Thursday, April 28, 2022

Wednesday, April 27, 2022

The Eleventh Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, April 29th

AIM Class of 2023 Student Equity Presentations

Friday, April 29th

Follow the link to access the student equity write-ups.

The 8-minute student

presentations can be viewed every Thursday afternoon on YouTube. Then join us live in person on Friday at 1:00

pm CST in the AIM Room or stream live via the AIM YouTube channel for the

presenter’s Q&A.

If you are unable to attend, you can always view

them live via YouTube HERE.

Friday, April 22, 2022

An International Equity holding: Artivion, Inc. (AORT, $22.57): “Hold the Door, Artivion is Here” By: Luke Hunneke, AIM Student at Marquette University

Artivion, Inc. (AORT, $22.57): “Hold the Door, Artivion is Here”

By: Luke

Hunneke, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Artivion, Inc. (NYSE:AORT) develops

solutions that. Address cardiac and vascular surgeons’ clinical challenges

in treating patients with aortic diseases.

- Artivion

rebranded from Cryolife in Q4 2021. The Artivion name is derived from the

words Aorta, Innovation, and Vision.

- YoY revenue

growth for the On-X product segments and stents and graft segment is up

33%.

- Management’s

near-term plan is to accelerate revenue growth through three initiatives;

drive On-X growth while commercializing other products, expanding into

Asia-Pacifc and Latin America by receiving regulatory approvals, and securing

regulatory approvals for PerClot and. PROACT Mitral products.

Key

points: Artivion, after a recent rebrand from the Cryolife brand, looks

to capitalize on several factors that will affect revenue growth. Firstly,

Artivion is focusing on maximizing several stent and graft products; AMDS, NEXUS,

E-nside, and their new product, NEO. AMDS, the world’s first arch remodeling

hybrid device for use in the treatment of acute Type A dissections. Revenues for

AMDS have increased 20% YoY.

Artivion’s NEXUS product has also

done extremely well, posting quarterly revenue increase YoY of 233%. Artivion

is confident that a decline in COVID-19 infections will continue to increase

the amount of non-COVID treatment in hospitals and will cause an uptick in

NEXUS procedures in 2022. Artivion is also increasing their initiative to

expand internationally in the Asia-Pacific and Latin America regions. The

company has executed this strategy well so far, with quarterly revenues increasing

in both regions by 29% and 34%, respectively. These regions are expected to be

important contributors to Artivion’s future growth.

What

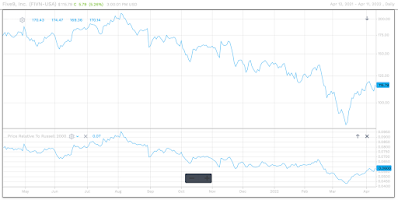

has the stock done lately?

Artivion’s stock price has hovered

around $18.00-$19.00 for the better part of 2021. February’s earnings call

increased the stock price several dollars to $21.00 and the price has hovered at

that range since. Artivion’s rebranding and several initiatives regarding new

products and international expansion should excite investors. Artivion’s stock

is up 25.53% over the past 3 months.

Past

Year Performance: Artivion is down -.04% YoY, holding evenly with the

Russell 2000 index. However, Artivion has performed much better than other

similar healthcare companies, where the sector as a whole is down -13% YoY.

My

Takeaway

Artivion has done a lot to

continue to increase their top line, and the introduction of several new

products, including NEO, look to continue to do so. Artivion’s international

initiative, if there are no regulatory problems, will also seek to provide

revenue growth for Artivion. It is my opinion that Artivion be kept in the AIM

Small Cap portfolio and classified as a Hold.

An International Equity holding: Ardagh Metal Packaging S.A. (AMBP, $7.94): “Getting Canned” By: Joseph Anason, AIM Student at Marquette University

Ardagh Metal Packaging S.A. (AMBP, $7.94): “Getting Canned”

By: Joseph

Anason, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Ardagh

Metal Packaging S.A. (NYSE: AMBP) develops, manufactures, and

sells metal beverage cans. The company operates through the Europe and

Americas geographical segments.

