Scott Minerd of Guggenheim Partners (Commercial Real Estate) is very bullish in a Bloomberg interview. Cites historical trends involving the financial marekts and economic business cycles.

Thursday, April 30, 2009

Chrysler Bankruptcy Will Reopen the Pandora's Box of Counterparty Risk

Confirming earlier reports, Chrysler filed for bankruptcy Thursday afternoon, and formed an alliance with Fiat. Under the new partnership, Chrysler hopes to emerge from bankruptcy "in as little as 60 days," says The AP, which further reports: "The government, which has already poured $4 billion in loans into Chrysler, would provide up to $8 billion more to carry the company through bankruptcy, said senior administration officials speaking on condition of anonymity."

Chrysler's bondholders will now take their case to a bankruptcy court, drawing the ire of President Obama: “I don’t stand with those who held out when everyone else is making sacrifices,” he said today.

Earlier: Chrysler appears headed for a bankruptcy filing after talks with its creditors broke down. If Chrysler’s creditors refused to take about 30 cents on the dollar for their approximately $6.9 billion of debt, what are the odds GM bondholders will take 10 cents on the roughly $27 billion of GM debt they hold, as has been proposed? (GM bondholders have presented a counter offer featuring a debt for equity swap, The WSJ reports.)

And if the Obama administration’s hard line with the automakers' creditors fails, is there any hope for a change in the current policy of paying bank debt holders 100 cents on the dollar?

In the accompanying video, the implications of this latest twist in the Chrysler saga are discussed. “It feels like the bondholders are willing to take their chances in bankruptcy court,” Harrison says. “If that is the precedent that’s set, we enter into the realm of counterparty risk.”

Noting there are upwards of $400 trillion of derivatives contracts in the system, the issue of counterparty risk could rear its ugly head again, Harrison says. “We can only hope we’ve learned from past mistakes [with AIG] in how we deal with these institutions.”

Chrysler's bondholders will now take their case to a bankruptcy court, drawing the ire of President Obama: “I don’t stand with those who held out when everyone else is making sacrifices,” he said today.

Earlier: Chrysler appears headed for a bankruptcy filing after talks with its creditors broke down. If Chrysler’s creditors refused to take about 30 cents on the dollar for their approximately $6.9 billion of debt, what are the odds GM bondholders will take 10 cents on the roughly $27 billion of GM debt they hold, as has been proposed? (GM bondholders have presented a counter offer featuring a debt for equity swap, The WSJ reports.)

And if the Obama administration’s hard line with the automakers' creditors fails, is there any hope for a change in the current policy of paying bank debt holders 100 cents on the dollar?

In the accompanying video, the implications of this latest twist in the Chrysler saga are discussed. “It feels like the bondholders are willing to take their chances in bankruptcy court,” Harrison says. “If that is the precedent that’s set, we enter into the realm of counterparty risk.”

Noting there are upwards of $400 trillion of derivatives contracts in the system, the issue of counterparty risk could rear its ugly head again, Harrison says. “We can only hope we’ve learned from past mistakes [with AIG] in how we deal with these institutions.”

Bond Markets Did Not Like the FOMC Announcement

Federal Reserve officials left the door open to boosting their emergency programs to aid financial markets and the U.S. economy even as the worst recession in five decades shows signs of waning. The Fed’s Open Market Committee voted unanimously yesterday to keep unchanged its targets for purchases of long-term Treasuries and housing debt announced last month. At the same time, the panel will “continue to evaluate the timing and overall amounts” the central bank buys. The Fed said it will keep purchasing as much as $1.25 trillion of mortgage-backed securities, $200 billion of federal agency debt and $300 billion of Treasuries as part of efforts to reduce home-loan rates and “improve overall conditions in private credit markets.”

Wednesday, April 29, 2009

Volker Says The Economy Has Levelled Off, More Stimulus Needed

Bloomberg TV interviewed Former Fed Chair Paul Volcker. He says the economy has a long way to go and that housing is the key indicator to watch.

Six Banks Fail Stress Test

Six banks have failed the preliminary stress test, Bloomberg says. They're now appealing. The government wants these banks to raise capital by converting preferred stock to common stock, which would stave off the need for additional capital injections. This makes sense, but debtholders should be forced to do the same thing.

At least six of the 19 largest U.S. banks require additional capital, according to preliminary results of government stress tests, people briefed on the matter said. While some of the lenders may need extra cash injections from the government, most of the capital is likely to come from converting preferred shares to common equity, the people said. The Federal Reserve is now hearing appeals from banks, including Citigroup Inc. and Bank of America Corp., that regulators have determined need more of a cushion against losses, they added.

By pushing conversions, rather than federal assistance, the government would allow banks to shore themselves up without the political taint that has soured both Wall Street and Congress on the bailouts. The risk is that, along with diluting existing shareholders, the government action won’t seem strong enough.

At least six of the 19 largest U.S. banks require additional capital, according to preliminary results of government stress tests, people briefed on the matter said. While some of the lenders may need extra cash injections from the government, most of the capital is likely to come from converting preferred shares to common equity, the people said. The Federal Reserve is now hearing appeals from banks, including Citigroup Inc. and Bank of America Corp., that regulators have determined need more of a cushion against losses, they added.

By pushing conversions, rather than federal assistance, the government would allow banks to shore themselves up without the political taint that has soured both Wall Street and Congress on the bailouts. The risk is that, along with diluting existing shareholders, the government action won’t seem strong enough.

In Weak GDP Report, Bulls See Reasons for Optimism

Stocks rallied sharply into Wednesday's FOMC announcement despite a much weaker-than-expected report on first-quarter GDP...or maybe because of it. The 6.1% decline was far worse than forecasts, but bulls took heart that a big chunk of the decline stemmed from a record $103.7 billion drop in business inventories. With inventories so lean, the hope is that businesses will have to start running production at or near full capacity once the recovery gets underway, or risk being out of stock and losing potential sales.

Meanwhile, consumer spending rose 2.2%, boosted by big gains in purchase of durable goods. Finally, state and local government spending fell 3.9%, the largest decline since 1981 -- but nobody expects that trend to last. "With the ‘spend-out' from the fiscal stimulus likely to kick into gear beginning in the second half of 2009, and with demand stabilizing, government spending and inventory restocking should be accretive to growth during the second half of the year," writes Michael T. Darda, chief economist at MKM Partners.

The market is also rallying because the end of the month is coming, which is forcing those short or "under-invested" to scramble and get long (or at least flat). But on a more fundamental basis, the market's recent rally is pricing in a more robust second-half recovery than today's GDP report suggests is likely, certainly not from the headline figures.

"Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time," the FOMC said in its policy statement.

Meanwhile, consumer spending rose 2.2%, boosted by big gains in purchase of durable goods. Finally, state and local government spending fell 3.9%, the largest decline since 1981 -- but nobody expects that trend to last. "With the ‘spend-out' from the fiscal stimulus likely to kick into gear beginning in the second half of 2009, and with demand stabilizing, government spending and inventory restocking should be accretive to growth during the second half of the year," writes Michael T. Darda, chief economist at MKM Partners.

The market is also rallying because the end of the month is coming, which is forcing those short or "under-invested" to scramble and get long (or at least flat). But on a more fundamental basis, the market's recent rally is pricing in a more robust second-half recovery than today's GDP report suggests is likely, certainly not from the headline figures.

"Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time," the FOMC said in its policy statement.

Fed's FOMC Meeting Concludes Today

Today is the second day of the FOMC meeting. Bloomberg interview with Former Fed Director of Monetary Affairs, Vincent Reinhart, discusses stress testing and likely Fed actions.

BoA and Citi Fail Stress Tests: Need To Raise More Capital

It's not good news that Bank of America (BAC) and Citigroup (C) have been told to raise more capital following the completion of the Fed's stress tests. The thing is, the stress test isn't even that stressful, so if they're being told to raise more cash under this scenario, how much more would they need under realistic worse-case conditions?

But the defenders are all out with the same line: Well, gee, everyone knew they needed more cash, how can this be a surprise to anyone?

The big problem with that reasoning is that shares of Bank of America and Citi are both off today. So it's kind of hard to be arguing that the news was already priced in when the news is moving the shares so much.

And there's the problem of the banks denying the stress test's conclusions and filing an appeal. So it's as though everyone knew they needed more capital - everyone except shareholders and banking CEOs.

But the defenders are all out with the same line: Well, gee, everyone knew they needed more cash, how can this be a surprise to anyone?

