Thursday, February 24, 2022

Wednesday, February 23, 2022

The Fourth Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, February 25th

AIM Class of 2023 Student Equity Presentations Friday, February 25th

The fourth set of spring AIM equity presentations for the Class of 2023 will be on Friday, February 25th.

Follow the link to access the student equity write-ups.

The 8-minute student presentations can be viewed every Thursday afternoon on YouTube. Then join us live in person on Friday at 1:00 pm CST in the AIM Room or stream live via the AIM YouTube channel for the presenter’s Q&A.

If you are unable to attend, you can always view them via YouTube HERE.

Monday, February 21, 2022

An International Equity holding: Aptiv PLC (APTV, $141.15): “Driving the industry forward” By: Harvey Read, AIM Student at Marquette University

Aptiv PLC (APTV, $141.15): “Driving the industry forward”

By: Harvey

Read, AIM Student at Marquette University

Summary

- Aptiv Plc. (NYSE:APTV) is a global manufacturer and designer of electronic automotive components, providing electrical and safety technology solutions to the global commercial vehicle and automotive market.

- Products include wiring assemblies, hybrid high voltage distribution systems, cable management, electrical centers, and advanced software development. All catering to passenger security, comfort, safety, and vehicle operation.

- Aptiv services automotive and commercial vehicle manufacturers across Europe, North America, Asia Pacific, the Middle East, and other international regions. Customers include GM, Volkswagen, Fiat, and Hyundai. The company manufactures out of 126 facilities across 44 countries, and is headquartered in Dublin, Ireland.

- Record breaking bookings, expanding market share, strong forecasted revenue growth, and valuable acquisitions have strengthened Aptiv’s position as an industry leader.

- Supply chain disruptions, semiconductor shortage, and raw material inflation have hampered profit margins. If Aptiv can mitigate these factors, their attraction to investors will increase significantly.

Key Points:

The connected car market is projected to reach $56.3 billion

by 2026, from its 2021 estimate of $23.6 billion, growing at a compounding

annual growth rate of 19%. The Asia Pacific region is driving much of this

growth amid rising government safety regulations for vehicles, increased

adoption of high end and luxury cars, and further integrated vehicle

connectivity.

Aptivs revenue has grown at a compounding annual growth rate

of 5.3% over the past 5 years, taking advantage of the increasing demand for

electric and connected vehicles, and expanding penetration into China and India.

With 96% of new vehicles being equipped with built in connectivity by 2030,

Aptiv is moving proactively, acquiring companies in the software space to stay

ahead of the market. In January, Aptiv acquired edge-to-cloud software firm

Wind River for $4.3 billion. Wind River is used on over two billion devices

across 1700 customers globally, and in 2021 generated $400 million in revenues.

As demand for connected devices and the internet of things increases, the

global semiconductor shortage worsens, halting production for companies from

Apple to Tesla. Aptiv will need to navigate these supply chain issues to stay

up with product demand.

What has the stock done lately?

Year to date, Aptiv stock has closed at prices ranging from

$174.12 and $130.84, with the stock down 13.79% from its January 3rd

opening. Despite growing revenues, and record bookings of $24 billion in 2021,

a combination of COVID and supply chain disruptions, and rising inflation have

squeezed profit margins, which has reflected in the stock dropping from its

all-time high in November 2021.

Past Year Performance:

Over the past 52 weeks, the price range for Aptiv was $127.63

to $180.81. Aptiv experienced their 52-week and all-time high on the 3rd

November 2021 after reporting third quarter earnings that exceeded analysts’

expectations. The company reported earnings of $0.38 a share on $3.7 billion in

sales, with Wall Street expecting earnings per share of $0.31 on $3.5 billion

in sales. While sales increased 19.5% from $13.066 billion in December ’20 to

$15.618 billion in Dec ’21, net income fell a dramatic 67% from $1.769 billion

to $527 million due to an increase in materials and manufacturing costs, a

global chip shortage, and supply chain complications.

My Takeaway:

With global demand for connected vehicles surging, Aptiv is in

a great position to capitalize, with strong revenue growth forecasts on the

horizon and an expanding market share. Regular acquisitions of companies such

as Wind River is a solid indication of Aptiv moving proactively to continue to

innovate in the space and maintain its position as one of the industry leaders.

However, due to the ongoing global semiconductor shortage, supply chain

disruptions, and increasing commodity prices that have greatly reduced profit

margins, I recommend Aptiv as a hold, until supply chain disruptions stabilize,

and the company shows it can navigate current inflationary effects that have

greatly reduced profit margins.