- The

company was spun off from Ardagh Group SA (ARD) in early 2021 and

completed their partnership with Gores holdings V on August 4, 2021. ARD

remains majority shareholder at 75.32% ownership.

- The

company experienced decreasing net income before and after exceptional

items from 2020 to 2021. The net loss after exceptional items in 2021 was primarily

contributed to listing and professional fees related to issuing shares for

the new partnership.

- AMBP

submitted plans to build a new $200 million beverage can facility in

Ireland. It is planned to be operational in 2023.

- The

company missed EPS expectations for Q4 2021. Additionally, over the last

year, the stock has been declining in value.

Key

points:

Ardagh

Metal Packaging was the metal-packaging unit spun off from Ardagh Group SA (ARD).

The company completed their business partnering with Gores Holdings V on August

4, 2021. Ardagh Group SA has remained the majority shareholder at 75.32% ownership.

AMBP ended

the 2021 year with sales of $4,055 million and adjusted EBITDA of $612 million.

However, the company had declining net income before exceptional items from

2020 to 2021 of $15 million. After exceptional items, the company reported a

net loss of $210 million, compared to net income of $111 million in 2020. $242

million of the exceptional items that contributed to the net loss relates to the

listing service of the shares for the business combination on August 4 and for

professional advisory fees.

On April

5, 2022, Ardagh Metal Packaging submitted plans for a $200 million (£150

million) beverage can plant. This facility will be located in Northern Ireland,

40,000 square meters in size, and will create about 160 on site jobs and about

30 indirect jobs through associated businesses. This facility will strengthen

customer relationships across Ireland and Great Britain and grow their

production base in Europe. David Spratt, CEO of Ardagh Metal Packaging Europe,

is expecting the plant to be operational in 2023.

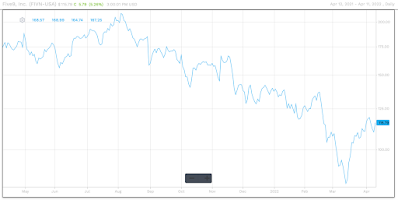

What

has the stock done lately?

The

stock experienced increased volatility in March 2022. AMBP hit a 52-week low of

$7.17 on March 17 and rebounded by the end of the following week to reach a

price of $8.80. Since then the stock has been in decline. This is despite submitting

plans to build a new beverage can facility in Ireland.

Past

Year Performance:

Shortly after the announcement of the completion of the business combination, Ardagh Metal Packaging hit an end-of-day stock high of $12.15. Since then, the stock has been declining, hitting a low on March 7, 2022. Additionally, the stock is down 12% YTD. For Q4 2022, AMBP reported $0.07 EPS, missing expected EPS of $0.09, and exceeded expected revenue of $1.02 billion by $0.07 billion. The company will be releasing Q1 2022 earnings on April 28. The expected EPS and revenue are $0.06 and $1.12 billion, respectively.

My

Takeaway

The market positively received the news of the completion of the partnership with Gores Holdings V. Since then, however, the company has been underperforming to the benchmark and has been in a steady decline. Despite the news of a new facility, the stock continues to decline. The company faces headwinds from current macro events in Europe, increase in material and transportation costs, and rising interest rates. The company will need to effectively manage these costs to improve their current situation and to stop their share price from further decline.

Thursday, April 21, 2022

Wednesday, April 20, 2022

The Tenth Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, April 22nd

AIM Class of 2023 Student

Equity Presentations

Friday, April 22nd

The tenth set of spring AIM equity presentations for the Class of 2023 will be on Friday, April 22nd.

Follow the link to access the student equity write-ups.

The 8-minute student

presentations can be viewed every Thursday afternoon on YouTube. Then join us live in person on Friday at 1:00

pm CST in the AIM Room or stream live via the AIM YouTube channel for the

presenter’s Q&A.

If you are unable to attend, you can always view

them via YouTube HERE.

