By:

Connor Jones, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary:

• ProPetro Holding, Inc. (NYSE:PUMP) is a growth-oriented oilfield

services company providing hydraulic fracturing and other complementary

services to upstream oil and gas companies engaged in unconventional oil and

natural gas resources. They operate in two segments: pressure pumping and other

services.

• Year-end fleet capacity

increased by 64% to 690,000 hydraulic horsepower, or 16 fleets in 2017 and

three more fleets have been deployed in 2018, bringing their HHP to 905,000

across 20 fleets.

• Maintained 100% fleet

utilization since September, 2016 which helped drive revenue for 2017 to $981.9

million which is an increase of 125% from 2016.

• PUMP grew their

adjusted EBITDA to $137.4 million from $7.8 million in 2016, representing an

increase of over 1,600%.

• Proven cross-cycle

financial performance has given PUMP the ability to increase margins and

maintain pricing power through industry cycles that have hurt competitors.

Key

points:

ProPetro’s efficiency in

regard to fleet utilization has led to improved profitability. During an

industry downturn in Q2, PUMP saw competitors having to divert maintenance

capital and cannibalize their existing units for spare parts and idle HHP. This

resulted in a tightening of hydraulic fracturing supply across the industry.

However, PUMP’s 100% fleet utilization enabled them to increase their services

provided while increasing their pricing power to take advantage of the excess

demand. Cost of services decreased as a percentage of revenue to 73.9% in Q3

compared to 79.9% in Q3 of 2017.

This was driven by increased demand and

pricing power and puts PUMP in a favorable position going forward in regards to

their competition who were hurt by pricing pressure and low supply of hydraulic

fracturing.

Continuing on the topic

of efficiency and improving margins, the use of West Texas Regional Sand

increased rapidly in Q3 to 57% of ProPetro’s sand pump by their fleet being

sourced locally, compared to 35% in Q2. With more regional and sand production

coming online in future months, this percentage is expected to increase well

beyond the amount in Q3. This transition to regionally sourced sand has allowed

PUMP to increase operational efficiencies for their customers due to improved

supply chain and related logistics. This also drove the increase in margins and

revenue and improving their position in the industry going forward.

Looking more into ProPetro’s

position in the industry moving forward, their emphasis customer relations has

immensely benefitted them. They have deep, local roots in the Permian Basin

with many of their diverse customer base having worked with them since their

inception. These relationships and the addition of new customers due to

competition being unable to generate adequate supply of services. When the

industry had a downturn, PUMP benefitted from their strong reputation with

customers by retaining and adding clients as opposed to competitors losing

customers to ProPetro and experiencing pricing pressure.

What

has the stock done lately?

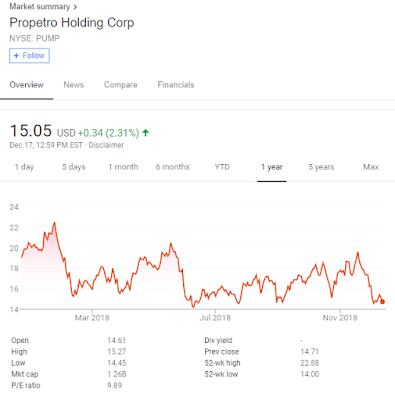

Over the past three

months PUMP’s stock price has fluctuated between $14.57 and $19.61. In these

past three months the stock has generated a return of 2.5%. The stock has seen

significant volatility during this time too. This was expected as management

predicted the industry would go through material changes this year with the

goal of ending in a strong position for 2019.

Past

Year Performance:

During the past year,

PUMP’s stock price has gone from $20.31 to $15.60, representing a return of

-23.19%. As seen in the last three months, the stock experienced significant

volatility throughout the year. This was expected due to shifts in the industry

and when factoring in the volatility in the overall market. This was a

strategic year for ProPetro and if it goes as planned, they will have a strong

2019 that provides more stability in price for shareholders.

Source: Google Finance

My

Takeaway

ProPetro Holding Corp has

developed its reputation in the Permian Basin and placed a high emphasis on

efficiency in their operations. This has paid dividends for PUMP lately as

evidenced by the increase in demand for their services and their ability to

maintain pricing power while their peers have faced pricing pressure. While the

stock faced some volatility during the year and has declined in price, I

believe the strategy that ProPetro implemented will allow them to have a strong

2019 mainly driven by their increasing margins, revenue growth, and fleet

utilization.