Thursday, March 31, 2022

The Eighth Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, April 1st

AIM Class of 2023 Student Equity Presentations Friday, April 1st

The eighth set of spring AIM

equity presentations for the Class of 2023 will be on Friday, April 1st.

April 1st Write-ups

The 8-minute student presentations can be viewed

every Thursday afternoon on YouTube. Then join us live in person on

Friday at 1:00 pm CST in the AIM Room or stream live via the AIM YouTube

channel for the presenter’s Q&A.

If you are unable to attend, you can always view

them via YouTube HERE.

Wednesday, March 30, 2022

Thursday, March 24, 2022

Wednesday, March 16, 2022

A Small Cap Equity holding: First Internet Bancorp (INBK, $45.03): “Climbing With the Rate Hikes” By: August Peterson, AIM Student at Marquette University

First Internet Bancorp (INBK,

$45.03): “Climbing With the Rate Hikes”

By: August Peterson, AIM Student at

Marquette University

Disclosure: The AIM Small-Cap

Equity Fund currently holds this position. This article was written by myself,

and it expresses my own opinions. I am not receiving compensation for it, and I

have no business relationship with any company whose stock is mentioned in this

article.

Summary

- First Internet Bancorp

(INBK) is an online

regional bank holding company offering commercial and retail banking

products and services to individuals primarily in the Midwest. As of Q4

2021, the company has $4.2 billion in total assets and approximately $3.0

billion in total loans.

- Management has weathered the risk of interest rate

sensitivity to Net Interest Income by adjusting its deposit composition to

favor Non-Maturing Deposits over CDs & Brokered Deposits and MMDA

& Savings accounts.

- Future Net Interest Margin expansion is anticipated due

to CD repricing in the next twelve months, a higher yield on assets from

the First Century merger, and deployment of FCB’s excess liquidity to

retire the Bank’s high-cost deposits.

- Despite management’s risk-parity approach to minimizing

deposit betas and their strong capital allocation strategy, the market

continues to price INBK at a ~40% discount, as evidenced by an

unreasonably low P/TBV multiple.

Key points: With escalating geopolitical

tensions, rising inflation, and a Federal Reserve expected to raise rates seven

times in 2022 according to the CME as of March 10th, a flattened

yield curve poses a material threat to regional banks. Since the difference

between the 10-year and 2-year treasury yield is only ~25bps, the interest paid

by banks to customers has nearly converged to the interest generated from

investments. According to INBK’s Q3 interest rate sensitivity analysis, an interest

rate increase of 100bps reduces the company’s net interest income by 65bps over

a twelve-month period. Despite this, INBK has positioned itself to undermine the

risk of interest rate hikes in Q1 2022.

Non-Maturity Deposits (NMDs) have no stated

maturities and allow for customers to withdraw funds at any point in time (i.e.,

retail savings, interest and non-interest-bearing checking accounts, money

market accounts, etc.). Due to their short-term maturity and repricing nature, NMDs

are characterized by their low sensitivity to interest rate risk, or deposit

beta. In anticipation of the Fed’s expected rate hikes this year, INBK has

improved its deposit composition by holding a larger percentage of NMDs (2.8%

increase since 3Q21) and a smaller percentage of MMDA & Savings accounts (0.84%

decrease) and CDs & Brokered Deposits (7.1% decrease).

INBK saw a favorable fourth quarter as net income

and diluted EPS ended the fiscal year up 63% and 61%, respectively, over 2020

results. Net Interest Margin (NIM) increased 30 bps to 2.30% from 2.00% in the

third quarter, driven by a 22bp increase in the company’s yield on loans and a

6bp decline in the cost of interest-bearing deposits. NIM growth is expected to

continue as $712.8 million CDs with a weighted average cost of 1.02% will mature

in the next twelve months, and replacement costs are currently in the range of

~0.55%. Simply put, the company’s yields on assets are increasing while deposit

costs are decreasing. CD repricing coupled with a deposit composition favoring

NMDs, which provides a cheaper source of funding for the Banks’ assets than

other means, will catalyze future NIM expansion.