The big problem with that reasoning is that shares of Bank of America and Citi are both off today. So it's kind of hard to be arguing that the news was already priced in when the news is moving the shares so much.

And there's the problem of the banks denying the stress test's conclusions and filing an appeal. So it's as though everyone knew they needed more capital - everyone except shareholders and banking CEOs.

UAW, Fiat, and US Government Might End Up Owning Chrysler

Chrysler has reached separate deals with the UAW and its bondholders that may help the automaker avoid bankruptcy, although the White House won't rule out that outcome. But if all goes according to plan, the proposal will leave Chrysler with a radically new ownership structure:

- The UAW has agreed to effectively swap a $10 billion payment due its retiree health fund in exchange for a 55% stake in a restructured Chrysler, according to the Washington Post.

- Chrysler bondholders have agreed to take about 30 cents on the dollar for about $6.9 billion of debt obligations; in exchange, the creditors will share a 10% stake in the automaker with the U.S. government.

- Fiat will own the remaining 35% of the company.

- The UAW has agreed to effectively swap a $10 billion payment due its retiree health fund in exchange for a 55% stake in a restructured Chrysler, according to the Washington Post.

- Chrysler bondholders have agreed to take about 30 cents on the dollar for about $6.9 billion of debt obligations; in exchange, the creditors will share a 10% stake in the automaker with the U.S. government.

- Fiat will own the remaining 35% of the company.

Tuesday, April 28, 2009

$1 billion a day for stimulus

The Obama administration has committed $75 billion in stimulus money in 10 weeks. So far $14.5 billion has been spent, mostly for Medicaid.

The Obama administration has committed $75 billion in stimulus money in 10 weeks. So far $14.5 billion has been spent, mostly for Medicaid.The federal government has made available more than $75 billion for stimulus projects in the 10 weeks since President Obama signed the $787 billion recovery package into law.

Not all of that money has hit the streets, however. So far, $14.5 billion has been spent, nearly all of it to help states cope with rising Medicaid costs.

A CNNMoney.com analysis of the program's financial reports shows how difficult it is to quickly inject billions of dollars into the economy. Experts interviewed said they are not surprised by the pace of spending, though they had mixed views on whether the effort would boost the economy.

"There's a natural tension between using taxpayers' money in a prudent way and getting the money out the door quickly," said Isabel Sawhill, a Brookings Institution senior fellow.

The massive recovery package was designed to stimulate the economy and create jobs, as well as assist states and people suffering from the recession by providing funding for education, Medicaid and other public services.

The federal government is now tasked with putting $499 billion to work in coming years. The remaining $288 billion consists of tax relief, the signature program of which, the Making Work Pay credit, began earlier this month.

The Obama administration says it is satisfied with the pace of spending and should meet its goal of making 70% of the funds available by September 2010. So far, about 15% has been committed.

"We're ahead of schedule and making steady progress," said Liz Oxhorn, a press secretary for Vice President Joe Biden, who is heading the recovery effort. "We're pleased."

Still, the funding must pass over several hurdles before the federal government considers it "spent."

Some dollars can flow relatively quickly through existing channels to the intended recipient, be it state and local governments, nonprofit agencies or private contractors. It's also easier to get funds for projects that were already in the works and just needed funding.

Other money, however, remains in federal agencies' hands waiting to be distributed. Many would-be recipients are still wading through all the recovery program's requirements or waiting for guidance from federal agencies before they put in requests.

Lastly, a significant amount of funding won't be made available until recipients either sign contracts or file grant applications. And in some cases, new programs must be created before the money can flow.

Sunday, April 26, 2009

The Economist Interview With Former Lehman CFO, Brad Hintz, on Wall Street's Future

Brad Hintz, Lehman Brothers' former CFO, talks about Wall Street's future with The Economist. He offers his opinions about regulation, "disaster virgins," and why you don't see grey hair on Wall Street A video worth watching to understand the past and future of Wall Street.

The Next Big Bailout: State and Local Governments

With state and local governments suffering from a steep decline in tax revenues, there's "another S&L crisis" coming, says Diane Garnick, investment strategist at Invesco. And since every crisis deserves its own bailout, get ready for the Federal Government to step in an prop up state and local municipalities, says Garnick, whose firm has about $350 billion of assets under management.

While states like Michigan and California are the most likely candidates for a bailout - especially the former if Chrysler and/or GM files for bankruptcy - other states will be quick to raise a hand if Federal funds are flowing, she says. And even the states in stronger financial position may not have a choice Garnick says, recalling that automakers like Ford and financial firms like Goldman Sachs were compelled to take Federal monies they may not have wanted or needed.

If Washington D.C. similarly tries to avoid "playing favorites" with the states, there are two immediate investing implications of the scenario: 1)Muni bonds are a good investment, especially since yields have risen recently amid fears that declining tax revenues will lead to higher default rates. (A Federal bailout would effectively prevent such a scenario, meaning muni bondholders will get paid -- in full.) 2)The Federal government deficit is going even higher than currently projected. Since most state and local governments are prohibited from running deficits, Washington D.C. will have to go deeper into debt to pay for the "S&L" bailout.

Swine Flu and Firms That Operate in This Space

While to some it might seem inappropriate to make investment decisions related to the swine flu outbreak, the reality is that events like this change the economic fortunes of many firms (for better and worse). In the AIM Program we follow global geo-economic events to understand their implications on economies, industrial sectors, and individual companies. A potential outbreak of swine flu could have significant ramifications on many economic participants. The following contains a short listing of firms that operate in the space impacted by a possible swine flu outbreak.

Some reports/rumors are indicating that this strain of swine flu has some H5N1 bird flu mixed in with it. That is why BCRX (see previous posting) was up 26% Friday on 7

times the average volume. BCRX is the maker of "Peramavir" (a cutting edge avian flu vaccine). Note: the stock was up another 12.5% in after hours trading on Friday.

If it turns out that there is no bird flu associated with the current swine flu outbreak, then SVA - Sinovac Biotech Ltd. - traded on the AMEX - a Chinese flu vaccine maker is another firm to consider. It was up 16% Friday on 1.4 times average volume.

Viral vaccine maker Novavax (NVAX) rose more than 75 percent on Friday to $1.42 per share (see previous posting). Note that these small firms are young, unproven, and highly speculative equity investments. Further due diligence is required before making any investment.

Other potential stocks likley to see action related to the potential swine flu outbreak are:

Roche Holding Ltd. (ADR)(RHHBY). They acquired DNA the maker of "Tamiflu"

GlaxoSmithKline plc (ADR)(GSK). Maker of "Relenza"

3M Company(MMM). A major manufacturer of N95 face masks

Crucell N.V. (ADR)(CRXL). A Dutch firm with advanced vacine manufacturing technology

Teva Pharmaceutical Industries Ltd (ADR)(TEVA). A generic drug maker

Gilead Sciences, Inc.(GILD). A major bio-pharma research firm

Quidel Corporation(QDEL). A US vaccine applicator manufacturer

Johnson & Johnson(JNJ). A major manufacturers of anti-bacterials and other products

Some reports/rumors are indicating that this strain of swine flu has some H5N1 bird flu mixed in with it. That is why BCRX (see previous posting) was up 26% Friday on 7

times the average volume. BCRX is the maker of "Peramavir" (a cutting edge avian flu vaccine). Note: the stock was up another 12.5% in after hours trading on Friday.

If it turns out that there is no bird flu associated with the current swine flu outbreak, then SVA - Sinovac Biotech Ltd. - traded on the AMEX - a Chinese flu vaccine maker is another firm to consider. It was up 16% Friday on 1.4 times average volume.

Viral vaccine maker Novavax (NVAX) rose more than 75 percent on Friday to $1.42 per share (see previous posting). Note that these small firms are young, unproven, and highly speculative equity investments. Further due diligence is required before making any investment.

Other potential stocks likley to see action related to the potential swine flu outbreak are:

Roche Holding Ltd. (ADR)(RHHBY). They acquired DNA the maker of "Tamiflu"

GlaxoSmithKline plc (ADR)(GSK). Maker of "Relenza"

3M Company(MMM). A major manufacturer of N95 face masks

Crucell N.V. (ADR)(CRXL). A Dutch firm with advanced vacine manufacturing technology

Teva Pharmaceutical Industries Ltd (ADR)(TEVA). A generic drug maker

Gilead Sciences, Inc.(GILD). A major bio-pharma research firm

Quidel Corporation(QDEL). A US vaccine applicator manufacturer

Johnson & Johnson(JNJ). A major manufacturers of anti-bacterials and other products

Mexico Swine Flu Sparks Worldwide Fear (click to go to CDC Swine Flu web site)

Human cases of swine influenza A (H1N1) virus infection have been identified in the U.S. in San Diego County and Imperial County, California as well as in San Antonio, Texas. Internationally, human cases of swine influenza A (H1N1) virus infection have been identified in Mexico. As of 4/25/09 7:30 pm there were 11 confirmed cases in the U.S. Investigations are ongoing to determine the source of the infection and whether additional people have been infected with similar swine influenza viruses.