Wednesday, April 13, 2022

An International Equity holding: Five9 Inc. (FIVN, $115.79): “Five9 Isn’t Calling it a Day” By: Owen Filbin, AIM Student at Marquette University

Five9 Inc. (FIVN, $115.79): “Five9 Isn’t Calling it a Day”

By: Owen Filbin, AIM Student at Marquette

University

Disclosure: The AIM International Equity Fund currently holds this position. This article was

written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Five9

Inc. (NASDAQ: FIVN) is

a leader in providing cloud software for contact centers, leveraging their

expertise in delivering real-time customer data to their clients. They

derive almost all of their revenue in the United States (~90%), as well as

in China and various European countries.

- FIVN plans to expand their exposure in

this market by delivering their Intellectual Virtual Assistant (IVA)

offering, positioning them to be the first player in the industry with

this service.

- FIVN’s strong growth history stems

from their 93% recurring revenue and 66% YoY increase in customer

bookings. FIVN has also entered into new markets internationally.

- Management has targeted new, larger

contracts to boost revenues. This initiative has led to margin expansion and

more than $1 million in annual recurring revenue.

- FIVN was founded in 2001 and is

headquartered in San Ramon, CA. Rowan Trollope currently serves as CEO and

director.

Key points: FIVN strives to

enhance customer call productivity through their integrated cloud capabilities,

as well as expertise in implementing tailored solutions based on client needs. Their

offerings are scalable, which is an attractive perk nowadays with SaaS and

similar models gaining traction in these markets. FIVN has

experienced a 5-year sales CAGR of roughly 30% and plans to aggressively grow

their top line through the next five fiscal years. Their moat in the contact

center cloud industry, coupled with international market expansion positions

the company well to achieve and surpass their intended revenue goals. FIVN’s

core driver of revenue is measured in bookings, something they have handled

well in the past 3 FY. In 2021 EMEA and LATAM bookings increased at a 167% and

128% CAGR YoY, respectively.

FIVN’s new core offering, Intellectual Virtual

Assistant (IVA), is a one of a kind technology that FIVN is bringing to market

before their competitors. This product was made possible due to their

acquisition of Inference Solutions, an IVA provider. Since FY21, usage for this

offering has grown 180%, measured on how many minutes per week the software is

handling calls.

Based on a recent Five9 publication, main uses for

this software include password resets, authentication, appointment bookings,

balance updates, and status updates. As demonstrated, firms across all sectors

and industries have benefitted from this service. Key notable milestones

include surpassing 80 million calls, mainly health care providers like Covid

Clinic, as well as other health insurance and clinics

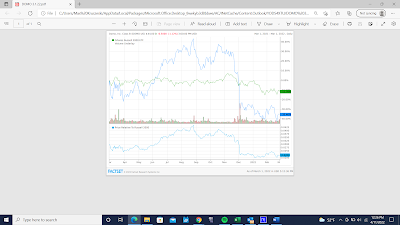

What has the stock done lately?

FIVN

was recently added to the Marquette AIM Small Cap fund. Since this addition,

the stock has increased roughly 5%, with attractive drivers moving forward. FIVN

boasts strong historical revenue growth, as well as future growth projections

from management that make FIVN appealing moving forward.

Past Year Performance: FINV is trading

well below its YTD pattern. Since Q1 FY21, FINV is down about 35%, and reached

its 52 WK low in March 2022. Since then, the stock has climbed 26%, signaling

an adjustment back to its appropriate valuation. Firm initiatives to capture larger contracts which drive their

bookings and revenue, as well as their rollout of their IVA technology is driving

the share price back to historical trading prices.

My Takeaway

FIVN

was pitched with a projected price target of $161.28, and is currently trading

towards the bottom of its 52 WK L-H. The current state of the market, specifically

within this sector, underscores the discrepancy in valuation. As FIVN

recognizes the benefits from their newly released IVA technology, and as

domestic & international bookings increase, it will be interesting to see

how FIVN reacts. Additionally, words like ‘moat’ and ‘first to the industry’ being

tossed around by management is an attractive signal moving forward. Strong YoY

bookings & recurring revenue, and the expansion of these offerings into

international markets is an additional tailwind to consider for this firm

heading into FY22.