INBK’s partnership with ApplePie and the acquisition

of First Century Bancorp (expected to close 1H22) are proving to be lucrative.

ApplePie Capital, a franchise loan marketplace that sold $100 million of its

core conventional loans to INBK in 4Q21, has given the company a strong

franchise pipeline with a growing SBA loan portfolio. Franchise loan balances

were up 218% to $81.4 million from 3Q21, and SBA loans have grown nearly 6%

over the same period. Since only ~7.8% of First Century’s total assets are

comprised of loans, INBK management has decided to use $150 million of its

excess liquidity to retire the company’s high-cost deposits and use another

$150 million to purchase securities at yields close to 1.5%. The merger will

effectively raise asset yields as INBK’s current excess cash earning an average

yield of only 0.33% will be reduced while securities earning ~1.5% will be

gained. NIM will further expand as higher-cost deposits will be retired.

What has the stock done

lately?

Since

being inducted into the AIM Small Cap Fund, INBK is up ~1.5%. The stock reached

an all-time high at $52.80 following its earnings release on January 19, 2022,

before a steady decline to today’s price. INBK followed the performance of the

Russell 2000 closely until it announced its merger with First Century Bancorp

on November 2, 2021, when the stock jumped over 25% in a single day.

Past Year Performance: Despite a negligible change in the stock’s

price since November, INBK still remains undervalued as the company’s P/TBV of

~1.2x falls short of a regional/tech-centric bank peer average of ~1.7x. With a

P/E of 9.8x and EPS growth anticipated to add another dollar from the merger of

First Century in 2022, it’s safe to say that Ben L’Empereur’s thesis remains

palatable.

My Takeaway

Management

has aptly positioned INBK to mitigate the risk of high deposit betas from the

Fed’s expected seven rate hikes in 2022. Several factors are expected to

catalyze expansion in the Bank’s NIM in the coming years; CD repricing in the

next twelve months (weighted average cost 1.02% compared to current replacement

cost ~0.55%), changing deposit composition favoring NMDs (cheaper source of funding

for Bank’s assets), and the deployment of excess capital from the First Century

merger. It’s evident that management understands how to weather interest rate

risk while being exceptional capital allocators. Despite this, The Street

continues to price First Internet Bancorp at a ~40% discount per relative valuations.

An International Equity holding: IonQ (IONQ, $11.77): “Quantum-Mania” By: Nasser Hyat-Khan, AIM Student at Marquette University

IonQ

(IONQ, $11.77): “Quantum-Mania”

By: Nasser

Hyat-Khan, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position.

This article was written by myself, and it expresses my own opinions. I am not

receiving compensation for it, and I have no business relationship with any

company whose stock is mentioned in this article.

Summary

- IonQ,

Inc. (NYSE: IONQ) develops and manufactures quantum

computers. The firm specializes in quantum computing and quantum

information processing, bringing this new technology into commercial, industrial,

and academic applications.

- IonQ’s

quantum hardware is now available on all major clouds (AWS, Azure, Google

Cloud) and all major quantum software development kits (SDK’s). They have

partnered with top academic institutions such as Cambridge, MIT, Oxford,

Princeton, University of Chicago and more.

- The

revolutionary company has recently reported that they will publish FY21

financial results on March 28, 2022.

- They

have recently developed a new barium-based quantum computer which,

per-qubit, has reduced errors over 12x.

- IONQ

may be off its 52-week highs, but with the latest innovations, we could

see the stock push passed those figures.

Key

points: IonQ continues to outperform its

competitors in technological developments. On March 3rd, they

reported that its new Barium systems demonstrated industry leading qubit

readout performance. According to the article, per-qubit, IonQ has reduced

errors from

50 per 10,000 computations to 4 errors per 10,000 computations. This development

has brought IonQ from a 99.5% state detection fidelity, up to first place in

the industry with 99.96%.

One of

the many perks in this industry is that there are a lot of complicated acronyms

with words that make little sense to most readers, but fear not I am here to

help. In short, a regular computer operates step-by-step on “bits” (0’s and

1’s), a quantum computer uses “qubits” that can operate both 0’s and 1’s and

everything in between simultaneously. Something a regular computer would take

centuries to process; a quantum computer could accomplish in several minutes.

