Horizon

Pharma plc. (HZNP, $105.84): “New Growth on the Horizon?”

By: Grace

Schwartz, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Horizon Pharma plc. (NYSE:HZNP) is

an international biopharmaceutical company that focuses on the discovery,

development and commercialization of treatments for rare, autoimmune inflammatory

diseases. The company operates in two segments: the orphan segment (89%)

and the inflammation segment (11%). HZNP was founded in 2008 and is headquartered

in Dublin Ireland.

- Horizon

acquired Viela Bio, Inc for $2.5 billion in 2021. This acquisition added

one approved product, Uplinza, to the orphan segment. Additionally, two

drugs in Phase 1 trials, five in Phase 2 trials, and two in Phase 3

trials, were added.

- The company

operates in China, Japan, Germany, and the United States. 99.5% of revenue

comes from the United States.

- HZNP

has increased 110% since being added to the International Fund in January

2020, well past the target price of $49.96

- HZNP

currently has over 20 programs in its pipeline, with three programs in Phase

3 and four additional Phase 4 programs. The company expects ten program approvals

in the second-half of the decade.

Key

points: In March 2021, HZNP completed its acquisition of Viela Bio,

Inc. This expanded the company’s commercial medicine portfolio by adding Uplinza

to the orphan segment. Management expects that this acquisition will provide

multiple opportunities to drive long-term growth and solidify HZNP as an

innovative-driven biotech company. Viela’s mid-stage biologics pipeline,

R&D, and initiated clinical trials will assist with this.

2021 also saw the global

agreement with Arrowhead. This collaboration is for ARO-XDH, a discovery-stage

investigational RNA interference therapeutic meant to treat gout. HZNP has

agreed to pay potential milestone payments of up to $660.0 million contingent

on the achievement on development, regulatory, and commercial milestones.

In addition to bringing new medicines

to market, HZNP is also leveraging current drugs. Daxdilimab is an antibody

that was originally intended to treat lupus. Recently, HZNP has initiated four

additional Phase 2 clinical trials for Daxdilimab. These trials will target

Alopecia Areata and Dermatomyositis.

What

has the stock done lately?

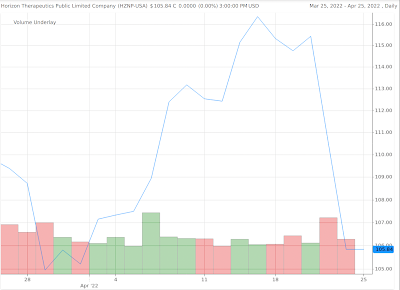

For the month of April 2022, HZNP

is down -3.24%, trading at $107.15 on April 1 and $105.84 on April 22.

Past

Year Performance: Over the course of HZNP’s most recent fiscal year,

the stock increased 10.85% YTD. The 52-week range includes a low of $83.42 and

a high of $120.53.

Source: FactSet

My

Takeaway

Since the addition of HZNP to the

International fund, the company has far exceeded expectations. The stock has increased

well past its original target price and been consistent with investment

drivers. Additionally, HZNP has shown the potential for future growth through

its acquisitions and commercialization of new products. The acquisition of

Viela Bio has already shown success. Management has also given reason to believe

the company will continue to acquire other companies and expand its portfolio. Although

the stock has met investment drivers and surpassed original price target, there

looks to be growth in Horizon Therapeutics. Because of this, it is recommended

that the AIM International fund holds the position.

Source: FactSet