The swine flu outbreak could be very serious. As indicated in the two videos below and the information contained on the CDC web site - this is a situation that needs to be monitored closely.

In the midst of this potential 'crisis,' several firms might benefit. Shares of the two public companies — BioCryst Pharmaceuticals and Novavax — jumped Friday on news that the swine flu killed a reported 60 people in Mexico and has infected people in the United States.

Shares of BioCryst, a maker of drugs that block key enzymes in viral diseases, jumped more than 26 percent on Friday to $2.21 per share. Viral vaccine maker Novavax rose more than 75 percent to $1.42 per share.

BioCryst Pharmaceuticals Inc. (BCRX:NASDAQ)

LAST $2.21 CHANGE TODAY +0.46 26.29% VOLUME 461.6K

Novavax, Inc. (NVAX:NASDAQ)

LAST $1.42 CHANGE TODAY +0.61 75.31% VOLUME 1.6M

Saturday, April 25, 2009

Baird's Analysts Not As Bullish on Education Stocks

DeVry and Lincoln, as well as the for-profit education sector, were downgraded yesterday to "Neutral" by Robert W. Baird's analysts. Amy Junker downgraded DeVry despite beating estimates in the short-term: is this the end of the bull run for education stocks?

Pressure builds on BofA's Ken Lewis

Questions about whether Bank of America breached its duties to shareholders come at an inconvenient time for embattled CEO Ken Lewis.

According to documents released Thursday by a top state prosecutor, the BofA (BAC, Fortune 500) chief met repeatedly late last year with federal regulators and the bank's board to discuss the deteriorating condition of Merrill Lynch, the struggling brokerage BofA had agreed to acquire in September.

At one point, according to an account released by New York Attorney General Andrew Cuomo, Lewis told then-Treasury Secretary Henry Paulson that BofA was considering backing out of the Merrill deal -- only to relent when Paulson said regulators, fearing a financial sector collapse, might respond by removing Lewis and his directors.

According to documents released Thursday by a top state prosecutor, the BofA (BAC, Fortune 500) chief met repeatedly late last year with federal regulators and the bank's board to discuss the deteriorating condition of Merrill Lynch, the struggling brokerage BofA had agreed to acquire in September.

At one point, according to an account released by New York Attorney General Andrew Cuomo, Lewis told then-Treasury Secretary Henry Paulson that BofA was considering backing out of the Merrill deal -- only to relent when Paulson said regulators, fearing a financial sector collapse, might respond by removing Lewis and his directors.

US Stress-Test Accounting May Make Banks Raise Capital Levels

Financial regulators may force many of the largest US banks to raise new capital or conserve extra cash after accounting for assets held off their balance sheets. Crucial regional banks are expected to fail the Fed's "stress tests." In this CBS News video Sen. Chris Dodd from the Senate Banking Committee speaks to the issue.

Friday, April 24, 2009

BoA / Merrill Lynch Controversy Discussed

NY's attorney general says former Treasury Secretary Paulson applied heat to Bank of America CEO Ken Lewis to make a deal to buy Merrill Lynch. Charles Ortel, managing director of Newport Value Partners, and Fred Lane, of Lane Berry & Co., discuss the controversy.

Thursday, April 23, 2009

Credit Card Regulations Proposed

(Bloomberg News) An interview about President Obama's proposed credit card regulations with Rep. Scott Garrett (R) of New Jersey, Ranking Republican on House Financial Services Committee; Featuring Insight from Sen. Jeff Merkley (D) of Oregon, Member of Senate Banking Committee.

Marquette's Part-Time MBA Program Ranked 12th Best in the Nation by US News

The latest Graduate School rankings published by U.S. News & World Report lists Marquette’s part-time MBA program 12th nationwide and the executive MBA program 20th. To see the rankings go to: http://grad-schools.usnews.rankingsandreviews.com/best-graduate-schools/top-business-schools

WSJ: BofA CEO says was told to be quiet on Merrill

NEW YORK -- Bank of America Chief Executive Kenneth Lewis told the New York attorney general he believed former Treasury Secretary Henry Paulson and Fed Chairman Ben Bernanke wanted him to keep quiet about the worsening terms of the bank's acquisition of Merrill Lynch, according to testimony reviewed by The Wall Street Journal.

The New York AG's office plans to release the testimony on Thursday to federal regulators and overseers of bailout funds and banks, the newspaper reported after reviewing a transcript.

Lewis testified in February to New York Attorney General Andrew Cuomo's office, which has been trying to determine if Merrill and Charlotte, N.C.-based Bank of America failed to provide adequate disclosures to shareholders about the more than $15 billion in losses Merrill incurred in the 2008 fourth quarter and hefty bonus payments. Had they had that information, BofA shareholders might have voted down the deal.

The Journal said in Thursday's edition that Lewis doesn't say in the transcript that he was told specifically to remain silent about Merrill's burgeoning losses. But the paper quotes Lewis as testifying that disclosing that information "wasn't up to me," and that he was warned by Paulson and Bernanke that failing to complete Merrill's takeover would "impose a big risk to the financial system."

Citing a person familiar with the matter, the newspaper said Paulson told the NY AG's office last month that Lewis may have misread some remarks about Treasury's disclosure requirements as instead pertaining to his bank's obligations.

The government helped orchestrate the acquisition of Merrill by Bank of America over the same weekend in September that another investment bank, Lehman Brothers, went under and insurer AIG received its initial government support. Both the government and Wall Street were under substantial pressure to contain the financial meltdown.

Bank of America had received $25 billion in federal bailout funds, but was later given an additional $20 billion as Lewis showed trepidation about completing Merrill's purchase and said the bank needed help offsetting the losses it was absorbing from the troubled brokerage.

Just a few weeks after the deal was completed, Bank of America's earnings report showed the major hit its balance sheet would take on the Merrill transaction, quickly making Lewis the target of much shareholder fury.

Two of the nation's largest state pension funds are seeking to lead a class action lawsuit against Bank of America, alleging the bank's management "misstated or omitted" important information about Merrill's financial health before the deal was completed.

And Finger Interests Number One Ltd., which owns about one-fifth of one percent of Bank of America stock, is asking shareholders to vote against re-electing Lewis as well as lead director O. Temple Sloan and Jackie Ward during the bank's annual meeting April 29.

Bank of America warned of worsening loan default problems this week even as it posted a first-quarter profit of $2.81 billion. The amount of its problem loans more than tripled to $25.7 billion and Lewis said he couldn't predict when the bank's credit morass would end.

The New York AG's office plans to release the testimony on Thursday to federal regulators and overseers of bailout funds and banks, the newspaper reported after reviewing a transcript.

Lewis testified in February to New York Attorney General Andrew Cuomo's office, which has been trying to determine if Merrill and Charlotte, N.C.-based Bank of America failed to provide adequate disclosures to shareholders about the more than $15 billion in losses Merrill incurred in the 2008 fourth quarter and hefty bonus payments. Had they had that information, BofA shareholders might have voted down the deal.

The Journal said in Thursday's edition that Lewis doesn't say in the transcript that he was told specifically to remain silent about Merrill's burgeoning losses. But the paper quotes Lewis as testifying that disclosing that information "wasn't up to me," and that he was warned by Paulson and Bernanke that failing to complete Merrill's takeover would "impose a big risk to the financial system."

Citing a person familiar with the matter, the newspaper said Paulson told the NY AG's office last month that Lewis may have misread some remarks about Treasury's disclosure requirements as instead pertaining to his bank's obligations.

The government helped orchestrate the acquisition of Merrill by Bank of America over the same weekend in September that another investment bank, Lehman Brothers, went under and insurer AIG received its initial government support. Both the government and Wall Street were under substantial pressure to contain the financial meltdown.

Bank of America had received $25 billion in federal bailout funds, but was later given an additional $20 billion as Lewis showed trepidation about completing Merrill's purchase and said the bank needed help offsetting the losses it was absorbing from the troubled brokerage.