IonQ is

famous for its Quantum Volume, which is the overall metric that measures the

capabilities of a quantum computer, more volume means more circuits means more

computing power. With the latest information IonQ boasts a 4.2 million QV. Its

closest competitor Google is at 256 QV.

This is

an astounding number, but one of the drawbacks with new technologies is that

there are issues. One of problems in the industry are state preparation and

measurement (SPAM) errors. SPAM errors are key metrics for producing accurate

and reliable quantum computers, which were the computation errors mentioned

previously that have since been reduced significantly.

The

accuracy of computing results is key for the further adoption of quantum

computers in all industries from finance to agriculture. However, there are

three main types of errors that a QC’s experience: imperfect state preparation

at the beginning of a program, imperfect logic gates while running an

algorithm, and imperfect measurements. Essentially for the computer to do its

job these errors have to be terminated quicker than Lewis Hamilton can go

around an F1 track.

Fortunately, IONQ is doing that

better than anyone else with a technical lead over all commercial quantum

computing providers. Its ion-trapped computers have proven to yield more qubits

than any other architecture, and it seems as though barium computers will

surpass its predecessor.

What

has the stock done lately?

IonQ has fallen off its weekly

high of $16.57 by almost 30%. This may sound like a lot but given current

market conditions and how the rest of the tech industry has been treated over

the last few months this is not surprising. With earnings coming up, a better

picture should be shown of how the company is operating.

Past

Year Performance: Since its public

release, IonQ has seen lots of volatility. At one point the stock was up over

400% and has since come down from its $35.90 high by about 60%. The AIM

programs conservative price target of $18.34 was surpassed and shares remained

above for months, but global factors such as COVID and Russia have been

affecting the stock price ever since.

My

Takeaway

IonQ is a pure play quantum

computing company that has consistently developed outperforming computers that

are available to commercial, industry, and academic users through SaaS. The

stock price decline over the last several months indicates an interesting

long-term buy opportunity. The innovation at this company is unprecedented, and

the high of $35.90 demonstrated that not only could our long-term valuation be

beaten, but Wall Streets as well. The current share price of $11.77 depicts a

serious discount opportunity for investors with the potential for massive

upside in the future. Quantum computing is still in its early stages, but at

the rate that IonQ is developing its craft, we may see those highs become the

lows.

An International Equity holding: Hitachi (HTHIY, $91.91): “Ahead of the Curve” By: Margaret Diedrich, AIM Student at Marquette University

Hitachi

(HTHIY, $91.91): “Ahead of the Curve”

By: Margaret

Diedrich, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Hitachi Ltd. (OTCMKTS: HTHIY) is

a Japanese conglomerate that offers a range of services to their customers

including energy facilities, water distribution, and information

technologies.

- HTHIY

is in a position to continue to grow. Their sales growth has transitioned

into their digital and green business.

- Management

has announced a new organizational structure. Their new structure will

revolve around renewable energy, digital systems, and connective industries.

The transition is meant to improve overall efficiency and help meet new client

demands.

Key

points:

Hitachi

Ltd. has a strategic focus on sustainable business practices. They are committed

to becoming a global leader in renewable energy technology. They will accomplish

this through focusing on environmental improvement, resilience, and security

and safety. These attributes are evident in Hitachi’s newfound focus on green

and technological business initiatives.

Hitachi’s

renewable energy business is an exciting position for growth. The Japanese

economic environment is primed for expansion in this area. The company sees

47.6% of revenue come from Japan. According to the International Trade

Administration, 36-38% of Japan’s energy will come from renewables by 230. This

provides an enormous growth opportunity for the company.

In

addition to the company positioning itself as a leader in green technology,

other segments will transition to focus more heavily on digital solutions. The

company announced the formation of Hitachi Automation, a new business segment

focused on robotic structures. It is this constant innovation that continues to

add value to shareholders.

What

has the stock done lately?