A Small Cap Equity holding: Crocs Inc (CROX, $72.18): “Holes in the Shoe” By: Ryan Kreie, AIM Student at Marquette University

Crocs Inc (CROX, $72.18): “Holes in the Shoe”

By: Ryan

Kreie, AIM Student at Marquette University

Disclosure:

The AIM Small-Cap Equity Fund currently holds this position. This article was

written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Crocs, Inc. (NASDAQ:CROX) is

a worldwide casual footwear manufacturer, distributor, and retailer for men,

women, and children.

- Their

stock price has dropped nearly 50% since the acquisition of HEYDUDE in

December 2021

- The

company has taken out significant amounts of debt the over past 3 years as

we wait to see if management’s decisions will pay off.

- Management

has indicated that it will suspend its stock buyback program after making

a huge mistake when it bought back stock at a price of $121

- CROX

could be heading in the wrong direction with the stock price down 60%

since it was pitched in November 2021 at a price of $178.50

Key

points:

The drivers for Crocs are

certainly in play. Their Ecommerce growth has led to an 8% increase in gross

profit from 52% of revenue in 2020 to 60% of revenue in 2021. The company has

also had a strong net income for the second year in a row ($725.7 Million in

2021 and $312.9 Million in 2020) after barely breaking even before 2019. Their

income statement looks promising, and Crocs are more popular than ever.

Collaborations and advertising

are still strong. They have numerous partnerships to promote their products.

This spending has led to strong revenue growth. However, now that the pandemic

appears to be almost over. Will their strategy still hold up? People bought

Crocs during the pandemic, but will they continue to buy them coming out of the

pandemic? Crocs has also continued to expand globally with China and South

Korea as current targets for expansion.

In December 2021, Management announced

plans to acquire HEYDUDE which left investors concerned and resulted in a large

sell-off of the stock. Investors question whether this was a good decision by

management especially since the acquisition was funded by taking out debt.

Management has roughly $920

million in long-term debt on the balance sheet after only $326 million in 2020.

With only $213 million of cash on hand at the end of 2021 management has a lot

of work to do to pay all of this back. Their decisions are extremely risky with

their LT debt to total asset ratio growing significantly to 0.60 in 2021

compared to 0.29 in 2020.

Management took a risk and bought

back $1 billion in stock at a price of $121 per share. This appears to have

been a huge mistake with the stock currently at $72.18 per share. Crocs has

since suspended its buy-back program. Management has to find ways to generate

revenues to pay off its huge amounts of debt they recently took out. Management

has said it expects a 26% decrease in operating margin for 2022.

What

has the stock done lately?

Since Crocs was pitched in

November 2021 their stock is down ~60%. This is a significant amount and could

be a serious concern to investors. Management’s decisions to acquire HEYDUDE,

buy back stock at too high of a price, and take out huge amounts of debt have

caused this collapse in price. A poor start to the year for Russell 2000 is

also part of the cause.

Past

Year Performance: AIG has only decreased ~12% in value over the past

year, but they may be able to rebound and regain some value. Especially with so

much debt outstanding, it seems like management has big plans. The question is

will they pay off?

My

Takeaway

It will be very difficult for the

AIM program to get their money back on with Crocs. The stock has lost over $100

(in value per share since it was pitched in November. It will be interesting to

see what how management’s plans pay off so we can cut our losses. With the

market in a bad place right now, we should be able to regain some value before

this stock is sold. The pitching of this stock was very poorly timed with it

pitched very close to its 52-week high and a month before the news about the acquisition

of HEYDUDE broke. Management’s decisions were not properly considered when

Crocs was pitched, and their high debt levels should have led to a more

conservative valuation. Things can only go up from here for Crocs as it must

work with their high debt levels.

An International Equity holding: F5 Inc. (FFIV, $210.23): “Up in the (F5) Clouds” By: Max Kruszeski, AIM Student at Marquette University

F5 Inc. (FFIV, $210.23): “Up in the (F5) Clouds”

By: Max

Kruszeski, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- F5, Inc. (NASDAQ: FFIV) is

a provider of multi-cloud security and application delivery. FFIV connects

business, applications and customers, allowing them to reach their full

potential in the next generation of tech security, infrastructure and

solutions.

- The

company operates out of three segments; services (52% of total revenue), systems

(29%), and software (19%). The company mainly operates in the United

States (53% of total revenue), but also has operations in China, Japan,

Germany and others.