Just a few weeks after the deal was completed, Bank of America's earnings report showed the major hit its balance sheet would take on the Merrill transaction, quickly making Lewis the target of much shareholder fury.

Two of the nation's largest state pension funds are seeking to lead a class action lawsuit against Bank of America, alleging the bank's management "misstated or omitted" important information about Merrill's financial health before the deal was completed.

And Finger Interests Number One Ltd., which owns about one-fifth of one percent of Bank of America stock, is asking shareholders to vote against re-electing Lewis as well as lead director O. Temple Sloan and Jackie Ward during the bank's annual meeting April 29.

Bank of America warned of worsening loan default problems this week even as it posted a first-quarter profit of $2.81 billion. The amount of its problem loans more than tripled to $25.7 billion and Lewis said he couldn't predict when the bank's credit morass would end.

Wednesday, April 22, 2009

AIM Fund Investment Meeting Tonight

Tonight is the sixth (and final) AIM Fund Investment meeting of the 2008-09 school year. The 20 juniors in the AIM Class of 2010 are making their first equity pitches. You are invited to attend one or both sessions.

What: AIM Investment Meeting

When: Wednesday, April 22

- Session 1 4:00 pm - 5:45 pm

- Session 2 6:00 pm - 8:00 pm

Where: Raynor Library Conference Center, Lower Level

Who: AIM Class of 2010

AIM Advisory Meeting Details: http://www.busadm.mu.edu/aim/Events.shtml

Session 1 Equity Write-ups: http://www.busadm.mu.edu/aim/documents/AIMForum_April_22_2009_Session_1.pdf

Session 2 Equity Write-ups: http://www.busadm.mu.edu/aim/documents/AIMFundAdvisoryMeeting_April_22_2009_Session2.pdf

We hope you can attend. The students appreciate your support and welcome your questions and comments. If you are interested in attending and need directions, please contact Dr. David Krause at AIM@marquette.edu. If you can’t attend, but would like to submit a question, please e-mail Dr. Krause. Thank you.

David S. Krause, PhD

Director, Applied Investment Management Program

Marquette University

Telephone: (414) 288-1457

david.krause@marquette.edu

Visit www.busadm.mu.edu/aim for more information.

What: AIM Investment Meeting

When: Wednesday, April 22

- Session 1 4:00 pm - 5:45 pm

- Session 2 6:00 pm - 8:00 pm

Where: Raynor Library Conference Center, Lower Level

Who: AIM Class of 2010

AIM Advisory Meeting Details: http://www.busadm.mu.edu/aim/Events.shtml

Session 1 Equity Write-ups: http://www.busadm.mu.edu/aim/documents/AIMForum_April_22_2009_Session_1.pdf

Session 2 Equity Write-ups: http://www.busadm.mu.edu/aim/documents/AIMFundAdvisoryMeeting_April_22_2009_Session2.pdf

We hope you can attend. The students appreciate your support and welcome your questions and comments. If you are interested in attending and need directions, please contact Dr. David Krause at AIM@marquette.edu. If you can’t attend, but would like to submit a question, please e-mail Dr. Krause. Thank you.

David S. Krause, PhD

Director, Applied Investment Management Program

Marquette University

Telephone: (414) 288-1457

david.krause@marquette.edu

Visit www.busadm.mu.edu/aim for more information.

CFA States That Weakened Mark-to-Market Rules Undermine Investor Confidence

The comments below are from Kurt N. Schacht, managing director, and Patrick Finnegan, director of financial reporting policy, of the CFA Institute Centre for Financial Market Integrity, a global association for investment professionals. They commented on FASB's ruling on mark-to-market accounting changes.

On April 2, the Financial Accounting Standards Board did what many investors feared and what the banking industry hoped for - it eased the financial reporting standards concerning a technical area of accounting called "impairments."

Simply put, an impairment is when the market value of an asset or liability is less than the value reported on a company's balance sheet. The consensus is that political and special interest pressures forced FASB's hand to make this change, even though it is supposed to be an independent, objective standards setter.

Federal regulators, such as the Securities and Exchange Commission, and the Obama administration now need to look harder at banking regulations to strengthen financial institutions and restore the confidence of investors.

Unfortunately, FASB's decision has only amplified the natural tension between the interest of investors in transparent, unbiased financial reporting, and the interest of business executives in casting a company's finances in the most positive light. Positive is fine, but inaccurate is not. The curtailing of the FASB standard diminishes this accuracy and, as a result, investors and lenders will find it more difficult to differentiate between high-risk and low-risk firms.

Complaints about fair value reporting, which determines the price that the investment marketplace should pay for an asset, have arisen largely in the context of their effect on the measures of a bank's ability to cover its loans and meet its financial obligations. One way to make the bank's capital look better is by changing the accounting rules. This is the exact dilemma the FASB faced last month and folded on.

A better alternative, and one the CFA Institute Centre for Financial Market Integrity has urged Congress and banking regulators to consider, is to address capital adequacy concerns through the banking regulations, not financial reporting standards. Fair value accounting, also known as the mark-to-market rule, did not cause our banking crisis any more than gutting the rule will solve it.

It is a mistake for FASB to encourage poor accounting practices in hopes that doing so will erase years of poor lending practices, inappropriate risk management, executive compensation schemes that were not aligned with company performance and thus were not in investors' best interests, and poor corporate governance. Yet, on April 2, FASB rushed to modify these important accounting rules.

So, where do investors go from here? Here is what to watch for:

-- Companies' early adoption of the new rules: This probably signals a more aggressive approach to adjusting their financial reports. Investors should watch to see which companies suddenly look much healthier now compared to previous quarters.

-- How bank assets are reported to the SEC and investors: Read the fine print of notes in annual and quarterly reports to understand the changes in assumptions company management makes and the related financial impact. If these disclosures are not clear, they will likely serve to further shake investor confidence.

Federal regulators, Congress and the Obama administration now have a larger duty to protect the interests of investors. They should:

-- Resist all opportunities to pressure so-called independent standard setters into doing their dirty work.

-- Determine the true level of economic capital in our financial system, stress test it and then decide which financial institutions should receive more capital support.

-- Insist that the SEC be on the alert for those who may take the new FASB rules too far.

Real people live with fair value accounting every day. Looking at one's 401(k) statement these days may hurt, but ignoring it doesn't put more money in your account. When you go to the bank for a loan and use your stock portfolio as collateral, the bank is not interested in what you think the assets may be worth once they recover. They are interested in only what your assets are worth today. Why should the rules of the road be any different for financial institutions and other public companies?

Fair value accounting doesn't create problems, it just identifies them.

On April 2, the Financial Accounting Standards Board did what many investors feared and what the banking industry hoped for - it eased the financial reporting standards concerning a technical area of accounting called "impairments."

Simply put, an impairment is when the market value of an asset or liability is less than the value reported on a company's balance sheet. The consensus is that political and special interest pressures forced FASB's hand to make this change, even though it is supposed to be an independent, objective standards setter.

Federal regulators, such as the Securities and Exchange Commission, and the Obama administration now need to look harder at banking regulations to strengthen financial institutions and restore the confidence of investors.

Unfortunately, FASB's decision has only amplified the natural tension between the interest of investors in transparent, unbiased financial reporting, and the interest of business executives in casting a company's finances in the most positive light. Positive is fine, but inaccurate is not. The curtailing of the FASB standard diminishes this accuracy and, as a result, investors and lenders will find it more difficult to differentiate between high-risk and low-risk firms.

Complaints about fair value reporting, which determines the price that the investment marketplace should pay for an asset, have arisen largely in the context of their effect on the measures of a bank's ability to cover its loans and meet its financial obligations. One way to make the bank's capital look better is by changing the accounting rules. This is the exact dilemma the FASB faced last month and folded on.

A better alternative, and one the CFA Institute Centre for Financial Market Integrity has urged Congress and banking regulators to consider, is to address capital adequacy concerns through the banking regulations, not financial reporting standards. Fair value accounting, also known as the mark-to-market rule, did not cause our banking crisis any more than gutting the rule will solve it.

It is a mistake for FASB to encourage poor accounting practices in hopes that doing so will erase years of poor lending practices, inappropriate risk management, executive compensation schemes that were not aligned with company performance and thus were not in investors' best interests, and poor corporate governance. Yet, on April 2, FASB rushed to modify these important accounting rules.

So, where do investors go from here? Here is what to watch for:

-- Companies' early adoption of the new rules: This probably signals a more aggressive approach to adjusting their financial reports. Investors should watch to see which companies suddenly look much healthier now compared to previous quarters.

