L’Oréal (OR-FR, €277.70): “L’Oréal Covers Some Blemishes and Positions for Reopening”

By: Ciara Jones, AIM Student at Marquette University

Disclosure: The AIM Equity Fund currently holds this position. This article was written by myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article.

Summary

• L’Oréal (OR.FR): manufactures and sells beauty and hair products. Founded in 1909, the company is known for their high-end skin care and beauty products. L’Oréal operates through four business segments which include Professional Products, Consumer Products, L’Oreal Luxe and Active Cosmetics.

• Based on reported figures in the company’s Q2 2020 earnings report, L’Oréal’s sales for the six months ended June 30, 2020 were €113.07 billion, down -11.7% from same period last year.

• On June 25, 2020, L’Oréal launched its new sustainability program “L’Oréal for the Future”, laying out the company’s latest set of ambitions for 2030. This program will accelerate L’Oréal’s ESG positioning in the fields of sustainability and inclusion.

• L’Oréal announced its long-term succession plan with Jean-Paul Agon as Chief Executive Officer and Barbara Lavernos as Deputy CEO effective May 1, 2021.

• Despite the recent declines of consumer sales in the cosmetic industry during the COVID-19 pandemic, L’Oréal is well positioned to respond to continued lockdown measures.

Key points: L’Oréal can be considered a well-positioned makeup and beauty brand during the COVID-19 pandemic because of its multiple business channels. During its Q1 2020 earnings call in April, L’Oréal discussed a -10.5% decline in sales in its Professional Products division, as well as a -9.3% sales decline in its L’Oréal Luxe division. Despite these declines, L’Oréal experienced a significant 57% increase in e-commerce sales worldwide and an impressive 13.2% sales increase in its Active Cosmetic Division. L’Oréal is well positioned to respond to increased online consumer demand through their strength in ecommerce and expertise in digital media services that will help enrich customer’s experience on an online platform. Additionally, the 13.2% increase in its Active Cosmetic division is due, in part, to its retail presence in pharmacies and drugstores. Given that these channels have a main priority of supplying medicine, they have been deemed essential businesses and have remained open throughout the pandemic. Despite its ability to shift sales to new channels, the company announced in its Q2 2020 earnings report an overall -11.7% decline in sales for the first six months of 2020, highlighting the challenge that many well-established cosmetic brands continue to face.

Although L’Oréal’s sales were down for the recent six-month period, the company has continued to stay relevant with important public policy issues. In June, L’Oréal announced its decision to commit to becoming a more sustainable brand by 2030. Looking at its ESG rating, their overall score of 20.4 and their 56th percentile ranking for corporate governance shows that this recent commitment to sustainability will help to make the company more socially responsible.

Looking toward the future, on October 14, 2020, L’Oréal announced the succession of Jean-Paul Agon as Chief Executive Officer effective May 1, 2021. This decision came after the company’s Board of Directors decided on new governance and a long-term succession plan that would guarantee the sustainability of the performance, values and commitments of the company. L’Oréal’s plan is then that, after 15 years as the company’s CEO, Agon will be replaced with Barbara Lavernos, who will serve as Deputy CEO and lead research, innovation and technology during the interim period. In a statement on these decisions, Jean-Paul Agon said, “Given her background, skills, and personal qualities, Barbara Lavernos is perfectly equipped to take on the strategic role of Deputy CEO. With her appointment, research is placed at the highest level of the company, confirming its critical role for L’Oréal.” This shows a strategic business move by L’Oréal to make research the critical theme for business improvement.

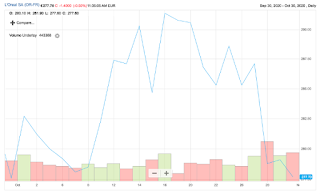

What has the stock done lately? Over the last month, L’Oréal has experienced a stock price range from a low price of $277 per share to the highest price reached of $290 per share. These stock price fluctuations and the recent decline are likely due to the announcement of a return to lockdowns in France, as well as other parts of Europe, which many expect to have a negative impact on retail sales of beauty products.

Past Year Performance: L’Oréal’s performance in the last year reflects the decline many cosmetic brands have experienced during the outbreak of the COVID-19 pandemic. The stock price fell to $210 per share in March at the outset of the global pandemic, but recently it has performed better than the fall season of last year.

Source: FactSet

My Takeaway

Despite the decrease in sales in many of its business segments, L’Oréal is well positioned to come out of the COVID-19 pandemic as one of the leading cosmetic brands. L’Oréal’s commitment to both improving its sustainability commitments as well as its recent management change shows that the brand is investing in its long-term success and positioning itself for the future. L’Oréal along with other beauty product brands may prove to be frontrunners of economic rebound as consumers begin to purchase makeup and beauty products once again if there is reason to leave the sweatpants in the drawer and get dressed up once again.

Source: FactSet