SK Telecom, Co. (SKM, $24.49): “SK……All Day”

By: Holden Patterson, AIM Student at Marquette University

Disclosure: The AIM Equity Fund currently holds this position. This article was written by myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article.

Summary:

● SK Telecom, Co. (NYSE: SKM) is a leading telecommunications and internet services provider in South Korea. SKM has three major business segments: Cellular services, fixed-line telecommunications, and security. Their cellular services make up around 70% of their total revenue and is currently in the process of shifting toward a 5G network. The newer security segment consists of their two acquisitions in 2018, SK infosec and ADT Caps. SKM also generates a portion of their revenues from media services they provide such as their B TV and Wavve tv channel services. SKM currently has around 31.4 million subscribers to their wireless network which is up from 28.65 million in 2019. SK Telecom was founded in 1984 and is headquartered in Seoul, South Korea.

● SKM partnered with Amazon to provide their customers the ability to shop directly for Amazon products through their e-commerce subsidiary, 11st.

● SKM announced plans to split off its mobility business unit and launch T Map Mobility. Uber will partner with spin-off by investing over $100M in a joint venture with T Map Mobility and about $50M in T Map Mobility.

● From 2019 to 2020, net income grew 74.3%, EPS grew 68.7%, operating income grew 21.8%, and EBITDA grew 7.6%. This reflects their ability to effectively create bottom line growth through the global pandemic.

● Continued growth of SK infosec and ADP Caps’ CMS subs net adds specifically led to the record quarterly revenue of 370.9 billion for their security segment. SKM announced that in Q1 of 2021 they are going to merge these two brands together to offer more complete security services to their customers.

Key points:

SKM was added to the portfolio in October of 2020 at around $22.58 per share and since then has grown about 8.5%. Part of this success was due to the heavy additions to their wireless network and a 17.2% growth in their media segment which was partly due to stay at home orders resulting from the COVID-19 pandemic. They also have seen growth in their security segment as it has moved from 7% of total revenue to 9% over the past 6 months. SKM has made many different moves over the past 6 months, including their partnership with Amazon to now offer their products through their e-commerce subsidiary, 11st. This was part of their goal to boost overall growth through elevated convenience for their customers. Amazon is extremely excited about the synergy created through this deal to give South Korean customers the ability to shop their vast e-commerce easier than ever before. Another part of this deal is that Amazon has an investment right to acquire a minority interest in 11st through new preferred shares if certain conditions are met.

One of the drivers for this firm when added to the portfolio was the rollout of their 5G network. Since then, they have increased their 5G network to 5.48 million total subscribers. Their 5G network subscribers is expected to continue to grow heavily over the next few quarters which will continue to drive growth for SKM. Over the past year they have also seen exponential growth in their security segment that was launched in 2018. Annual revenue from this segment was up to 12.2% YoY growth thanks to double digit growth from their security brands, SK infosec and ADT Caps. Continued growth of ADP Caps’ CMS subs net adds specifically led to the record quarterly revenue of 370.9bn for their security segment. SKM announced that in Q1 of 2021 they are going to merge these two brands together to offer more complete security services to their customers. This is hoped to help bolster their already seen growth in this segment through better brand awareness and pioneer the technology-based integrated security service market.

At the end of 2020, SKM announced plans to split off its mobility business unit and launch T Map Mobility. Uber will partner with spin-off by investing over $100M in a joint venture with T Map Mobility and about $50M in T Map Mobility. SKM’s management has announced that they expect T Map Mobility, which was valued at around $873.3 million, to grow into a company worth 4.5 trillion by 2025. Uber will own 51% of the joint venture while SKM will own the remanding 49%. Their partnerships with big American companies such as Uber and Amazon show their commitment to growing their business on a larger scale and is reflected by their successes in growth over the past couple years. SKM saw substantial top-line all the way down to bottom-line growth in 2020. Net income grew 74.3% in from 2019 and EPS grew 68.7% respectively. Operating income grew only 21.8% and EBITDA grew only 7.6% which shows their ability to produce bottom line growth effectively.

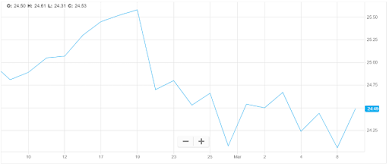

What has the stock done lately?

As I mentioned earlier, SKM price has increased at around 8.5% since being added to our portfolio, but over the past month has decreased about 1.6%. Since October when we purchased SKM, there has been only one major drop in stock price during the overall 8.5% growth. This came right in between their announcement of the partnership with Uber to create T Map Mobility and their quarter 3 earnings report. Since they released Q3 earnings in November, their stock price has gone up 16.17% which is mainly due to the fact that they saw their strongest success in that quarter over the previous four periods.

Source: FactSet

Past Year Performance:

Over the past year (March 2020 - March 2021), SKM has grown 19.29% and has recovered nicely from their 5-year low they hit during the beginning of the pandemic where their stock price fell to $16.86. Their stock price has struggled to exceed their past highs they experienced throughout the past decade. It has consistently sat at a price range of $16.86-$25 and has not been able to get back to its $27.02 price at the beginning of 2019. The company has seen several successes over the past year that I believe are not yet reflected in their price which will lead to potential upside in the future.

1 Year Stock Chart vs. Benchmark

Source: FactSet

My Takeaway:

SKM should continue to stay in the AIM International Fund as they are in a great place to adapt to where their industry is shifting and have expanded their busines tremendously over the past year. Since their record low in 2019, they have been moving back towards the valuation their have traded at in past years and through that have seen record growth in top to bottom line income measures. As they continue to gain subscribers to their 5G network, grow their security segment even more, and take advantage of some of their new synergies with big American companies, they will be in a great place to bring great continuous value to their investors. If they are not able to mitigate any risks associated with their 5G and security network’s infrastructure, this could severely impact their ability to provide durable value for our portfolio and changing to a sell recommendation.