Return Performance Results for the AIM Equity Funds for the Class of 2018

The students in the AIM program manage two equity portfolios for Marquette University's endowment. The AIM Small Cap Equity Fund is benchmarked to the Russell 2000 Index (a small cap blend of 2000 publicly traded firms in the US with market capitalizations between about $500 million and $3 billion).

The AIM International Equity Fund is benchmarked to the Russell Global xUS Index (this represents over 90% of the investable universe of non-US equities). The AIM students are limited to only investing in ADRs and global stocks denominated in US dollars - which results in a currency effect within the portfolio across time versus the benchmark.

For both portfolios the AIM students employ a bottom-up, fundamental approach to portfolio construction. The small cap portfolio needs to remain sector neutral, while the international portfolio has the dual task of attempting to remain sector neutral without taking huge region or country exposure.

AIM Small Cap Equity Fund

AIM Small Cap Equity Fund

Since its inception in September 2005, the AIM Small Cap Fund has had a slight tilt toward growth stocks. As can be seen in the graph below, as of 5/31/2017 over 50% of the stocks were considered 'growth' according to Morningstar metrics; while only 7% were tagged as 'value' stocks.

The students in the AIM program do not attempt to 'time the market' and instead focus on adding and holding high quality equities with an investment window of 3 to 5 years. While small cap growth and value stocks tend to perform similarly over the longer term, there are times when performance of the two deviate. It is our philosophy that by being bottom-up, fundamental analysis driven, the equity funds managed by the AIM students for the University's endowment will achieve long-term returns in excess of the Russell 2000.

The fund has exceeded the benchmark by 1.6% since April 1, 2017 (the beginning of the holding period for the Class of 2018). Strong relative performance of the health care sector has been responsible for nearly all of the excess return performance.

The tables below pertain to the AIM Small Cap Equity Fund (they can be enlarged by clicking on the graphic). Note: performance tables for the AIM International Fund are below these.

AIM International Equity Fund

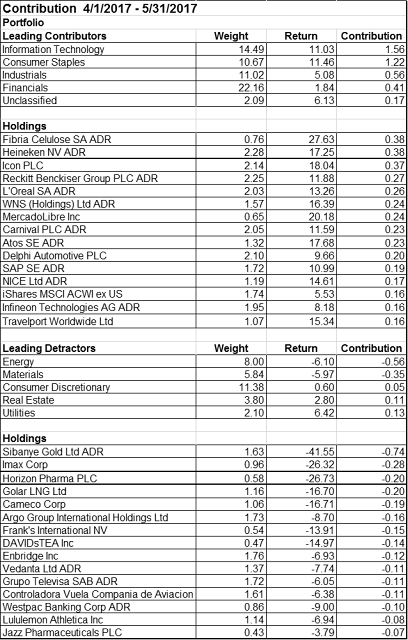

The AIM students in the Class of 2018 have had a challenging start to their portfolio experience. While the absolute returns have been strong the past year, the performance for the first two months has been challenging (3.6% versus the benchmark of 6.0%). Issues related to NAFTA and energy policy have resulted in an underperformance in Energy and North American equities (especially Canadian and Mexican stocks). A close examination of the attribtuion tables will reveal that 2.0% of the underperformance is directly attributable to the overweight of North American holdings in the portfolio.

As the table below shows, the AIM International Fund has a slight growth tilt - it also tends to have a slight bias towards more mid- and small cap holdings than the benchmark. This portfolio has significantly more tracking error to the benchmark than the AIM Small Cap Equity Fund, as would be expected.