Curtiss-Wright

Corporation (CW, $155.56): “The ‘Wright’ Decisions Paying Off”

By: Michael

O’Donnell, AIM Student at Marquette University

Disclosure:

The AIM Small-Cap Equity Fund currently holds this position. This article was

written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Curtiss-Wright Corporation

(NYSE: CW) is a precision manufacturer of components that

provide solutions to the commercial/industrial, defense, and nuclear power

generation markets. Products across segments include transmission

shifters, electro-mechanical actuation control components, turret aiming

and stabilization products, airlock hatches, etc. Of CW’s FY ’21 revenues,

74.1% were derived in the US. CW is headquartered in Davidson, NC.

- CW’s

revenue grew 4.79%, YoY, due to a 19% increase in their Defense

Electronics segment.

- Operating

Margin increased 320-bps, YoY, showing execution of restructuring and

operational initiatives which enabled management to invest an incremental

$14m in R&D.

- CW repurchased

a record $350m of shares outstanding which contributed to a 37% increase

in diluted EPS, YoY.

- In

January of 2022, CW announced the acquisition of Safran’s arresting business

for $240m cash. The arresting business is a supplier of mission-critical,

fixed-wing military aircraft arresting systems. In that same month CW

divested Phönix Group, their German valves business, because of a lack of

synergies recognized.

- CW’s

growth prospects look promising considering geopolitical tensions and

growing government defense spending.

Key

points:

When CW announced FY ‘21 earnings

on February 24, investors were impressed. In the week ensuing CW’s earnings,

share price rose 13.79%. Throughout 2021, CW beat EPS and revenue estimates

(excluding Q4 ’21 revenue missing by 1.22%). For FY ’21, revenues grew 4.79%,

YoY, primarily from their 19% increase in their Defense Electronics segment. This

demonstrates CW’s continuing ability to align product offerings with government

spending.

Arguably what impressed investors

most was CW’s ability to expand margins. In FY ’21, operating margins expanded

320-bps. This jump can be attributed to CW’s FY ’20 restructuring initiatives.

These initiatives set to identify any administrative inefficiencies that

hampered margins. Paired with this was operational initiatives that set to do

the same on the manufacturing side. Because of the success of these initiatives

management invested an incremental $14m in R&D which should pay dividends

in future growth opportunities.

CW has consistently bought back

shares. In FY ’20, CW repurchased $200m in shares. In FY ’21, that number grew

to $300m which is $50m more than what CW had initially announced. Ultimately

this share buyback program has contributed to shareholders seeing a 37%

increase in diluted EPS, YoY.

January 2022 was an active month

for CW. In this month they announced the acquisition of Safran’s arresting

systems business for $240m cash which is expected to close in Q3 of FY ’22. This

acquisition will expand their global defense portfolio and is projected to be

accretive to EPS in year one. Also, in this month CW chose to divest Phönix

Group, their German valves business. Phönix was acquired in 2013 and divested

because of the inability to recognize anticipated synergies regardless of time

and resources contributed.

What

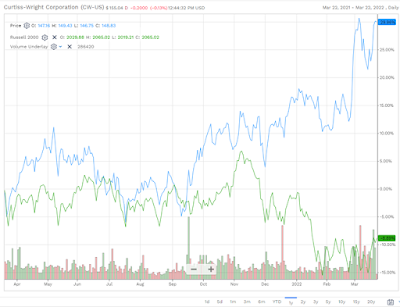

has the stock done lately?

Since earnings were released CW

has been trading in the $152 area. This excludes the share price downturn to

$145.23 on March 16.

Past

Year Performance:

Currently CW is trading at

$155.56. Over the past 52 weeks, CW has ranged from $112.11 - $155.88.

My

Takeaway

When CW was pitched in Fall of

2020, the price target was $133.35. While CW currently exceeds that value, I

believe that there is still a lot of potential and growth opportunities. In May

2021, the federal government announced that 2022 defense spending would be $715

billion, a 1.6% YoY increase. Because of Russia’s invasion of Ukraine many

countries are revaluating their defense spending. There have been reports that the

US could increase the 2023 defense budget to $780 billion.