By:

Jimmy O’Brien, AIM Student at Marquette University

Summary

• ShotSpotter, Inc. (NASDAQ:SSTI) provides gunshot detection

solutions to help law enforcement identify, locate, and respond to gunshots.

Their systems are offered on a subscription model basis with the life of an

average contract ranging between 1-5 years. Through this subscription they

design, implement, manage, and maintain the systems for their customers. Currently,

SSTI has contracts with 100 cities in the United States. They generate 97.4% of

their revenues in the United States and 2.6% in South Africa. ShotSpotter made

their IPO in 2017 and is headquartered in Newark, CA.

• SSTI has not grown

their revenues at the pace they expected and decreased guidance 5-7% the last

quarter.

• Their target market has

not changed, but SSTI has run into difficulties with the timing of their

contracts and acquiring new customers.

• Management stresses the

importance of a long-term outlook for SSTI and are confident that the value

proposition still remains intact.

• The stock is extremely

volatile and SSTI has not shown much transparency into their financial future.

Key

points:

ShotSpotter has lowered their revenue guidance for

EOY2019 for the second straight quarter from 21-28% growth down to 15-17%. This

is a result of prolonged contract negotiations between Universities and

Government Agencies. However, SSTI has been able to increase their

profitability despite not meeting revenue expectations.

In the Q3 earnings call,

Chief Executive Officer Ralph Clark stressed the importance of looking at the

company with a long-term mentality. Due to the timing of their contracts it is

difficult to value the company based on quarter performances. This is why the

guidance has been lowered continuously and is difficult for them to estimate,

but the market size still remains the same. The main driver for SSTI is their

lack of competition in the market and the value proposition of their systems

still remains intact.

The main problem for

ShotSpotter is acquiring new customers. With the recurring revenue from their

subscription based service they have a good foundation to build on, but are not

expanding as quickly as they expected. They recently announced a new deal three

year deal with Puerto Rico for 4.6 million, which will be activated in 2020.

This is in line with their growth strategy that is still targeting major US

cities of Houston, Dallas, and Charlotte. They believe the contracts they are

currently negotiating are going to come to fruition, but are not confident on

the timing. This is promising, but does not give any real insight into their

future.

What

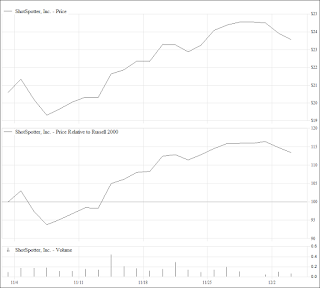

has the stock done lately?

ShotSpotter’s closing

price of $23.60 is up 14.42% over the last month. This is a result to earnings

beating estimates, despite missing on the top line. The EPS of $.04 came in one

cent above expectations, but showed a positive sign for a company that has not

been profitable on an annual basis yet. Furthermore, the company is showing

positive signs of growth from the contract with Puerto Rico.

Past

Year Performance:

ShotSpotter has been getting rocked in

this highly volatile year. SSTI has a 52 week range of $18.44-$58.61 and are

down 37.33%. This volatility has come from their inability to show real clarity

into the financial future for the company and inability to become profitable on

an annual basis.

My

Takeaway

ShotSpotter was added to

the AIM small cap fund in March of 2018. Since then it has well exceeded the

price target of $27.00, but has also fallen well below it. The extreme

volatility of the stock is expected from a company that has not yet proven to

be profitable. Although the long-term outlook for the company yields some

positive possibilities, there is very little clarity into ShotSpotter’s ability

to acquire new customers in a timely fashion. For this reason, I recommend

ShotSpotter should not be held in the AIM portfolio and is replaced with a more

stable company.

Source:

FactSet