Accenture

Plc (ACN, $161.07): “All Firms Need This Sidekick”

By:

Edward Eisenhauer AIM Student at Marquette University

Disclosure: The AIM Equity Fund currently holds this

position. This article was written by myself, and it expresses my own opinions.

I am not receiving compensation for it and I have no business relationship with

any company whose stock is mentioned in this article.

Summary:

●

Accenture Plc (NYSE: ACN)

is an investment holding company that engages in management and technology

consulting and outsourcing services. ACN is made up of four segments:

Communication and Media, Financial Services, Health and Public Service,

Products, and Resources. They serve a variety of businesses across all sectors

and government entities. Their services aim to streamline businesses processes,

such a customer management systems, supply chain management systems, and other

business processes by improving communication and data efficiencies. There

services are focused on technology and cloud integration among all segments of

the client firm.

●

ACN is the global leader among its

competitors in the technology and business process consulting space.

●

ACN is on pace to continue its

leadership with above average net sales growth of 5-8% estimated for 2019 based

off 20 % global growth of emerging technologies.

●

Accenture’s dominate business model

and future growth projections rely heavily upon the ability to retain and

attract talent, given emerging technologies are 60% of revenues.

●

Analysts are optimistic for the

future of Accenture and its competitors. A Capgemini survey reported that 77%

of firms struggle with in-house tech talent and are relying on outsourcing for service.

Key Points:

Since Accenture has been added to

the AIM portfolio, it has outperformed its analysts’ predictions for 3

quarters, beating both top line and bottom line estimates. ACN’s Q3 reported

double digit revenue growth in all geographic segments except Europe, which

still recorded growth of 9%, and in the Communication and Media, Product, and

Resources business segments. Accenture is still in a powerful position for

future growth as it continues to lead its space while also having growing

global demand for its business. 77% of firms globally are relying on technology

and management consulting services and their dependence on these services will

continue to grow. Increasing speeds of technology evolution and increasing

complexity gives Accenture’s service a sweet spot for all sectors.

Since February 2018, Accenture has

acquired more than 10 firms scattered across the world and within different

business segments. To start, Accenture has acquired HO Communication in greater

China to expand its digital design and commerce services to their clients in

China. They have also acquired Mindtribe, Pillar Technology, and Designaffairs

in Europe as bolt-on acquisitions to help design smart products

(Designaffairs), and to help build and implement smart products into the

business structure of their customers (Mindtribe and Pillar Technology). Most

recently, on November 12, ACN acquired the swedish firm Kaplan. Kaplan will

improve Accenture’s data-driven customer relationship management services and

will allow Accenture to strengthen its end-to-end experience service for

Northern European nations.

What has the stock done lately?

Accenture is staying focused on

generating and maintaining a substantial cash balance to continue their high

rate of acquisitions. The recent 10k was released last month on October 24th

and details much of what was discussed above. Its last 3 quarters sales growth

was 14.9%, 15.8%, and 10.4% respectively and is expected to continue around

7-9% for 2019, keeping margins consistent at 14%. With the brexit deadline on

the horizon, Accenture could be hurt by some legislation but also could see a

boost in sales as companies look to restructure. According to a study conducted

by Accenture, 90% of banks plan on implementing an Open Banking service for

their commercial clients, which should boost sales growth into the double

digits. Accenture is expected to profit from this industry move to Open

Banking.

Past year Performance:

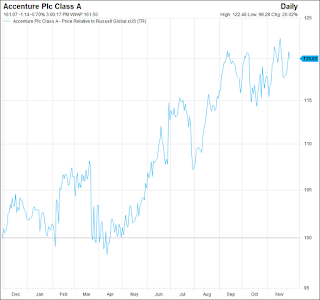

Accenture YTD return is 5.21% and

its 52 week change is 9.61%. Accenture has an average beta of 1.05 and its last

3 month return is -5.12%, which reflects the beta and recent market

performance. Despite the recent dip in price, ACN has outperformed its

benchmark and is still leading its competitors.

Source:

FactSet

My

Takeaway:

As

of late, Accenture’s stock price seems to be following the markets and is a

relatively cheap buy right now, as markets are slumped. Based off the factors

discussed above, Accenture is growing rapidly with 10 plus acquisitions made

within the last year and double digit top line growth, paired with double digit

industry growth. Accenture has an incredible bright future as technology

continues to evolve and make its way into every sector across the globe. With

increasing competition in all sectors globally, evolving industry 4.0, and the

need for integration and efficiency to stay profitable, the demand for

Accenture’s services is expected to explode. The brexit shakeup should give

Accenture an opportunity for additional clients. Lastly, cloud services account

for 60% of ACN revenues and global cloud growth is expected to grow by a CAGR

of 21.1% for the next 5 years. To conclude, Accenture has immense long term

growth potential as the global economy continues to digitalize.

Source:

FactSet