- Although FFIV’s has sustained a recent price

slide from ~$240 to ~$210, the company still shows upside.

- The

company continues to beat guidance and grow their cloud software platform

posting 47% YoY growth vs expectations of around 35%.

- Cloud

provider partnerships (e.g. AWS) and 2021’s acquisitions of Volterra Inc.

and Threat Stack, Inc. and 2019’s acquisition of Shape, ensures FFIV’s

ability to grow and expand their software platform.

Key

points: As a result of the COVID-19 Pandemic,

companies face more and more pressure to integrate a cloud platform that connects

their business to their customers and tech applications. The cloud

communications industry will continue to see growth. The market is expected to

grow from $4,632.3 million in 2021 to $22,408.5 million by 2028; representing a

25.3% CAGR in 2021 through 2028.

Because

of this, FFIV has focused their business efforts toward growing and expanding

their cloud platform, and has seen success. FFIV’s total net revenues increased

10.7% in fiscal year 2021 from fiscal year 2020, compared to an increase of

4.8% in fiscal year 2020 from the prior year. This growth was driven by the 47%

YoY software revenue increase, and more specifically from the addition of the

software-as-a-service product offerings through the Shape acquisition and FFIV’s

subscription-based offerings, which include software sold via their flexible

consumption program or multi-year subscriptions.

FFIV’s

recent acquisitions are also set to provide them success in the near future. In

2021 FFIV acquired Volterra Inc. a SaaS platform that helps detect threats more

rapidly and reduce neutralization times. This, along with the combination of

the Shape, a leader in online fraud and abuse prevention, added protection

against automated attacks, bots, and targeted fraud, Together, F5’s portfolio

provides maximum protection and reduced risk for all applications across data

centers, cloud, and the edge.

FFIV

has also seen success with their enterprise customers, with 71% of product

bookings coming from enterprise customers, followed by Service Provider (15%) and

Government (14%). With increased security through acquisitions, and FFIV’s

investment into their cloud software platform FFIV will continue to grow and

beat guidance.

What

has the stock done lately? Since being added to the portfolio in March

of 2020, FFIV has seen a 73.87% increase in its share price. The stock has

recently slid in the last 3 months as FFIV is down 14% since January 1st.

The 52-week H-L is $174.34-$249.00, the stock has suffered along with other

tech stocks amidst the recent COVID-19 pandemic, Russia-Ukraine conflict and

rising interest rates, however FFIV will look to regain some positive momentum

coming into their next earnings call coming up next month.

Past

Year Performance: FFIV is up .66% in the

past year, obviously, this is underwhelming, however, the past year has been

riddled with macroeconomic setbacks bringing share price down every time FFIV

seems to gain some momentum.

My

Takeaway

Due to FFIV’s ability to provide,

grow, and improve their cloud-based software system will continue to drive FFIV’s

price. Their recent acquisitions and the integration of these companies allow

for FFIV to provide a more secure SaaS. With earnings set to release next month,

it’s likely that FFIV will beat guidance. If FFIV can continue to acquire market

share from a surging cloud communication market, they are sure to be in a good

spot moving forward. Analysts estimate FFIV shares could reach up to $280. With

this, it is recommended that FFIV continue to be held in the AIM Small Cap

Portfolio.

Thursday, April 7, 2022

Wednesday, April 6, 2022

The Ninth Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, April 8th

AIM Class of 2023 Student

Equity Presentations

Friday, April 8th

The ninth set of spring AIM equity presentations for the Class of 2023 will be on Friday, April 8th.

Follow the link to access the student equity write-ups.

The 8-minute student

presentations can be viewed every Thursday afternoon on YouTube. Then join us live in person on Friday at 1:00

pm CST in the AIM Room or stream live via the AIM YouTube channel for the

presenter’s Q&A.

If you are unable to attend, you can always view

them via YouTube HERE.

A Small Cap Equity holding: Clean Harbors, Inc. (CLH, $108.25): “Clean Future Ahead for CLH” By: Andrew Payne, AIM Student at Marquette University

Clean Harbors, Inc. (CLH, $108.25): “Clean Future Ahead for CLH”

By: Andrew Payne, AIM Student at Marquette University

Disclosure: The AIM Equity Fund currently holds this position. This article was written by myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article.