-- How bank assets are reported to the SEC and investors: Read the fine print of notes in annual and quarterly reports to understand the changes in assumptions company management makes and the related financial impact. If these disclosures are not clear, they will likely serve to further shake investor confidence.

Federal regulators, Congress and the Obama administration now have a larger duty to protect the interests of investors. They should:

-- Resist all opportunities to pressure so-called independent standard setters into doing their dirty work.

-- Determine the true level of economic capital in our financial system, stress test it and then decide which financial institutions should receive more capital support.

-- Insist that the SEC be on the alert for those who may take the new FASB rules too far.

Real people live with fair value accounting every day. Looking at one's 401(k) statement these days may hurt, but ignoring it doesn't put more money in your account. When you go to the bank for a loan and use your stock portfolio as collateral, the bank is not interested in what you think the assets may be worth once they recover. They are interested in only what your assets are worth today. Why should the rules of the road be any different for financial institutions and other public companies?

Fair value accounting doesn't create problems, it just identifies them.

High-Grade Corporate Bonds Should Boom, According to Credit Analyst

The results of the bank stress tests will be closely watched in the global corporate debt market. More than $155 billion of new issuance has come into the European credit market this year. Joe Biernat from European Credit Management discusses the credit market. He believes high quality corporate bonds will out-perform.

Tuesday, April 21, 2009

Yesterday the VIX Moved To The Highest Point Since Inauguration Day

(Bloomberg News) Volatility Index Rises to Three Month High on Credit Concerns

MARQUETTE UNIVERSITY REAL ESTATE STUDENTS WON THE 2009 NAIOP UNIVERSITY CHALLENGE

Congratulations to the Marquette team who participated and won the NAIOP University Challenge in Minnesota April 16, 2009.

The team consisted of Matt Egan, Eng ‘10, Kaitlynn Koeppler, BusAd ’09 , David Martin, BusAd ’09, Joe Powers, BusAd ’09, Ted Stratman, BusAd ’09, Mike Thomas, BusAd ’09, and Mike Wanezek, BusAd ’09.

The Minnesota Chapter of NAIOP coordinated the 6th annual competition in which student participants analyzed the feasibility of developing a real-world project given the current market conditions. Six universities competed including Marquette University, the University of St. Thomas, University of Wisconsin-Madison, St. Cloud State University, University of Northern Iowa, and the University of Minnesota.

Each university performed a highest and best use analysis of a site across from the Minneapolis Metrodome. Marquette’s team proposed to develop a 70,000 SF LEED Certified medical office building and submitted a comprehensive written report that outlined all aspects of due diligence to the judging committee. Students then presented their analysis to the panel of judges along with 150 members from the NAIOP committee in Minneapolis.

Congratulations again to all those who participated!

The team consisted of Matt Egan, Eng ‘10, Kaitlynn Koeppler, BusAd ’09 , David Martin, BusAd ’09, Joe Powers, BusAd ’09, Ted Stratman, BusAd ’09, Mike Thomas, BusAd ’09, and Mike Wanezek, BusAd ’09.

The Minnesota Chapter of NAIOP coordinated the 6th annual competition in which student participants analyzed the feasibility of developing a real-world project given the current market conditions. Six universities competed including Marquette University, the University of St. Thomas, University of Wisconsin-Madison, St. Cloud State University, University of Northern Iowa, and the University of Minnesota.

Each university performed a highest and best use analysis of a site across from the Minneapolis Metrodome. Marquette’s team proposed to develop a 70,000 SF LEED Certified medical office building and submitted a comprehensive written report that outlined all aspects of due diligence to the judging committee. Students then presented their analysis to the panel of judges along with 150 members from the NAIOP committee in Minneapolis.

Congratulations again to all those who participated!

Monday, April 20, 2009

Stress Testing: Is This Backdoor Nationalization of the Banks?

Discussing the "backdoor" government takeover of banks, with Robert Albertson, Sandler O'Neill & Partners; Noam Scheiber, The New Republic; Lee Hoskins, Pacific Research Institute; and CNBC's Larry Kudlow.

Presentation Materials From the "Ins and Outs of Wall Street"

Presentation materials from the "Ins and Outs of Wall Street" are located on the Department of Finance website at:

http://www.busadm.mu.edu/undergraduate/academics/finance/Events.shtml

http://www.busadm.mu.edu/undergraduate/academics/finance/Events.shtml

China Zhongwang plans 2009's largest IPO at $1.6B and investors are returning to Hong Kong market

China Zhongwang Holdings, Asia's biggest maker of aluminium extrusion products, began marketing on Monday for a Hong Kong IPO to raise as much as $1.58 billion in what would be the world's largest new listing so far this year.

The company, which generates a large share of its business from the transport sector, including railways, is a beneficiary of Beijing's 4 trillion yuan ($585 billion) economic stimulus package, a big chunk of which is being spent on infrastructure.

The offering is the biggest test yet of investor appetite for new listings since the global meltdown in markets last year, and the fund-raising target is higher than the roughly $1 billion that the company and its bankers had previously considered.

Hong Kong's benchmark Hang Seng share index has fallen 30 per cent from its high, but in 2009 the Chinese stock markets are among the best performers in the world. Some residents of Hong Kong and Shanghai are getting back into the market, believing that the global economy has turned and that the best way to make up the losses is to invest even more.

The company, which generates a large share of its business from the transport sector, including railways, is a beneficiary of Beijing's 4 trillion yuan ($585 billion) economic stimulus package, a big chunk of which is being spent on infrastructure.

The offering is the biggest test yet of investor appetite for new listings since the global meltdown in markets last year, and the fund-raising target is higher than the roughly $1 billion that the company and its bankers had previously considered.

Hong Kong's benchmark Hang Seng share index has fallen 30 per cent from its high, but in 2009 the Chinese stock markets are among the best performers in the world. Some residents of Hong Kong and Shanghai are getting back into the market, believing that the global economy has turned and that the best way to make up the losses is to invest even more.

Sunday, April 19, 2009

The Second "Ins and Outs of Wall Street" Was Held Yesterday

Following a mock interview, the MU "Wall Street" alumni respond to questions from the students in audience.

The second "Ins and Outs of Wall Street" event was held on Saturday, April 18 on the Marquette University campus. Over 80 students, alumni, and faculty attended the event. Everyone agreed that the all-day forum was a huge success.

The Department of Finance website soon will contain an in-depth article about the event, including pictures. The purpose of this blog posting is to recognize the superb efforts of those alumni who participated and helped prepare the materials.

The group includes: Daniel Williams, Mike Rems, Matt Bruno, Susan Harnett, Mike Trainor, Greg Sirotek, Barrett Willich, Thomas Warden, and Peter Merkel. Many others were involved in the prepartion for the event; however, were unable to attend. These included Adam Bordner, Brandon Giles, Charles Holznecht, Tom Kruse, Thomas Villanova, Ashley Beckner, Sarah Somers, Ben Somers, Steven Holtkamp, and others.

Thanks to everyone involved - we know that the students learned much and look forward to becoming a part of the expanding MU network.

AIM Equity Presentations, Wednesday April 22, 4-5:45 pm and 6:00 - 8:00 pm

Join us as the students in the AIM Class of 2010 present their first equity recommendations. Attached please find PDF downloadable files for sessions 1 and 2. See the table above (and in the attached files) for the presentation schedule of the students and their company.

Date: Wednesday, April 22nd

Time: 4:00-5:45 pm and 6:00-8:00 pm

Location: Raynor Library Conference Center Lower Level

AIM Equity Presentations, Wednesday, April 22 Session 1 (4:00-5:45 pm):

http://docs.google.com/fileview?id=F.0c6d9bd0-3b7b-447b-8ea7-ef10469f4300

AIM Equity Presentations, Wednesday, April 22 Session 2 (6:00-8:00 pm):

http://docs.google.com/fileview?id=F.3adf6b34-eb6c-40b6-930c-d78a71174b0f

By Popular Demand - All About TIPS

There has been more talk lately about the potential for inflation returning. Is inflation in the U.S. good or bad for investors? While inflation can reduce purchasing power and stock returns, it can also become an investment opportunity. These videos discuss in varying degrees of complexity Treasury Inflation Protected Securities (TIPS) and an exchange traded fund (TIP) that can help investors protect against the problems of rising inflation. The following link will take you to a very insightful video that discusses the TIP ETF:

http://www.learningmarkets.com/index.php/20090409313/Stocks/Mutual-Funds-and-ETFs/profiting-from-inflation-with-bond-etfs.html

The following videos contain informaton about TIPS:

Understanding TIPS (Treasury Inflation Protected Securities) -

http://www.learningmarkets.com/index.php/20090409313/Stocks/Mutual-Funds-and-ETFs/profiting-from-inflation-with-bond-etfs.html

The following videos contain informaton about TIPS:

Understanding TIPS (Treasury Inflation Protected Securities) -

Saturday, April 18, 2009

Nice Stock Rally, But The Consumer Is Still Not Back

The consumer rally is still far away according to Ira Harris. Despite the six-week rally in the stock market, the credit crisis still has consumers hurting. He calls the current rally a bear trap.