The stock has experienced a substantial

dip since mid-November. The stock price fell from $128.57 to the current price

of $92.94. Despite this recent dip, Hitachi Ltd. is in a position to continue

to grow. Their transition to digital and renewable technology is an encouraging

signal to shareholders. The stock was pitched in the Spring of 2020 at a price

of $80.79.

Past

Year Performance: HTHIY has a 52-week range of $89.00 – 128.56.

Currently the stock is trading at $91.59.

My

Takeaway

Hitachi Ltd. provides services to

a multitude of industries worldwide. The company is known for being an innovative

leader in each industry they operate in. My takeaway is that Hitachi is an

established company that has potential to grow in their technology and green

businesses. I recommend we hold Hitachi. Their diversified businesses and new

innovative initiatives will prove to be a stable bet, especially in this time

of global political instability.

Thursday, March 10, 2022

An International Equity holding: Wheaton Precious Metals (WPM, $43.48): “Not So Precious Anymore” By: Alexander Mastalish, AIM Student at Marquette University

Wheaton Precious Metals (WPM, $43.48): “Not So Precious Anymore”

By: Alexander

Mastalish, AIM Student at Marquette University

Summary

Wheaton

Precious Metals, Corp. (NYSE:WPM) is a mining company which deals

with the sale of precious metals. They primarily sell three precious metals:

Gold, Silver and Palladium.

- Wheaton

currently has 24 operating mines with 12 development projects spread across

the Americas with some European exposure.

- 85% of current production comes from assets

that fall in the lowest half of the cost curve.

- WPM

currently one of the highest rated materials sector companies in regard to

ESG (AA Rating) and the WPM is a part of the UN Global Compact as well.

- Wheaton

current pays a high dividend which is increasing by 25% YoY to $0.15 per

share.

Key

points: Wheaton Precious Metals is a streaming metals company. When a

company is a streaming metals company, it makes an agreement with mining company

to purchase most of the mining company production at a set price in advance. The

streaming model offers WPM the advantage of buying below the cost curve often (85%

as of 2021 Q3), allowing WPM to lock in pricing in advance and better position

the company against price volatility. Streaming also allows for the precious

metal company to focus on selling the good to end user, and the miners on

mining. This reduces the cost of operations for Wheaton compared to if it had mining

operations of its own. WPM’s main partners include Capstone, Rio2 and Artemis.

The company has seen a decrease

in gold production, primarily due to a lower output from a major partner Vale

and their Salobo operation, alongside a decrease of production at the Sudbury

operation. These challenges in production helped contribute to the decrease in

adjusted net earnings for WPM. This has also caused the trend of WPM missing

earnings expectations for all of 2021, and missing revenue on 2 of the 3 quarters

so far announced in 2021. Most notably, Q3 2021 saw a 12.5% decrease in

revenue, while also seeing a 10% decrease in earnings.

To reverse this trend, management

is planning on continuing their development projects for increased growth. A

partnership with New Gold and Artemis Gold in Canada will further diversify

Wheaton’s existing portfolio, while strengthening the partnership with Artemis.

The project will start in 2021 Q4 and be complete in 2024. Management also just

increased the dividend to $0.15 in Q3 of 2021, a 25% YoY increase,

demonstrating their commitment to shareholders.

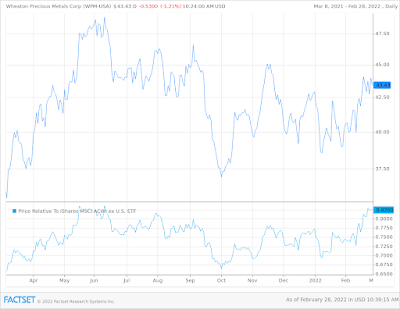

What

has the stock done lately?

The

company has seen steady growth in the last month, seeing share price increasing

7.84% over that time period. At its current share price, WPM is trading at 47.15%

upside from the original pitched price target of $29.50. The company in the

last 6 months is down 3.46%, while being down 19.02% from the all-time high share

price in July of 2020.

Past

Year Performance: Wheaton’s share price has seen great growth after rebounding

from a drastic sell off from its all-time high in July 2020. Share price for

the year has been up 21.86%, primarily from the elevated commodity prices in

the spring and summer of 2021. Going forward, Wheaton is poised to see growth,

albeit at a slower rate than the first 6 months of the past year.