Summary

- Clean Harbors, Inc. (CLH, $108.25) is a leading provider of energy, environmental, and industrial waste services operating through two segments: Environmental Services (78.3% of revenue) and Safety-Kleen (21.7%)

- Safety-Kleen engages in the sales of industrial and automotive cleaning parts and is the largest re-refiner and recycler of used oil in North America

- CLH acquired HydroChemPSC (HPC) in Q3 of 2021, which directly ties into the company’s Industrial Services revenue portion included within their Environmental Services segment.

- CLH beat Q4 2021 EPS by 30% and revenue by 9%

- Waste Management (WM) has potential interest in a buyout of CLH

Key Points: Clean Harbors has been a leader in environmental waste disposal over the past two decades. Through strategic acquisitions, the company has started to expand both geographically and into other industries. These acquisitions are meant not only to expand their reach, but also to add the acquiree’s operational efficiencies and automation to their own services. Most recently, the company acquired HydroChemPSC (HPC), which directly relates to the company’s Industrial Services revenue portion included within their Environmental Services segment. CLH was heavily affected by the COVID-19 pandemic and saw revenues drop 8%, as the result of less industrial waste volume from decreased production across all industries. Prior to 2020, CLH was growing revenue at a 5-year CAGR of 7.8% and EBITDA at a 5-Year CAGR of 9.3%. As waste volume returned in 2021, CLH saw its revenue skyrocket 24% YoY.

Some risks that CLH continues to face include changes in regulation and high levels of debt that the company has taken on to finance acquisitions. Environmental waste and oil re-refining are both highly regulated industries. Changes in regulation could have an adverse effect on operations. As of 2021, CLH has approximately $2.5 billion in debt. These substantial levels of debt could adversely affect the company’s financial state if they are not able to meet their obligations. While CLH is highly leveraged, the risk behind the investment is very small given the similarities in operations of CLH and the newly acquired HPC.

What has the stock

done lately?

Since being added to the AIM portfolio, there have been developments of a possible buyout deal from Waste Management (WM). WM is the largest residential waste disposal company in North America and is looking to expand its industrial waste segment. An acquisition of Clean Harbors would do just that, but they will most likely have to pay a large premium to acquire CLH. On February 24, 2022, CLH released earning for Q4 2022. Within the earnings report, management discussed the early successes of the HPC acquisition and highlighted steeper revenue estimates for FY 2022 than most analysts. Management also revealed an updated capital expenditure schedule that highlighted more investments into incinerator development and expansion in 2023 - 2024.

Past Year

Performance: Over the past year, CLH’s

share price grew 24.1%. This was largely due to recovery from the pandemic,

driven by sales growth of 28% YoY. This increase in sales growth was caused by

the return of waste volume to normal levels. The pandemic significantly reduced

waste usage.

My Takeaway

Clean Harbors was

added to the AIM portfolio at a share price of $94.25 and is now trading at $108.25,

yielding a 14.8% return since added to the portfolio. Looking forward, CLH’s

growth strategy includes expanding its Safety-Kleen segment of revenue and

growing through acquisitions. CLH has continuously taken strides to grow this

segment of revenue and seen growth in the oil segment of revenue at a four-year

CAGR of 54%. This is attributed to the increase in volume over this period of

time and price of base oils over the past two years. As

businesses continue to transition to clean solutions, Safety-Kleen’s oil

segment will continue to increase the amount of oil they collect each year,

which is currently 250 million gallons.

The company’s acquisition of HPC is

estimated to generate $744 million in additional revenues and EBITDA of $115

million. In addition to the added revenue, management has also projected $40

million in cost synergies produced by cross-selling, implementation of

automation, and improvements of operational efficiencies. It is my

recommendation that CLH remain in the AIM small cap portfolio.