7 Small Banks Return TARP Money

Friday was the first day that some banks returned TARP money. While the funds returned only totalled $467 million, it might be the beginning of a trend, reports CNBC's Steve Liesman.

"Ins and Outs of Wall Street" Forum Today on Marquette Campus

“Ins and Outs of Finance” Alumni Presentation

April 18, 2009 AGENDA Location: Wehr Physics 141

Marquette University College of Business Administration

8:30 am Registration & Continental Breakfast

9: 00 am Welcome: Drs. Peck & Krause introduce alumni, guests, and presenters

9:15 am The Current Job Market and the Functional Areas of Finance

• Investment Banking & Private Equity: Greg Sirotek (Baird) and Barrett Willich (Baird)

• Asset Management: Matt Bruno (CAIA UBP)

• Wealth Management: Sue Harnett (CitiBank), Mike Trainor (Milwaukee Private Wealth Management, Inc.), Tom Warden (Morgan Stanley), Dan Williams (US Trust / Bank of America

• Sales & Trading: Mike Rems (Goldman Sachs)

10:30 –11:10 am Student Selection- Breakout #1

Investment Banking & Private Equity (Wehr 122), Asset Management (Wehr 138), Wealth Management (Wehr 153), Sales & Trading (Wehr 209)

11:15 –11:55 am Student Selection Breakout #2

Noon/Lunch Prepare for Careers in Finance

1:30 pm Mock Interview Demo

Mock Interview- NYC Style

Interviewers: Sue Harnett, Greg Sirotek, Dan Williams, Barrett Willich

Interviewee: Matt Bruno

2:15 pm Conclusion: Drs. Peck & Krause recap take-aways

2:30-3:00 pm Networking Reception

April 18, 2009 AGENDA Location: Wehr Physics 141

Marquette University College of Business Administration

8:30 am Registration & Continental Breakfast

9: 00 am Welcome: Drs. Peck & Krause introduce alumni, guests, and presenters

9:15 am The Current Job Market and the Functional Areas of Finance

• Investment Banking & Private Equity: Greg Sirotek (Baird) and Barrett Willich (Baird)

• Asset Management: Matt Bruno (CAIA UBP)

• Wealth Management: Sue Harnett (CitiBank), Mike Trainor (Milwaukee Private Wealth Management, Inc.), Tom Warden (Morgan Stanley), Dan Williams (US Trust / Bank of America

• Sales & Trading: Mike Rems (Goldman Sachs)

10:30 –11:10 am Student Selection- Breakout #1

Investment Banking & Private Equity (Wehr 122), Asset Management (Wehr 138), Wealth Management (Wehr 153), Sales & Trading (Wehr 209)

11:15 –11:55 am Student Selection Breakout #2

Noon/Lunch Prepare for Careers in Finance

1:30 pm Mock Interview Demo

Mock Interview- NYC Style

Interviewers: Sue Harnett, Greg Sirotek, Dan Williams, Barrett Willich

Interviewee: Matt Bruno

2:15 pm Conclusion: Drs. Peck & Krause recap take-aways

2:30-3:00 pm Networking Reception

Friday, April 17, 2009

John Mauldin (Millenium Wave Investments) on CNBC This Morning

The recession is not over according to John Mauldin, president of Millenium Wave Investments. "I would not be surprised if the US market retests the lows after second-quarter earnings come out. It's just not going to be good," he added.

Thursday, April 16, 2009

Housing Gloom CNBC Interview with Ivy Zelman

Ivy Zelman of Zelman & Associates was interviewed on CNBC yesterday (and formerly of Credit Suisse, but she left when her “superiors” told her it would be better for business if she stopped the completely correct bearish housing forecasts and engaged in incorrect happy talk about housing).Zelman is still bearish and made some interesting points. Among them:

Foreclosures were under a moratorium since last November that is now being lifted so expect them to rise in the coming months.

The uptick in home sales is due to increased foreclosure sales. This is happening because “Real Estate Owned” (REO) prices are being cut to move inventory. This means that homes prices are continuing to fall so home equity is being further eroded. This is not a good situation for homeowners and banks that will be forced into further writedowns.

The majority of homes are built by “two guys and a pick-up” and not the Centex, Pulte or Toll’s of the world. These small-time home builders continue to get killed, which is why starts are collapsing.

Homes were over-built during the boom. Zelman estimates the supply of homes is 4 million greater than demand. This is why homebuilders are getting killed. Home prices cannot advance until this inventory is worked off. This will take more time. There is no reason for starts to recover with excess inventory homes on the market. This commentary is from Bianco Research.

Foreclosures were under a moratorium since last November that is now being lifted so expect them to rise in the coming months.

The uptick in home sales is due to increased foreclosure sales. This is happening because “Real Estate Owned” (REO) prices are being cut to move inventory. This means that homes prices are continuing to fall so home equity is being further eroded. This is not a good situation for homeowners and banks that will be forced into further writedowns.

The majority of homes are built by “two guys and a pick-up” and not the Centex, Pulte or Toll’s of the world. These small-time home builders continue to get killed, which is why starts are collapsing.

Homes were over-built during the boom. Zelman estimates the supply of homes is 4 million greater than demand. This is why homebuilders are getting killed. Home prices cannot advance until this inventory is worked off. This will take more time. There is no reason for starts to recover with excess inventory homes on the market. This commentary is from Bianco Research.

IndexIQ Plans To Launch 15 More Hedge Fund ETFs

All of the following new hedge fund ETFs, created by IndexIQ, are designed to track the various underlying indexes. Most will consist of fund of funds structures, combining different subindexes and use ETFs to replicate the various strategies. It's a system that IndexIQ is implementing with the IQ Hedge Multi-Strategy Tracker ETF (NYSEArca: QAI). For information on QAI, go to:

http://www.indexiq.com/etfs/etfsiqh/etfsiqhmultistrat.html

That ETF launched in late March with an expense ratio of 0.75%. The firm's most recent filing doesn't list expense ratios for the new batch. Assuming the Securities and Exchange Commission finds no special quirks to halt a launch, the new ETFs will be the:

IQ CPI Inflation Tracker ETF

IQ Hedge Equal Weight Multi-Strategy Tracker ETF

IQ Hedge Asset Weight Multi-Strategy Tracker ETF

IQ Hedge Inverse Multi-Strategy Tracker ETF

IQ Hedge Distressed Tracker ETF

IQ Hedge Convertible Arbitrage Tracker ETF

IQ Hedge Dedicated Short Bias Tracker ETF

IQ Hedge Managed Futures Tracker ETF

IQ Hedge Market Directional Tracker ETF

IQ Hedge Absolute Return Tracker ETF

IQ Hedge Relative Value Tracker ETF

IQ ARB Merger Arbitrage ETF

IQ ARB Global Natural Resources ETF

IQ ARB Global Real Estate ETF

IQ ARB Global Infrastructure ETF

http://www.indexiq.com/etfs/etfsiqh/etfsiqhmultistrat.html

That ETF launched in late March with an expense ratio of 0.75%. The firm's most recent filing doesn't list expense ratios for the new batch. Assuming the Securities and Exchange Commission finds no special quirks to halt a launch, the new ETFs will be the:

IQ CPI Inflation Tracker ETF

IQ Hedge Equal Weight Multi-Strategy Tracker ETF

IQ Hedge Asset Weight Multi-Strategy Tracker ETF

IQ Hedge Inverse Multi-Strategy Tracker ETF

IQ Hedge Distressed Tracker ETF

IQ Hedge Convertible Arbitrage Tracker ETF

IQ Hedge Dedicated Short Bias Tracker ETF

IQ Hedge Managed Futures Tracker ETF

IQ Hedge Market Directional Tracker ETF

IQ Hedge Absolute Return Tracker ETF

IQ Hedge Relative Value Tracker ETF

IQ ARB Merger Arbitrage ETF

IQ ARB Global Natural Resources ETF

IQ ARB Global Real Estate ETF

IQ ARB Global Infrastructure ETF

Wednesday, April 15, 2009

Fed's Beige Book Released Today

On Wednesday, the latest Beige Book, an anecdotal view of the economy in the central bank's 12 U.S. districts, described a troubled economic landscape, but one that is thawing.