An International Equity holding: FirstService Corporation (FSV, $151.32): “Acquisitions Galore” By: Ayden Domico, AIM Student at Marquette University

FirstService Corporation (FSV, $151.32): “Acquisitions Galore”

By: Ayden

Domico, AIM Student at Marquette University

Summary

FirstService

Corp. (NASDAQ: FSV) is a Canadian real estate firm that provides

property management services in the United States and Canada, primary in the

residential space. Offerings include security services, engineering and

maintenance, proprietary banking and insurance products, and management

solutions. The company operates through both company-owned and franchised

subsidiaries, namely California Closets, Century Fire Protection, and Paul

Davis Restorations among many others.

- Over

the past five years, FirstService’s revenue has grown at a CAGR of over

17% driven by increased demand in the housing market and inorganic growth

through acquisitions.

- FirstService

shares were trading at $67.33 per share on March 20th, 2020,

and at $202.08 on October 22nd, 2021, representing growth of

over 200% in just under a year and a half.

- FirstService

and its subsidiary brands have made a number of acquisitions in 2021 and

during the first quarter of 2022 to further expand their reach within

North America.

- FirstService

has increased dividends by exactly 10% during the first quarter of each

fiscal year since beginning distributions to stockholders in the second

quarter of 2015, and the company has announced plans to increase payments

by 11% in 2022 for the first time.

Key

points: FirstService Corp. has consistently grown since 2015,

positioning themselves as one of the premier property management and

restoration conglomerates in North America. Through many smaller acquisitions in

various concentrated metropolitan areas over the years, management has pursued

a strategy of aggressive yet consistent inorganic growth by building up their

subsidiary brands through franchising before purchasing them. In terms of debt,

FirstService typically uses cash in acquiring other companies, but the firm has

~$415mm due in variable rate term loans in mid-2024 and $120mm owed in fixed

rate bonds by the beginning of 2023, so they will need to generate extra

liquidity over the next year in order to meet those deadlines. Following the

end of the third quarter of 2021, FirstService had ~$141mm in Cash & Cash Equivalents

as well as over $600mm in Liquidity Available according to their most recent financial

statements. In five years, following

those two major repayments, FirstService’s management plans to only have about

$30mm in debt obligations left on the balance sheet.

Over the past year, FirstService

has made a number of acquisitions to continue to grow, but a majority of the

firms acquired have already been operating under the company’s operating

subsidiary, First Onsite Restoration. Acquisitions include A-1 Flood Tech out

of Virginia, Bales Restoration in the Seattle area, Kauai Restoration &

Cleaning in Hawaii, Emergency Fire & Water Restoration based out of

Milwaukee, and Chesapeake Sprinkler Company from Maryland. By acquiring

smaller, more local companies all around North America, FirstService is slowly

but surely buying their way into a majority of the major metropolitan markets

without having to start from scratch in each new area. These deals not only

strengthen FirstService’s brand, but also help to expand the company’s

footprint across the United States, allowing FirstService to service new geographical

areas on a regular basis.

Since 2015, when dividends were

first initiated by FirstService, the company has increased its distributions to

shareholders by an astounding 10% each year as the brand has grown

exponentially. FirstService paid a dividend of $0.1825 per share in each

quarter of 2021, and for the first time in 2022, the company announced that it

would pay an 11% increase in dividends. This marks the first time that FSV has

increased distributions at an amount greater than 10%, and it is a positive

indicator for the financial health of the company in both the short- and

long-term future.

What

has the stock done lately?

After nearly peaking in price at

the very end of December 2021 at $196.47, FirstService has fallen nearly 30%

despite no material bad news or otherwise negatively implicating information

being released up to this point. With no fundamental explanation for the drop

in price, FSV shares are now implied to be trading with at least a 30%

discount, presenting a great opportunity for investors also looking for

consistently growing dividends.

Past

Year Performance: With shares seeing an extended drop in price since

New Year’s, FirstService’s stock price has only grown 1.7% year over year.

While that is not quite encouraging, FSV shares have still grown at a compound annual

growth rate (CAGR) of 24.9% over the past five years.; in that same time

period, the S&P 500 grew at a CAGR of 13.3% while the MSCI only increased

in price by a CAGR of 4.8%, illustrating that FSV consistently and

significantly outgains the market.

My

Takeaway

Especially following the sharp

decline in price at the start of the 2022 fiscal year, I recommend FirstService

Corp. as a Buy. Since being added to the AIM fund at a price of $49.89

in February of 2017, FSV has generated returns of over 203.3%. With a peak

price of over $200 implying a share price discount of over 30%, as well as a

continued strategy of inorganic growth through mostly cash acquisitions,

FirstService still has much room to grow, especially following the housing boom

during the COVID-19 Pandemic.

