant products: WinGuard, PremierVue,

and PGT Architectural Systems. PGT has a vast product line and assembles

products using both aluminum and vinyl frames.

·

On

September 22nd, 2017, PGTI sold $28 million in assets to Cardinal

Glass Industries. This was a strategic sale, given that PGTI also signed a

seven year supply agreement with the same company shortly after. Cardinal Glass

will continue supplying the glass components for doors at PGT’s current cost to

produce. This allows PGT to pay down debt and focus more on their core

business, which is window and door manufacturing.

·

Reconstruction

and remodeling make up the other 60% of PGTI’s business. Considering that Florida

represents around 90% of their market, the recent impact of Hurricane Irma is

significant. Management does expect R&R to be up next quarter and possibly

into next year based off of rises in demand due to damages and people’s desire

to refortify their residences.

·

In the

first half of 2018, PGT Innovations will be moving into a new facility in the

Miami area. They are planning on increasing ad expense to possibly gain

exposure here, as this is their first facility. Ideally, they want to

capitalize on the strong labor market in Miami, and be closer to large

customers in both Fort Lauderdale and Miami.

Key points: PGT Innovations has been a steady gainer,

and stands to see a pop in sales due to the increased reconstruction efforts in

much of Florida, especially the Gulf Coast. Their expanding market presence is

moving them closer to Miami-Dade County, which controls a lot of the impact

resistant glass/window regulations. PGTI sees large potential in the Florida

market, and hope to hit 20% EBITDA margins within two years. This is a realistic

goal, since they have attained 19% EBITDA margins, and will add depreciation

upon buying the building in Miami and increasing equipment in the facility they

retained after the sale to Cardinal Glass Industries.

Even though PGTI is focused on Florida,

they have not been shy about making acquisitions and growing in other markets. In

the past, they have made multiple acquisitions that have helped move them into

Canada, where 2.5% of sales now come from. There best opportunity for growth

prospects could be in interstate expansion, especially up the coasts and along

the Gulf where states are affected by hurricanes and natural disasters. They

also could see expansion in tornado alley where there is a need for impact

resistant products. During this year, sales outside of Florida have grown

between 25 and 30%.

Reconstruction efforts are going to

be heavy over the next few years, which should boost sales above expected

levels. PGTI will also continue their vertical integration to gain more control

on lead times and manufacturing processes, which should increase margins. PGTI

is built on a foundation of efficiency and market demand created by regulation

and consumer demand for safety.

Their management team has been strong, but

the CEO is stepping down after 2017. Even though he will continue to act as Chairman

of the Board, this is not ideal given his knowledge of the industry,

relationships with regulators and suppliers, and long-term planning ability.

What has the stock done

lately?

On November 2nd, PGTI missed

earnings and saw about a dollar dip in their share price. The miss was largely

driven by lack of demand given the hurricane filled quarter. Management

projected that there was a $13 million negative impact on sales due to

Hurricane Irma and a few million dollar escalation in expenses related to

complications. The stock did bounce back quickly after earnings, and is now

trading near a 52 week high.

Past Year Performance:

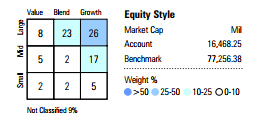

Over the last 12

months, PGTI has been on the up and up, returning 37% during that period. Since

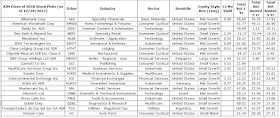

PGTI was added to the AIM Small Cap Equity Fund on April 25th, it

has returned 37.44%. There has been some volatility over the last year around

earnings dates and a large increase in share price correlated with timing of

the recent hurricanes.

Source: FactSet

My Takeaway:

PGTI has sped past

its target price of $13.80 in a little less than seven months. The stock was a sound

play given Florida’s housing demand and strong economy, high margins that are

increasing with efficiency, and a more than competent management team. However,

the stock has far exceeded my expectations mainly due to the effect that

hurricanes had on a majority of PGTI’s market space. I imagine that sales will

grow in 2018 above expected levels, but I wonder if PGTI is prepared for this

uptick and how it will affect their margins and long term plan going forward.

They will also be going through this during a major management transition. For

these reasons, I am skeptical and recommended that PGTI be sold from the AIM

Small Cap Equity Fund. There may be more potential left in this stock, but we

are happy taking a 37.44% return given the opaque future and current valuation.

Source: FactSet