According to the report, which covered the last six weeks until April 6, the Fed's banks saw overall economic activity contracted further or remained weak. However, five of the twelve districts noted a moderation in the pace of decline, and several saw signs that activity in some sectors was stabilizing at a low level.

Everything is relative though, and the bar was set low for Wednesday's report. The prior report, which was released in early-March, indicated the U.S. economy won't be recovering from its subprime blues much before the end of this year. (See "Beige Book Paints It Bleak.") According to that report, 10 of the 12 reports demonstrated weakening conditions or declines in economic activity in the six weeks through late February.

Despite stronger headline from Wednesday's report, the contents were essentially an echo of previous releases. Credit remains tight, manufacturing weakened, retail spending remains sluggish, while home prices continue to fall and commercial real estate market deteriorates due to dropping demand for office, industrial and retail space.

The Beige Book traditionally isn't a market mover, and Wednesday's release proved no different, despite its warming overtones. The market shouldn't have been too surprised though with the brighter commentary. On Tuesday Fed chairman Ben Bernanke said he saw "tentative signs" of economic improvement.

According to the report, which covered the last six weeks until April 6, the Fed's banks saw overall economic activity contracted further or remained weak. However, five of the twelve districts noted a moderation in the pace of decline, and several saw signs that activity in some sectors was stabilizing at a low level.

Everything is relative though, and the bar was set low for Wednesday's report. The prior report, which was released in early-March, indicated the U.S. economy won't be recovering from its subprime blues much before the end of this year. (See "Beige Book Paints It Bleak.") According to that report, 10 of the 12 reports demonstrated weakening conditions or declines in economic activity in the six weeks through late February.

Despite stronger headline from Wednesday's report, the contents were essentially an echo of previous releases. Credit remains tight, manufacturing weakened, retail spending remains sluggish, while home prices continue to fall and commercial real estate market deteriorates due to dropping demand for office, industrial and retail space.

The Beige Book traditionally isn't a market mover, and Wednesday's release proved no different, despite its warming overtones. The market shouldn't have been too surprised though with the brighter commentary. On Tuesday Fed chairman Ben Bernanke said he saw "tentative signs" of economic improvement.

Tuesday, April 14, 2009

Bloomberg Interview with Larry Summers

(Bloomberg News, April 14). Larry Summers speaks on the status of the U.S. economy, including comments about the banks, automakers, and housing crisis.

Video of Marquette Economic Leadership Forum Held at Beginning of Spring Semester

The financial crisis of 2008-09 has been called the worst since the Great Depression. To shed light on these difficult economic conditions, Marquette University held an Economic Leadership Forum in January, bringing together a panel of industry leaders and faculty experts to examine the economy from a macro as well as regional perspective, discuss projections for the future, and field questions from an audience of over 400 attendees. The panel, moderated by James H. Keyes Dean of Business Administration Dr. Linda M. Salchenberger, included:

- Dr. Abdur Chowdhury, Professor, Economics

- Dr. David Clark, Chair and Professor, Economics

- Jim Imhoff, Bus Ad '66, Chairman and CEO, First Weber Group Inc.

- Dr. David Krause, Director, Applied Investment Management Program

- Mary Ellen Stanek, Arts '78, Managing Director and Director of Asset Management, Robert W. Baird & Co.

The following video contains extended highlights from the event.

- Dr. Abdur Chowdhury, Professor, Economics

- Dr. David Clark, Chair and Professor, Economics

- Jim Imhoff, Bus Ad '66, Chairman and CEO, First Weber Group Inc.

- Dr. David Krause, Director, Applied Investment Management Program

- Mary Ellen Stanek, Arts '78, Managing Director and Director of Asset Management, Robert W. Baird & Co.

The following video contains extended highlights from the event.

Monday, April 13, 2009

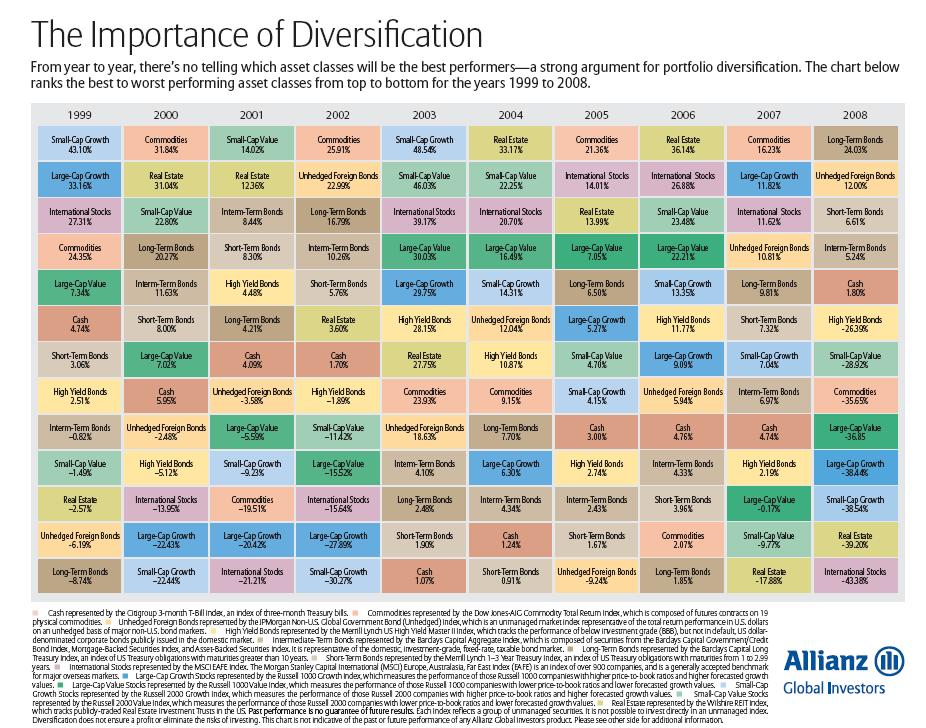

“The Importance of Diversification” Chart (Source: Allianz Global Investors)

Some observations from the Allianz 10 year "diversification" chart:

- In 2008, long-term bonds were the best performers with a return of 24%.

- Commodities fell about 36% and Real Estate was off 39%.

- Long-term bonds did well, high-yield bonds fell by about 26%.

(Click on chart twice to enlarge to view 10 year returns through 2008)

- In 2008, long-term bonds were the best performers with a return of 24%.

- Commodities fell about 36% and Real Estate was off 39%.

- Long-term bonds did well, high-yield bonds fell by about 26%.

(Click on chart twice to enlarge to view 10 year returns through 2008)

Talent is Overrated: Book Review

A 'friend of AIM' suggested this book.

Why are some people – Tiger Woods, Warren Buffett, Yo-Yo Ma – so incredibly accomplished at what they do, while millions of others in those same fields never become very good?

Why are some people so extraordinarily creative and innovative? Why can some continue to perform great at ages when conventional wisdom would deem it impossible?

Those are the questions Geoff Colvin set out to answer in Talent is Overrated: What Really Separates World-Class Performers From Everybody Else.

American’s believe that the highest achievers possess extraordinary talent; this often isn’t so. High IQ is also not helpful in predicting achievement at the highest level. Most often, the highest performers start young and engage in “deliberate practice” (distinct from practice) for hours/day for decades. People who become top-level achievers are almost never child prodigies.

It typically takes 10,000 hours (about 10 years) of practice to become expert at anything. Proven true in arts, athletics, chess, etc. Starting young helps get to 10,000 practice hours earlier and others never catch up.

Many years of deliberate practice actually changes the body and the brain.

At the beginning, nearly all great performers were “forced” by their parents to practice. After about 10 years of practice, great performers internalize their desire to excel and external motivators become less important. Competition & positive recognition are the most compelling forms of external motivation.

In business, often the most successful leaders start out as the least impressive until their 30s or 40s because knowledge-based skills are so complex that what needs to be practiced for 10,000 hours is hard to define. Similarly, most scientists, authors, inventors, etc (higher complexity) also produce their best work after 20 years of devoted effort.

