Delphi

Automotive PLC (DLPH, $100.86): “The

Position Accelerates Forward”

By:

Grant Runnoe, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

- Delphi Automotive PLC (NYSE: DLPH) is one of the world’s largest automotive part manufacturers running through four segments: Electrical/Electronic Architecture, Powertrain Systems, Product & Service Solutions and Electronics & Safety.

- The company’s plan to spin off the Powertrain System segment has accelerated into 1Q18.

- As of December 5th, Delphi Automotive will trade under a new name Aptiv (NYSE: APTV) leaving its spin-off, Delphi Technologies trading under ticker DLPH

- For every three shares of Delphi Automotive owed as of the close on 11.22.17 shareholders received one share of Delphi Technology.

- Delphi Automotive is well positioned to lead the trends towards autonomous and electric vehicle which is expected to reach incremental content per vehicle of $5,000 by 2020.

Third Quarter Highlights

- Announced acquisition of nuTonomy specialized in advanced automated driving technology.

- Repurchased shares and paid dividends of $172 million.

- Revenue increase 6% YoY to $4.3 billion.

- +6% Europe, +19% Asia, +25% South America, -8% North America

- GAAP operating margins of 11.3%.

- Record bookings of $2 billion in 2017 YTD.

- Operating margins +30 bps YoY, operating cash flow +16% YoY.

- Active safety revenues +70% during 3Q17.

- Raised guidance for 4Q17 and FY17.

Key points: The Powertrain spin off will be complete in 1Q18

leaving two companies, Delphi Automotive and Delphi Technology. Liam

Butterworth has been named CEO and President of Delphi Technologies PLC. He

currently holds the position of SVP of Delphi and president of the Powertrain

system segment. Mr. Butterworth has been with the company since 2012, joining with

the acquisition of FCI Holding SAS’s motorized vehicles division where he held

the president and general manager role. Vivid Sehgal has been named CFO. Prior

to joining the firm he worked as the CFO at LivaNova PLC. Delphi Technologies

will focus on electrification (mild hybrid to full electronic vehicles), software

and control and internal combustion.

Delphi

deepens its pipeline with the acquisition of nuTonomy, a provider of autonomous

driving software and technology. Delphi’s goal of accelerating their global

fleet expansion will be greatly accelerated as a result of the acquisition of

nuTonomy. Delphi reportedly will place 60 autonomous vehicles on the road

across 3 continents by year-end as well as gain 70 experienced engineers and

scientist, 25 PhDs and commercial relationships such as Lyft, Grab and PSA.

This acquisition is another example of Delphi’s initiative to remain the global

leader in autonomous software and technology capabilities as they previously acquired

Ottomatika, an autonomous driving software developer and Control-Tec and

Movimento which are data service companies.

Delphi is well positioned to capture future industry

growth. Internal combustion engines, which currently dominate the market, are

expected to continue to grow at a CAGR of 1% from 2017-2025, whereas

electrification penetration is forecasted to increase at a 32% CAGR. Catalyst

for expansion is that of regulation. China has implemented its New Energy

Vehicle (NEV) program that incentivizes plug-in hybrid electric vehicles

(PHEV) and battery electric vehicles (BEV). Europe’s

regulation regarding CO2 demands the need for electrification as well as

consumer trends toward eco-friendly alternatives is also expected to increase

electric vehicle production. Delphi holds a $4B lifetime backlog in this space.

Internal combustion engines will continue to grow, with the requirement that

they continue to find efficiency gains. Active drive assistant (ADA) systems

continue to drive revenue as the demand for these technologies accelerates.

Delphi indicated in their 3Q17 earnings call that they expect revenue from ADA

systems to top $800 million in 2018 due to increased penetration with existing

customers, and expand with new customers.

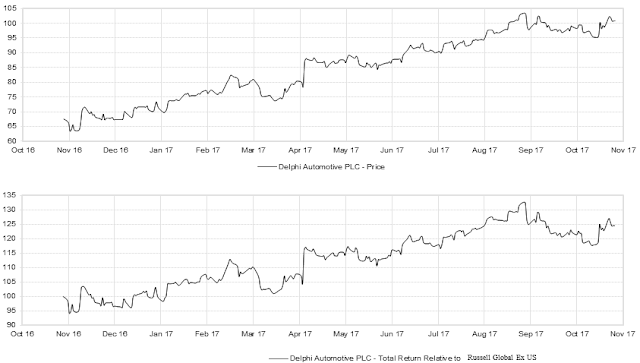

What has the stock done lately?

Delphi beat EPS estimates by $.09 and revenue

estimated by 5.9% reaching roughly $230 million. The stock continues to work as

they post a 3 month returns of +7%. Delphi continues to accelerate their market

position gaining share and engaging in strategic acquisitions (nuTonomy)

propelling themselves forward. Although the market has experienced flat growth

in vehicle production Delphi posted a +4.4% organic growth for the quarter.

Past

Year Performance: Delphi has steadily outperformed both the S&P and

Russell Global Ex US with a year to date return of 49.76% return. Delphi was

placed into the AIM International Equity Fund on 1.27.14 ($59.59) with a Price

Target of $71.45. The stock currently trades at $100.86 posting a 69.3% return.

My Takeaway