JAZZ

Pharmaceuticals PLC. (JAZZ, $156.62): “Listen to the Music!”

By: Danny

Scelza, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it and I have no business relationship with any company whose

stock is mentioned in this article.

Summary:

• Jazz Pharmaceuticals. (NASDAQ: JAZZ) is a global pharmaceutical

company that focuses on the identification, development, and commercialization

of pharmaceutical products. Their products are centered around medicines for

both adults and adolescents in the areas of neuroscience, oncology, and other.

JAZZ has developed staple brands like Xyrem and Xywav, as well as newly

approved drugs and therapies along with an extensive pipeline of 17 drugs and

therapies in clinical trial phases.

• In Quarter 1 of 2022, JAZZ

reported an EPS of $3.73, lower than the consensus EPS of $3.84 for the

quarter. EPS is up 7% YTD from Q1 2021.

• JAZZ’s vision 2025 plan to

reach a net leverage ratio of 3.5x by the end of 2022, a main point of focus in

JAZZ’s pitch in February, is on pace to meet the goal. Since the close of the

large GW acquisition in Q2 2021, JAZZ has consistently lowered net leverage

quarter-to-quarter and currently have a net-leverage ratio of 3.9x.

Key

points: JAZZ’s recent earnings call showed the company slightly missed

adjusted EPS by $0.11, but the company raised revenue guidance for fiscal year

2022 from $3.5 billion to $3.7. Focusing on Epidiolex, the adopted drug from

the GW acquisition with massive potential, product sales YTD are up 6.7% and

accomplished $18 million inventory build in 2021 Q4, majority reserved for this

past quarter. Commercialization of Epidiolex in European markets continues on

pace with the drug fully available in 4 of 5 key European markets with an

expected launch in France by the end of this year.

Recently launched and near-term R&D pipeline opportunities remain promising with the addition of two new early-stage molecules. Programs emerging from the cannabidiol platform are on track to begin additional phase 3 trial for Epidiolex in epilepsy later this quarter, which could bolster this drugs outlook. Ongoing compelling Xywav clinical trials to address idiopathic hypersomnia remain strong following the first full quarter of treatment options for IH that don’t just address symptoms. Active patients taking Xywav for IH has grown 200% over the past quarter.

Earlier this quarter, JAZZ acquired global development and commercialization rights to Werewolf Therapeutic’s WTX-613, worth up to $1.2 billion. "We believe WTX-613 has the potential to minimize the toxicity associated with systemic IFNα therapy, preferentially delivering IFNα to tumors, and thereby expanding its clinical utility in treating cancer," said Rob Iannone, executive vice president, global head of R&D of Jazz Pharmaceuticals. JAZZ made an upfront payment of $15 million, and Werewolf is eligible to receive a tiered, mid-single-digit percentage royalty on net sales of WTX-613.

What

has the stock done lately?

After

beating EPS estimates of $3.64 by producing a 2021 Q4 EPS of $4.21, JAZZ’s

stock price rose 12% and continued to trend positively reaching a six-month

high of $168.66. After their recent missed earnings, the stock dropped 4.7%. Focusing

on organic growth and taking a back seat on more major investments following

the GW acquisition, the company has seen their new top line drivers gain

traction as they lower their net leverage ratio, making recent stock price drop

nothing catastrophic to its long-term outlook.

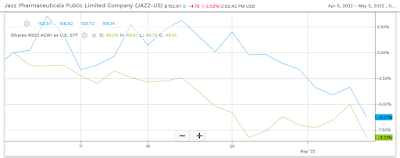

Past

Year Performance: In the last year, JAZZ is down 11.68%, with a

high $181.17 and a low price of $122.41. The iShares MSCI ACWI is down 8.28%

over that same time. The low-price period was due to the expected aftermath of

the GW acquisition which caused JAZZ unprofitability for quarter’s 2 3 and 4 of

2021.

My

Takeaway

Following the recent earnings

report, the stock price declined due to missed EPS guidance, but revenue outlook

for the year increased by $200 million. When AIM international fund acquired

JAZZ, their expanding drug portfolio and robust pipeline was essential to

driving top line growth and overall company growth. Financial goals and

continued guidance remain consistent with initial outlook presented, making the

long-term outlook on JAZZ strong. As top line growth and drug specific market

penetration continues, JAZZ is a strong recommended HOLD.