Standards of performance are rising rapidly owing to the global economy. As practice regimes become more refined, kids get better faster and excellence is achieved earlier and pushed further. (Ex: In 1878 Tchaikovsky finished a Violin Concerto that the premier violinist at the time said “was unplayable”. Today, every young violinist graduating from Juilliard can play it.)

Aging diminishes all facilities except those skills where excellence has been achieved and daily practice continues; these skills appear immune to aging.

In the debate about whether individual people or culture drives innovation, it’s more often corp culture that blocks innovation. Connecting people so they can talk about problems they’re working on encourages innovation.

As information becomes ubiquitous, corp strategies that “rely on customer ignorance as a profit center” are doomed. Turning great individuals into great teams requires well-designed practice activities, coaching, repetition, feedback, self-regulation, building knowledge, and shared mental models.

Why are some people – Tiger Woods, Warren Buffett, Yo-Yo Ma – so incredibly accomplished at what they do, while millions of others in those same fields never become very good?

Why are some people so extraordinarily creative and innovative? Why can some continue to perform great at ages when conventional wisdom would deem it impossible?

Those are the questions Geoff Colvin set out to answer in Talent is Overrated: What Really Separates World-Class Performers From Everybody Else.

American’s believe that the highest achievers possess extraordinary talent; this often isn’t so. High IQ is also not helpful in predicting achievement at the highest level. Most often, the highest performers start young and engage in “deliberate practice” (distinct from practice) for hours/day for decades. People who become top-level achievers are almost never child prodigies.

It typically takes 10,000 hours (about 10 years) of practice to become expert at anything. Proven true in arts, athletics, chess, etc. Starting young helps get to 10,000 practice hours earlier and others never catch up.

Many years of deliberate practice actually changes the body and the brain.

At the beginning, nearly all great performers were “forced” by their parents to practice. After about 10 years of practice, great performers internalize their desire to excel and external motivators become less important. Competition & positive recognition are the most compelling forms of external motivation.

In business, often the most successful leaders start out as the least impressive until their 30s or 40s because knowledge-based skills are so complex that what needs to be practiced for 10,000 hours is hard to define. Similarly, most scientists, authors, inventors, etc (higher complexity) also produce their best work after 20 years of devoted effort.

Standards of performance are rising rapidly owing to the global economy. As practice regimes become more refined, kids get better faster and excellence is achieved earlier and pushed further. (Ex: In 1878 Tchaikovsky finished a Violin Concerto that the premier violinist at the time said “was unplayable”. Today, every young violinist graduating from Juilliard can play it.)

Aging diminishes all facilities except those skills where excellence has been achieved and daily practice continues; these skills appear immune to aging.

In the debate about whether individual people or culture drives innovation, it’s more often corp culture that blocks innovation. Connecting people so they can talk about problems they’re working on encourages innovation.

As information becomes ubiquitous, corp strategies that “rely on customer ignorance as a profit center” are doomed. Turning great individuals into great teams requires well-designed practice activities, coaching, repetition, feedback, self-regulation, building knowledge, and shared mental models.

Karino Moreno (AIM Student) and Others Talk About Marquette

Karina Moreno and other Marquette University students share their experiences about college life. They also talk about the importance that scholarship aid has provided in making their education possible.

Saturday, April 11, 2009

Marquette Magazine: Spring 2009

Karina Moreno

College: Business Administration

Major: Finance (member of the Applied Investment Management Program), Senior

Urban Scholarship Recipient

Karina Moreno knows exactly where she wants to go.

She graduated from Cristo Rey Jesuit High School in Chicago, a college preparatory school serving children on the low-income west side. Cristo Rey students attend school four days a week and work one day a week to pay their tuition, giving them exposure to the working world and a personal investment in their education. Moreno thrived in the program, became valedictorian of her class and took a step no one in her family had taken before — she went to college.

Financial aid was crucial for Moreno, whose single mother couldn’t pay for college. She was awarded a scholarship through Marquette’s Urban Scholars Program. “The financial aid was a major player in selecting the school I would attend,” Moreno says. “Without those who have believed in me enough to fund my education, I would not have been able to get this far.”

Moreno has seized every opportunity. The senior finance major works 20 hours a week at Robert W. Baird & Co. in the risk management department, mentored by Mary Ellen Stanek, Arts ’78, the managing director and director of asset management for Baird and chair of Marquette’s Board of Trustees.

On campus, Moreno is just as much of a hands-on learner. She’s part of Marquette’s Applied Investment Management program, a team of finance students that invests a portion of the university’s endowment. She volunteers at the Latino Community Center and helps international students adjust to American life as an ambassador in Marquette’s Global Village residential community.

“One of the pillars of the Jesuit foundation,” she says, “is giving back to others.”

Urban Scholars Program The now 10 full-tuition Urban Scholarships are funded in part through the generosity of several benefactors and designated for graduates of Chicago's Cristo Rey High School, members of the Boys & Girls Clubs of Greater Milwaukke and graduates of Milwaukee-area high schools.

--------------------------------------------------------------------------------

How does scholarship aid fit into a financial aid package?

Students who receive assistance in affording tuition benefit from a mix of scholarship aid, grants, loans and student employment. The package helps bridge the gap between what students and their families can afford to pay and the cost of attending a university.

Q How many Marquette undergraduates receive aid?

Eighty-five percent of our full-time undergraduates receive some type of financial assistance. Even with the aid we provide, many students have unmet financial need. The average unmet financial need for a freshman this year is $6,089, which families meet through private loans, second jobs and other means. Long term, this amount of unmet need can affect a student’s ability to attend Marquette.

Q Is student debt affecting the choices students have post graduation?

Yes. Many students take on loans as part of a complete financial aid package. The average debt for undergraduate students who graduated in 2007-08 was about $30,000. Loan repayments can mean that these graduates must delay graduate school or set aside public service and nonprofit careers as viable options.

Q How much total does Marquette award in financial assistance each year?

In 2007-08, scholarship aid and grants for all students — including federal and state support and scholarship aid from private external sources as well as Marquette — exceeded $94 million.

Q Is Marquette changing scholarship aid in light of the tough economic situation?

President Robert Wild, S.J., says that fulfilling the promise to retain current students through graduation is the university’s first and foremost priority. University leadership is committed to working with students and families facing financial difficulties on solutions that make continued enrollment possible. In response to the increased stress felt by our families, the university raised the amount it commits to the financial aid budget by $4 million. Additionally, the university is working to secure more scholarship aid support for students who are struggling financially to remain at Marquette. Initial responses to this effort included a generous $250,000 gift from a family foundation to help 55 students continue their education this spring semester.

Financial need of Marquette undergraduate students

$38,776: Average Marquette undergraduate tuition, room and board and fees for 2009-10

25%: A quarter of Marquette students are the first in their families to go to college. On average families of these students can afford less than one-third of what it costs to attend Marquette. Scholarship aid helps ensure that these talented students continue to have access to Marquette.

$30,563: Average debt load of a graduating senior

Even after personal and family contributions, scholarships and grants, the unmet financial need is considerable. Marquette simply does not have enough funds to meet what students are fully qualified to receive in aid. Costs not covered by family contribution, federal grants and private scholarships must be made up through loans.

Thursday, April 9, 2009

Wells Fargo Reports Better Than Expected Earnings

Wells Fargo is the first bank to report their profits, which were soaring, for the first quarter of 2009. As Anthony Mason reports, this bank's successes caused an investor stampede on Wall Street.

Watch CBS Videos Online

Watch CBS Videos Online

Comments on the FDIC's Toxic Loan Program

(Bloomberg News, April 9) Stress Test Could Become Stick to Pressure Banks Into Selling Assets

Wednesday, April 8, 2009

George Soros on the Collapse of the World Financial System

CNNMoney interviews billionaire George Soros about why he thinks the financial system collapsed.

Restoring the "Uptick" Rule?

(Bloomberg News, April 8) SEC Weighs Short-Sale Limits. Bloomberg interviews former SEC Counsel Peter Chepucavage. He urges Congress to locate the loopholes. He discusses the "Uptick Rules" proceedings and refers it a diversionary tactic - suggests that "Circuit Breaker" and "Uptick Rules" are not the solution.

In a 5-0 decision, the U.S. Securities and Exchange Commission decided to revisit a Depression-era rule that limits short selling in a down market. However, comments from the agency's two Republican commissioners indicate the proposal is not likely to sail through. Commissioner Troy Paredes said restrictions on naked short selling along with other rules might be enough. Commissioner Kathleen Casey said she is not convinced that repealing the uptick rule contributed to the market turmoil of last year.