By:

Adam Hamilton, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

• Sberbank Russia (SBRCY) provides banking services to financial

institutions, corporate institutional clients, small businesses, and retail

individual clients. The bank provides solutions to over 137 million retail

clients and over 1.1 million corporate clients in 22 countries.

• Sberbank continues to

dominate the Russian financial sector; as the market leader, it accounts for

40.1% in retail loans, 31.7% in corporate loans, and 54.6% in mortgage loans.

• Management has

indicated that it will continue to invest in ways in which customers can

control their accounts remotely to improve customer efficiency through online banking

channels.

Key

points: Loan portfolio growth has been an accelerator of

Sberbank’s continued success. Corporate loans have grown 5.4% YOY and retail

loans grew 3.1% YOY. Management indicates they expect this trend to continue

particularly in the mortgage segment where they account for over fifty percent

of mortgage loans. As the economy continues to strengthen and interest rates

decrease, the loan portfolio has immense potential as both corporate and retail

clients will be in demand for loans.

A key priority of

management this year is to improve cost efficiency, which has been instrumental

in continuing to produce profitability. The cost efficiency ratio is calculated

to be at 33.5%, well below the 38.5% at this same time last year.

Sberbank has a healthy

capital base which maintains the capital adequacy needed for the bank, which

enables them to support growth and continue to strengthen its capital base. This

stemmed and resulted in a total capital ratio of 16.7% and core equity tier 1

capital ratio of 12.3%, respectively, as compared to 12.6%, and 8.9%,

respectively last year. Both the ratios were well above the minimum requirement

of 8% for Russian banks.

Sberbank continues to

develop unique partnerships in order to enhance its business units. In June,

Sberbank formed a partnership with Monotown Development Foundation. This

partnership was very strategic because it now with the help of Monotown,

Sberbank looks to provide more lending to small and medium size enterprises in

small towns to create jobs and bring investment opportunities to foster growth

in quality of life for its residents. This also helps on the retail banking

side, with opportunities to attract a new pool of customers. Another huge deal

they made was with RVC to innovate modern banking solutions for clients. This

partnership focuses on the exchange of analytical information about new

technologies and innovative activities, mostly gearing towards online banking

channels.

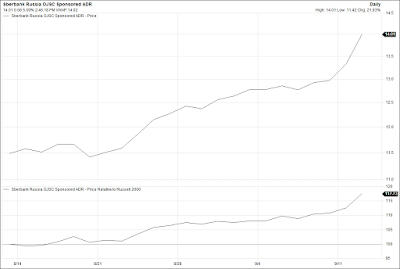

What has the stock done lately?

Since quarter 2 earnings

release, SBRCY has been up 45% after seeing lots of short-term volatility

throughout the year. The market

continues to undervalue SBRCY and if management continues to prioritize how

they are doing now, the stock should continue to be on an upswing over the next

year.

Past

Year Performance: SBRCY has had a rocky year; however, behind

management’s guidance they have

rebounded. With the increase of growth organically and inorganically the

company’s strategies are geared to perform and produce financial strength in

the long term.

My

Takeaway

The stock is now currently trading at $.14.01 and its outlook shows

numerous room for improvement. As the economy strengthens and interest rates decrease,

the demand for loans will increase as well, which will drive SBRCY’s growth. I

recommend that the AIM international portfolio hold on to Sberbank as of September

2017.