A Small Cap Equity holding: Curtiss-Wright Corporation (CW, $155.56): “The ‘Wright’ Decisions Paying Off” By: Michael O’Donnell, AIM Student at Marquette University

Curtiss-Wright

Corporation (CW, $155.56): “The ‘Wright’ Decisions Paying Off”

By: Michael

O’Donnell, AIM Student at Marquette University

Disclosure:

The AIM Small-Cap Equity Fund currently holds this position. This article was

written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Curtiss-Wright Corporation

(NYSE: CW) is a precision manufacturer of components that

provide solutions to the commercial/industrial, defense, and nuclear power

generation markets. Products across segments include transmission

shifters, electro-mechanical actuation control components, turret aiming

and stabilization products, airlock hatches, etc. Of CW’s FY ’21 revenues,

74.1% were derived in the US. CW is headquartered in Davidson, NC.

- CW’s

revenue grew 4.79%, YoY, due to a 19% increase in their Defense

Electronics segment.

- Operating

Margin increased 320-bps, YoY, showing execution of restructuring and

operational initiatives which enabled management to invest an incremental

$14m in R&D.

- CW repurchased

a record $350m of shares outstanding which contributed to a 37% increase

in diluted EPS, YoY.

- In

January of 2022, CW announced the acquisition of Safran’s arresting business

for $240m cash. The arresting business is a supplier of mission-critical,

fixed-wing military aircraft arresting systems. In that same month CW

divested Phönix Group, their German valves business, because of a lack of

synergies recognized.

- CW’s

growth prospects look promising considering geopolitical tensions and

growing government defense spending.

Key

points:

When CW announced FY ‘21 earnings

on February 24, investors were impressed. In the week ensuing CW’s earnings,

share price rose 13.79%. Throughout 2021, CW beat EPS and revenue estimates

(excluding Q4 ’21 revenue missing by 1.22%). For FY ’21, revenues grew 4.79%,

YoY, primarily from their 19% increase in their Defense Electronics segment. This

demonstrates CW’s continuing ability to align product offerings with government

spending.

Arguably what impressed investors

most was CW’s ability to expand margins. In FY ’21, operating margins expanded

320-bps. This jump can be attributed to CW’s FY ’20 restructuring initiatives.

These initiatives set to identify any administrative inefficiencies that

hampered margins. Paired with this was operational initiatives that set to do

the same on the manufacturing side. Because of the success of these initiatives

management invested an incremental $14m in R&D which should pay dividends

in future growth opportunities.

CW has consistently bought back

shares. In FY ’20, CW repurchased $200m in shares. In FY ’21, that number grew

to $300m which is $50m more than what CW had initially announced. Ultimately

this share buyback program has contributed to shareholders seeing a 37%

increase in diluted EPS, YoY.

January 2022 was an active month

for CW. In this month they announced the acquisition of Safran’s arresting

systems business for $240m cash which is expected to close in Q3 of FY ’22. This

acquisition will expand their global defense portfolio and is projected to be

accretive to EPS in year one. Also, in this month CW chose to divest Phönix

Group, their German valves business. Phönix was acquired in 2013 and divested

because of the inability to recognize anticipated synergies regardless of time

and resources contributed.

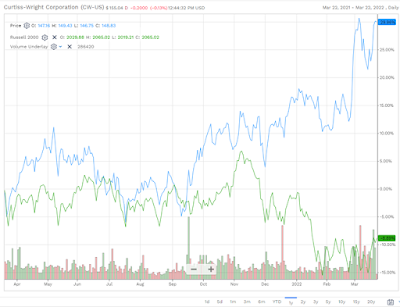

What

has the stock done lately?

Since earnings were released CW

has been trading in the $152 area. This excludes the share price downturn to

$145.23 on March 16.

Past

Year Performance:

Currently CW is trading at

$155.56. Over the past 52 weeks, CW has ranged from $112.11 - $155.88.

My

Takeaway

When CW was pitched in Fall of

2020, the price target was $133.35. While CW currently exceeds that value, I

believe that there is still a lot of potential and growth opportunities. In May

2021, the federal government announced that 2022 defense spending would be $715

billion, a 1.6% YoY increase. Because of Russia’s invasion of Ukraine many

countries are revaluating their defense spending. There have been reports that the

US could increase the 2023 defense budget to $780 billion.

