F5 Inc. (FFIV, $210.23): “Up in the (F5) Clouds”

By: Max

Kruszeski, AIM Student at Marquette University

Disclosure:

The AIM International Equity Fund currently holds this position. This article

was written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- F5, Inc. (NASDAQ: FFIV) is

a provider of multi-cloud security and application delivery. FFIV connects

business, applications and customers, allowing them to reach their full

potential in the next generation of tech security, infrastructure and

solutions.

- The

company operates out of three segments; services (52% of total revenue), systems

(29%), and software (19%). The company mainly operates in the United

States (53% of total revenue), but also has operations in China, Japan,

Germany and others.

- Although FFIV’s has sustained a recent price

slide from ~$240 to ~$210, the company still shows upside.

- The

company continues to beat guidance and grow their cloud software platform

posting 47% YoY growth vs expectations of around 35%.

- Cloud

provider partnerships (e.g. AWS) and 2021’s acquisitions of Volterra Inc.

and Threat Stack, Inc. and 2019’s acquisition of Shape, ensures FFIV’s

ability to grow and expand their software platform.

Key

points: As a result of the COVID-19 Pandemic,

companies face more and more pressure to integrate a cloud platform that connects

their business to their customers and tech applications. The cloud

communications industry will continue to see growth. The market is expected to

grow from $4,632.3 million in 2021 to $22,408.5 million by 2028; representing a

25.3% CAGR in 2021 through 2028.

Because

of this, FFIV has focused their business efforts toward growing and expanding

their cloud platform, and has seen success. FFIV’s total net revenues increased

10.7% in fiscal year 2021 from fiscal year 2020, compared to an increase of

4.8% in fiscal year 2020 from the prior year. This growth was driven by the 47%

YoY software revenue increase, and more specifically from the addition of the

software-as-a-service product offerings through the Shape acquisition and FFIV’s

subscription-based offerings, which include software sold via their flexible

consumption program or multi-year subscriptions.

FFIV’s

recent acquisitions are also set to provide them success in the near future. In

2021 FFIV acquired Volterra Inc. a SaaS platform that helps detect threats more

rapidly and reduce neutralization times. This, along with the combination of

the Shape, a leader in online fraud and abuse prevention, added protection

against automated attacks, bots, and targeted fraud, Together, F5’s portfolio

provides maximum protection and reduced risk for all applications across data

centers, cloud, and the edge.

FFIV

has also seen success with their enterprise customers, with 71% of product

bookings coming from enterprise customers, followed by Service Provider (15%) and

Government (14%). With increased security through acquisitions, and FFIV’s

investment into their cloud software platform FFIV will continue to grow and

beat guidance.

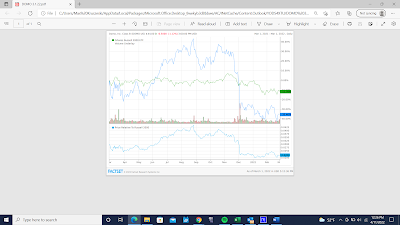

What

has the stock done lately? Since being added to the portfolio in March

of 2020, FFIV has seen a 73.87% increase in its share price. The stock has

recently slid in the last 3 months as FFIV is down 14% since January 1st.

The 52-week H-L is $174.34-$249.00, the stock has suffered along with other

tech stocks amidst the recent COVID-19 pandemic, Russia-Ukraine conflict and

rising interest rates, however FFIV will look to regain some positive momentum

coming into their next earnings call coming up next month.

Past

Year Performance: FFIV is up .66% in the

past year, obviously, this is underwhelming, however, the past year has been

riddled with macroeconomic setbacks bringing share price down every time FFIV

seems to gain some momentum.

My

Takeaway

Due to FFIV’s ability to provide,

grow, and improve their cloud-based software system will continue to drive FFIV’s

price. Their recent acquisitions and the integration of these companies allow

for FFIV to provide a more secure SaaS. With earnings set to release next month,

it’s likely that FFIV will beat guidance. If FFIV can continue to acquire market

share from a surging cloud communication market, they are sure to be in a good

spot moving forward. Analysts estimate FFIV shares could reach up to $280. With

this, it is recommended that FFIV continue to be held in the AIM Small Cap

Portfolio.