Wheaton Precious Metals (WPM, $43.48): “Not So Precious Anymore”

By: Alexander

Mastalish, AIM Student at Marquette University

Summary

Wheaton

Precious Metals, Corp. (NYSE:WPM) is a mining company which deals

with the sale of precious metals. They primarily sell three precious metals:

Gold, Silver and Palladium.

- Wheaton

currently has 24 operating mines with 12 development projects spread across

the Americas with some European exposure.

- 85% of current production comes from assets

that fall in the lowest half of the cost curve.

- WPM

currently one of the highest rated materials sector companies in regard to

ESG (AA Rating) and the WPM is a part of the UN Global Compact as well.

- Wheaton

current pays a high dividend which is increasing by 25% YoY to $0.15 per

share.

Key

points: Wheaton Precious Metals is a streaming metals company. When a

company is a streaming metals company, it makes an agreement with mining company

to purchase most of the mining company production at a set price in advance. The

streaming model offers WPM the advantage of buying below the cost curve often (85%

as of 2021 Q3), allowing WPM to lock in pricing in advance and better position

the company against price volatility. Streaming also allows for the precious

metal company to focus on selling the good to end user, and the miners on

mining. This reduces the cost of operations for Wheaton compared to if it had mining

operations of its own. WPM’s main partners include Capstone, Rio2 and Artemis.

The company has seen a decrease

in gold production, primarily due to a lower output from a major partner Vale

and their Salobo operation, alongside a decrease of production at the Sudbury

operation. These challenges in production helped contribute to the decrease in

adjusted net earnings for WPM. This has also caused the trend of WPM missing

earnings expectations for all of 2021, and missing revenue on 2 of the 3 quarters

so far announced in 2021. Most notably, Q3 2021 saw a 12.5% decrease in

revenue, while also seeing a 10% decrease in earnings.

To reverse this trend, management

is planning on continuing their development projects for increased growth. A

partnership with New Gold and Artemis Gold in Canada will further diversify

Wheaton’s existing portfolio, while strengthening the partnership with Artemis.

The project will start in 2021 Q4 and be complete in 2024. Management also just

increased the dividend to $0.15 in Q3 of 2021, a 25% YoY increase,

demonstrating their commitment to shareholders.

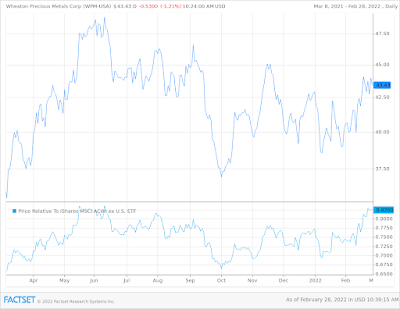

What

has the stock done lately?

The

company has seen steady growth in the last month, seeing share price increasing

7.84% over that time period. At its current share price, WPM is trading at 47.15%

upside from the original pitched price target of $29.50. The company in the

last 6 months is down 3.46%, while being down 19.02% from the all-time high share

price in July of 2020.

Past

Year Performance: Wheaton’s share price has seen great growth after rebounding

from a drastic sell off from its all-time high in July 2020. Share price for

the year has been up 21.86%, primarily from the elevated commodity prices in

the spring and summer of 2021. Going forward, Wheaton is poised to see growth,

albeit at a slower rate than the first 6 months of the past year.

My

Takeaway

Wheaton

Precious Metals, while being an industry leader and have demonstrated their capabilities

to diversify and expand their current portfolio, have already seen much of the

growth attached to these strengths. Therefore, WPM has underperformed earnings

and revenue expectations in 2021. This has raised concern over the firm’s

long-term performance and it is for that reason that I recommend WPM should be

sold from the AIM International Portfolio, recognizing 98.15% upside from the

original purchase.