A Small Cap Equity holding: Castle Biosciences, Inc. (CSTL, $45.92): “Myriad of Castles!” By: Kendra Preissner, AIM Student at Marquette University

Castle

Biosciences, Inc. (CSTL, $45.92): “Myriad of Castles!”

By:

Kendra Preissner, AIM Student at Marquette University

Disclosure: The AIM Small-Cap Equity Fund currently holds this

position. This article was written by myself, and it expresses my own opinions.

I am not receiving compensation for it, and I have no business relationship

with any company whose stock is mentioned in this article.

Summary

- Castle Biosciences, Inc.

(NASDAQ: CSTL)

provides testing that is able to predict the recurrence of cancers for patients

diagnosed with invasive cutaneous melanoma in the United States.

- The company has expanded its commercial footprint since

2020, with a recent announcement in 2021 of its intent to acquire Myriad’s

myPath business.

- CSTL launched DecisionDx DiffDx‐Melanoma (DiffDx) and

DecisionDx‐SCC (Dx‐SCC in 2020 helping to

further expand their product portfolio

- The firm indicates that they intend to add 3-5 additional

opportunities to their pipeline which could be launched as early as 2025.

- CSTL is up approximately 7%, as of March 22, since the end of the year 2021, and surprising fourth-quarter results that beat expectations by 41.86%.

Key

points: Castle

Biosciences remains ‘in-play’. CSTL bought myPath for $32.5 million in cash. Myriad

Genetics completed the sale of its subsidiary, Myriad myPath, LLC. Myriad myPath

offers the myPath Melanoma test which will be added to Castle’s portfolio and

contribute to their sales.

The firm’s product

expansion opens new market opportunities. DecisionDx-Melanoma offers the company

an opportunity to expand into the invasive melanoma market which has a $540 million

total addressable market. DecisionDx-SCC provides an opportunity to expand into

gene testing that has a total addressable market of $820 million.

The

expansions suggests that the company will be looking to create or acquire both cancer

and non-cancer solutions as long, and the products continue to serve customers that

are dermatologist, dermatopathologist, or affiliated specialties. The firm has opportunities

to expand its products that are upstream, downstream, and parallel to their current

product portfolio.

Castle

Bioscience is down 30% from one year ago, part of this can be attributed to

their attention being diverted by preparations for completing the acquisition

and boosting the sales of the new products in their pipeline. In addition,

geopolitical risk has created a more volatile environment in the equity markets

as well as other macroeconomic factors like inflation. The stock is still up

from the end of the 2021 fiscal year.

CSTL is up

approximately 7% from the end of the 2021 fiscal year. On February 28th,

2022 the company also announced its 4th quarter results for 2021

beating market expectations by 41.86% with resulting earnings per share of -$0.25

and had forecasted earnings per share of -$0.43.

CSTL also just completed their acquisition of Cernostics. Cernostics provided an esophagus test that adds approximately $1billion to the firm’s estimated U.S total addressable market. This also allows CSTL to expand into the gastrointestinal market.

What has the stock done lately?

Since CSTL completed its acquisition

of Cernostics on December 6, 2021, the stock is up almost 15%. The adjusted

close price on December 6th was $39.94 and on the 7th it jumped to $43.52

which was a 9% increase within one day. As the new products and acquisitions

become more established it will be interesting to see if the combination of CSTL

organic and inorganic growth will generate a company that has negative consequences,

stable financials, or positioned to be a major growth company.

Past Year Performance: CSTL has declined by 30% in value over the past

year, but the stock is still a strong performing, promising equity play. The

firm has a current price of $45.92 and street estimates estimate it could rise

in value anywhere from $60-$94/share. Acquisitions and product line expansion

are driving a lot of the growth and optimistic outlook for the company.

My Takeaway

Castle Bioscience has

created a growth strategy that combines both organic and inorganic growth to

help build up the company’s product offerings and sales. Even though large macroenvironmental

factors are playing out currently, which could greatly affect stocks across all

industries, CSTL has been able to continue releasing new products and juggling

their acquisitions through it all. This current strategy could be contributing

to the 30% performance decrease, but once the company starts to fully implement

these products the firm could provide large upside in the mid to long term.