Thursday, February 17, 2022

Marquette’s AIM Team Wins 2022 CFA Society of Madison’s Investment Research Challenge

The Marquette AIM Blue Team Advances in the CFA Research Challenge

Five AIM students to compete next in the regional round in March

February 17,

2022 – The CFA Society of Madison hosted the local round of the CFA Institute’s

Investment Research Challenge. Marquette

University’s Applied Investment Management (AIM) “Blue” team won the

competition and will move to the CFA’s regional competition as the

representative of the CFA Society of Madison. The CFA Institute is the global

association of investment professionals made up of portfolio managers,

investment advisors, educators and other financial professionals.

During the

local CFA Investment Research Challenge, which again was forced to be held virtually

via Zoom, the Marquette team competed against three other groups of students

from UW-Green Bay, UW-Eau Claire, and the Marquette AIM “Gold” team. If the Marquette

team is successful in the regional round then will advance to the America’s

level of the Challenge, which will be held in April, which could then lead to

the Global round against the winning schools from Europe and Asia.

The students

on Marquette’s advancing team were: Dominic Brisson, Madi Daleiden, Natalie

Frey, Rishi Kumar, and Christian Wilber. Members of the AIM gold team were:

Ciara Jones, Ben L’Empereur, Brett Selke, Ryan Witt, and George Wong. All of the students are members of the Applied

Investment Management program and they will be graduating in May 2022.

Dr. David Krause,

director of the AIM program at Marquette University, said: “This year’s

competition was a very challenging event for the students taking part. The

subject company was Kohl’s, the Wisconsin-based department store chain. As you

might be aware, the company recently received an unsolicited $9 billion bid to

go private from a group backed by an activist hedge fund investor.”

The global competition, which runs until April 2022, this year has attracted nearly 7,000 students and over 1,100 universities in more than 60 countries. The CFA Institute Research Challenge comprises:

• Analysis of a publicly-traded company

Teams

research a publicly traded company. The company’s management presents

information to the student teams and is available to answer student questions.

• Mentoring by a professional research

analyst

Each team

works with a CFA charterholder who mentors the team during the research process

and reviews and critiques its report.

• Writing a research report

Each team

produces an Initiation of Coverage report on its chosen company. The report is

reviewed and scored by a group of judges.

• Presentation of research to a panel of

experts

The teams'

final presentations are locally evaluated by panels of experts from top

financial institutions. Panelists include heads of research, portfolio

managers, and chief investment officers from the world’s top firms. The team

with the highest combined written report and presentation score is the winner

and advances to the regional level of the Research Challenge.

• Advancement to the CFA Institute

Research Challenge Global Finale

Regional

winners then progress to compete at the global finale. At the regional and

global stages of the Research Challenge, teams are evaluated solely on their

presentations.

For more information visit the CFA InstituteResearch Challenge website.

Local CFA societies host and launch an Investment Research Challenge in conjunction with the participating universities. The universities assemble teams of three-five business and finance students who work directly with a company in researching and preparing a company analysis. The team’s final presentations are locally evaluated by high-profile panels of heads of research, portfolio managers, and chief investment officers from the world’s top firms. The local champions advance to regional competitions in the Americas, Asia, and Europe and then to the global finale.

CFA Institute is the global association for investment professionals. It administers the CFA and CIPM curriculum and exam programs worldwide; publishes research; conducts professional development programs; and sets voluntary, ethics-based professional and performance-reporting standards for the investment industry. CFA Institute has more than 170,000 members More information may be found at www.cfainstitute.org

About the

AIM Program

The AIM

Program at Marquette University began in 2005. Since then over 120

undergraduate students have participated in the program. Our alumni can be

found in leading investment companies throughout the country - and the world.

As the first undergraduate partner with the CFA Institute, we take pride in our

students' successful placements and CFA exam pass rates. Please feel free to

contact us at: aim@marquette.edu

Marquette’s AIM Team Wins 2012 CFA Society of Madison’s

Investment Research Challenge

Students to compete in

America's regional finals in New York in April

February 24, 2012– The CFA Society of Madison hosted the local round of the CFA

Institute’s Investment Research Challenge. Marquette University’s

Applied Investment Management (AIM) team won the competition and will move

to the CFA America’s regional competition as the representative of the CFA

Society of Madison. The CFA Institute is the global association of investment

professionals made up of portfolio managers, investment advisors, educators and

other financial professionals.