My

Takeaway

Wheaton

Precious Metals, while being an industry leader and have demonstrated their capabilities

to diversify and expand their current portfolio, have already seen much of the

growth attached to these strengths. Therefore, WPM has underperformed earnings

and revenue expectations in 2021. This has raised concern over the firm’s

long-term performance and it is for that reason that I recommend WPM should be

sold from the AIM International Portfolio, recognizing 98.15% upside from the

original purchase.

A Small Cap Equity holding: Paycom Software, Inc. (PAYC, $324.45): “Paycom Is Paying Off” By: Richard Zaro, AIM Student at Marquette University

Paycom Software, Inc. (PAYC, $324.45): “Paycom Is Paying Off”

By: Richard

Zaro, AIM Student at Marquette University

Summary

- Paycom

Software, Inc. (NYSE: PAYC) Paycom Software, Inc. provides

comprehensive, cloud-based human capital management (HCM) software solutions. The

Software-as-a-Service platform provides functionality and data analytics that

businesses need to manage the complete employment life cycle from recruitment

to retirement.

- Its solutions require virtually no customization and is based on a core system of record maintained in a single database for all HCM functions, including talent acquisition, time and labor management, payroll, talent management and human resources management applications.

- PAYC recently reported earnings in which they outpaced their own guidance for fiscal ’21.

- For each of the years ended December 31, 2021, 2020, and 2019, PAYC’s gross margin was approximately 85%. Management has detailed that it expects its gross margin to remain relatively consistent in future periods.

Key

points

Paycom Software, Inc. has shown

exceptional growth over the past year. Revenue growing over 25% to $1.04 Billion

year over year. With an increasing market presence and growth of the companies it

serves, PAYC should see continued revenue growth and continued demand for its human

capital management software.

Management indicates that it

plans to continue to grow PAYC by growing its client base to include larger companies.

Paycom believes larger employers represent a substantial opportunity to

increase the number of potential clients and to increase our revenues per

client, with limited incremental costs.

Paycom Software, Inc. expects to have

its 2022-year end revenue be about $1.3 billion, an approximate 25% growth for

the year. This substantial growth rate has been partially due to increasing market

share and an overall growth in the industry and the need for human capital management

software.

Paycom Software, Inc. also has

been continuing to repurchase its shares. During the year ended December 31, 2021,

Paycom repurchased an aggregate of 163,849 shares of common stock at an average

cost of $400.24 per share. Paycom will continue to repurchase its shares until

their stock repurchase plan expires on May 13, 2023.

What

has the stock done lately?

Over the past month, PAYC has dropped

about 3.22% while the Russell 2000 Index has dropped about 2.22%. The stock’s

value has ranged from $300.98 to $364.94. The stock price has seen a decline since

2/17 after its earnings were released. The current price is hovering around $320.00

which is about ~13% off its month high.

Past

Year Performance: SPSC has decreased 15.05% in value over the past

year, trading at a high of about $558.97 in November 2021 and currently trading

around $320.00. In the past year, the stock has had a bull run that was put to

an end in November, and it has been beginning to stabilize just these past few

weeks.

My

Takeaway

Since being added to the AIM fund,

PAYC has exceeded its expectations. The increased demand for human capital management

software, the growth of the companies that PAYC serves, and an overall need for

solutions all benefit PAYC’s business. Management placing an emphasis on

growing the company and seeing revenue estimates continue to rise make PAYC a

strong investment. Although recent drops in share price make Paycom a daunting

investment, strong fundamentals show that it is an extremely strong company doing

better than ever. It is recommended that the AIM fund continues to hold their PAYC

position.

An International Equity holding: Vestas Wind Systems (VWDRY, $8.35): “A Blow Over” By: Hannah Cehaic, AIM Student at Marquette University

Vestas

Wind Systems (VWDRY, $8.35): “A Blow Over”

By:

Hannah Cehaic, AIM Student at Marquette University

Summary:

- Vestas Wind Systems, AS ADR.

