Five9 Inc. (FIVN, $115.79): “Five9 Isn’t Calling it a Day”

By: Owen Filbin, AIM Student at Marquette

University

Disclosure: The AIM International Equity Fund currently holds this position. This article was

written by myself, and it expresses my own opinions. I am not receiving

compensation for it, and I have no business relationship with any company whose

stock is mentioned in this article.

Summary

- Five9

Inc. (NASDAQ: FIVN) is

a leader in providing cloud software for contact centers, leveraging their

expertise in delivering real-time customer data to their clients. They

derive almost all of their revenue in the United States (~90%), as well as

in China and various European countries.

- FIVN plans to expand their exposure in

this market by delivering their Intellectual Virtual Assistant (IVA)

offering, positioning them to be the first player in the industry with

this service.

- FIVN’s strong growth history stems

from their 93% recurring revenue and 66% YoY increase in customer

bookings. FIVN has also entered into new markets internationally.

- Management has targeted new, larger

contracts to boost revenues. This initiative has led to margin expansion and

more than $1 million in annual recurring revenue.

- FIVN was founded in 2001 and is

headquartered in San Ramon, CA. Rowan Trollope currently serves as CEO and

director.

Key points: FIVN strives to

enhance customer call productivity through their integrated cloud capabilities,

as well as expertise in implementing tailored solutions based on client needs. Their

offerings are scalable, which is an attractive perk nowadays with SaaS and

similar models gaining traction in these markets. FIVN has

experienced a 5-year sales CAGR of roughly 30% and plans to aggressively grow

their top line through the next five fiscal years. Their moat in the contact

center cloud industry, coupled with international market expansion positions

the company well to achieve and surpass their intended revenue goals. FIVN’s

core driver of revenue is measured in bookings, something they have handled

well in the past 3 FY. In 2021 EMEA and LATAM bookings increased at a 167% and

128% CAGR YoY, respectively.

FIVN’s new core offering, Intellectual Virtual

Assistant (IVA), is a one of a kind technology that FIVN is bringing to market

before their competitors. This product was made possible due to their

acquisition of Inference Solutions, an IVA provider. Since FY21, usage for this

offering has grown 180%, measured on how many minutes per week the software is

handling calls.

Based on a recent Five9 publication, main uses for

this software include password resets, authentication, appointment bookings,

balance updates, and status updates. As demonstrated, firms across all sectors

and industries have benefitted from this service. Key notable milestones

include surpassing 80 million calls, mainly health care providers like Covid

Clinic, as well as other health insurance and clinics

What has the stock done lately?

FIVN

was recently added to the Marquette AIM Small Cap fund. Since this addition,

the stock has increased roughly 5%, with attractive drivers moving forward. FIVN

boasts strong historical revenue growth, as well as future growth projections

from management that make FIVN appealing moving forward.

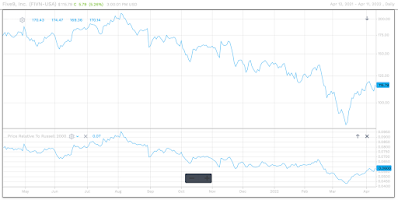

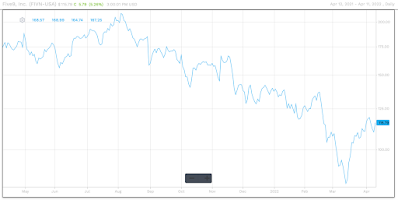

Past Year Performance: FINV is trading

well below its YTD pattern. Since Q1 FY21, FINV is down about 35%, and reached

its 52 WK low in March 2022. Since then, the stock has climbed 26%, signaling

an adjustment back to its appropriate valuation. Firm initiatives to capture larger contracts which drive their

bookings and revenue, as well as their rollout of their IVA technology is driving

the share price back to historical trading prices.

My Takeaway

FIVN

was pitched with a projected price target of $161.28, and is currently trading

towards the bottom of its 52 WK L-H. The current state of the market, specifically

within this sector, underscores the discrepancy in valuation. As FIVN

recognizes the benefits from their newly released IVA technology, and as

domestic & international bookings increase, it will be interesting to see

how FIVN reacts. Additionally, words like ‘moat’ and ‘first to the industry’ being

tossed around by management is an attractive signal moving forward. Strong YoY

bookings & recurring revenue, and the expansion of these offerings into

international markets is an additional tailwind to consider for this firm

heading into FY22.