(OTCMKTS:)VWDRY is the market leader of renewable energy

which install, manufacture, and service onshore and offshore wind

turbines.

- Vestas

2021 outlook has decreased again for the second time this year, making

their shares decrease as much as 14%.

- Vestas’

business and manufacturing has not responded well to the current supply

and shipping constraints.

- There

is a pending management change of CFO’s.

- New

wind farm contract in Estonia.

Key

points:

Vestas Wind Systems has undergone

a lot of stress since mid 2021 up until now. With supply chain issues and lack

of resources, Vestas has been under attack. The stock price has taken a hit

since then and has yet to increase from their high price of $17.23.

Recently, current CFO of Vestas,

Marika Fredriksson has handed over the financial reigns to new upcoming CFO

Hans Martin Smith. Hans Martin has many years of experiences as CFO of Vestas

Northern & Central Europe. This change will be implemented on March 1st,

2022.

Even though new management seems

promising, Vestas is still under water in terms of the industry. Costs of steel

and other materials are skyrocketing. Additionally, supply chain issues and

COVID have still led to slow delivery scheduled which has delayed many

operations. This has halted the completion of wind farms which has resulted in

firms not wanted to purchase these wind turbines due to volatile pricing and

unreliable shipping.

Though there a few setbacks with

the company, Vestas has recently won an Estonia turbine contract. This allows

Vestas to contract and supply turbines for Enefit Green’s Purtse wind project

in Estonia. This will allow the creation of electricity in Purtse using

renewable turbines. The construction of these new wind farms in Estonia will

begin early next year.

Recent

Performance:

Vestas’s

stock has been decreasing since middle of last year after the rise of material

costs and supply chain issues. From January of 2022 to February of 2022, the

stock alone has plummeted a whopping -17.55%. Additionally, Vestas has had a

negative average one month return of -6.87%. The new Estonia contract and new

management are needed to help pick up the stock’s pace.

Past

Year Performance:

Vestas

has decreased -47.50% in value over the past year. Vesta’s YTD returns are

-18.68 compared to the benchmark of -8.57. It is evident that geopolitics have

impacted Vestas in a very negative way.

My

Takeaway:

The new

contract in Estonia shows very promising returns of creating more wind farms,

specifically green wind farms. However, the building contract does not start

until early next year which still leaves almost a full year of Vestas to keep

up with changing geopolitical risks such as supply chain issues and increase

material costs. Vestas will need to complete another contract this year to keep

up with lost revenue despite changing geopolitical risks.

The Sixth Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, March 11th

AIM Class of 2023 Student

Equity Presentations

Friday, March 11th

Follow the link to access the student equity write-ups.

The 8-minute student

presentations can be viewed every Thursday afternoon on YouTube. Then join us live in person on Friday at 1:00

pm CST in the AIM Room or stream live via the AIM YouTube channel for the

presenter’s Q&A.

If you are unable to attend, you can always view

them via YouTube HERE.

Tuesday, March 8, 2022

Applied Investment Management Challenge: An anonymous donor from the Class of 1984 will donate $100,000 in support of the Applied Investment Management (AIM) Program when we secure 100 donors to the program.

Support the AIM Program on #GiveMUDay

Applied Investment Management Challenge: An anonymous donor from the Class of 1984 will donate $100,000 in support of the Applied Investment Management (AIM) Program when we secure 100 donors to the program.

Click here to support AIM today!

Other Opportunities

There is a range of opportunities to support the College of Business Administration today, with matches and challenges that can multiply the impact of your gift today!

Mark Schoenfelder, Bus Ad ’02, and Sarah Schoenfelder, Bus Ad ‘02, will match $2 for every $1 of gifts directed to the College of Business Administration up to $100,000.

Plus, if you make a gift today by 12:00 a.m. CT, you can choose your favorite pair of exclusive Marquette socks. Leave your footprint and give back here!

You can also participate today by helping us secure these challenges:

Applied Investment Management Challenge: An anonymous donor from the Class of 1984 will donate $100,000 in support of the Applied Investment Management (AIM) Program when we secure 100 donors to the program.

Click here to support AIM today!