During the local

CFA Investment Research Challenge, which was held at the Fluno Center in

Madison, the Marquette team competed against four other teams of students from

UW-LaCrosse, UW-Milwaukee, Milwaukee School of Engineering, and Carroll

University. Marquette advances to the America’s Regional level of the

Challenge, which will be held in New York in April, where they will compete

against fifty other university teams that won their local competitions from

North and South America. The winner of the America’s Investment Research

Challenge will then compete in the international final, which is also held in

New York in April 2012.

The students on Marquette’s

team were: Jacob Bear, Harrison Davis, Colleen Osborne, Bronson Wetsch, and

Alice Wycklendt. All of the students are members of the Applied Investment

Management program. They will be graduating in May 2012 and will be sitting for

Level I of the CFA exam in June.

The CFA

Institute Research Challenge offers students the unique opportunity to

develop and present an equity research report and compete on a global basis.

Students will learn from leading industry experts and their mentors and peers

from the world’s top business schools. This annual educational initiative is

designed to promote best practices in equity research among the next generation

of analysts through hands-on mentoring and intensive training in company

analysis and presentation skills.

Dr. David Krause,

director of the AIM program at Marquette University, said: “This

year’s competition was very challenging event for the students taking part. The

other teams did an excellent job presenting their recommendation. We are very

excited to represent the CFA Society of Madison and will do our best in New

York in April. We wish to thank the CFA Societies of Madison and Milwaukee for

hosting the Challenge. It gives students the chance to meet some of the finest

investment professionals in the state and to interact with students from other

schools. The Challenge supports our educational efforts and helps

groom the investment professionals of tomorrow.”

This represents the

fourth consecutive year that the Marquette team has advanced to the America’s

Challenge. Krause said, “This year’s team did an outstanding job

analyzing Marcus Corporation. They used a propriety survey, econometric

modeling, and various types of sensitivity analysis to arrive at their

recommendation on the stock. They worked well together and I am pleased that

they will have the opportunity to present their research findings in New York.”

The global

competition, which runs until April 2012, has attracted over 3,000 students and

600 universities in nearly 50 countries, including Vietnam, Kenya and Colombia

for the first time.

The CFA

Institute Research Challenge comprises:

· Analysis

of a publicly-traded company

Teams research a publicly traded company. The company’s management presents

information to the student teams and is available to answer student questions.

· Mentoring

by a professional research analyst

Each team works with a CFA charterholder who mentors the team during the

research process and reviews and critiques its report.

· Writing a

research report

Each team produces an Initiation of Coverage report on its chosen company.

The report is reviewed and scored by a group of judges.

· Presentation

of research to a panel of experts

The teams' final presentations are locally evaluated by panels of experts from

top financial institutions. Panelists include heads of research, portfolio

managers, and chief investment officers from the world’s top firms. The team

with the highest combined written report and presentation score is the winner

and advances to the regional level of the Research Challenge.

· Advancement

to the CFA Institute Research Challenge Global Finale

Regional winners then progress to compete at the global finale. At the regional

and global stages of the Research Challenge, teams are evaluated solely on

their presentations.

For more information visit the CFA Institute Research Challenge website.

About the Global

Investment Research Challenge

The challenge

gathers students, investment industry professionals, publicly traded companies

and corporate sponsors together locally, regionally, and globally for a world

competition. In order to promote best practices in equity research

and company analysis, students research, analyze, and report on a

company as if they are practicing analysts. Local CFA societies host

and launch an Investment Research Challenge in conjunction with the

participating universities. The universities assemble teams of three-five

business and finance students who work directly with a company in researching

and preparing a company analysis. The team’s final presentations are locally

evaluated by high-profile panels of heads of research, portfolio managers, and

chief investment officers from the world’s top firms. The local champions

advance to regional competitions in the Americas, Asia, and Europe and then to the

global finale.

About CFA Institute

CFA Institute is

the global association for investment professionals. It administers the CFA and

CIPM curriculum and exam programs worldwide; publishes research; conducts

professional development programs; and sets voluntary, ethics-based

professional and performance-reporting standards for the investment industry.

CFA Institute has more than 105,000 members, who include the world’s 97,000 CFA

charterholders, as well as 135 affiliated professional societies in 58

countries and territories. More information may be found at www.cfainstitute.org

About the AIM

Program

The AIM Program at Marquette

University began in 2005. Since then over 120 undergraduate students have

participated in the program. Our alumni can be found in leading investment

companies throughout the country - and the world. As the first undergraduate

partner with the CFA Institute, we take pride in our students' successful

placements and CFA exam pass rates. Please feel free to contact us at: aim@marquette.edu

Wednesday, February 16, 2022

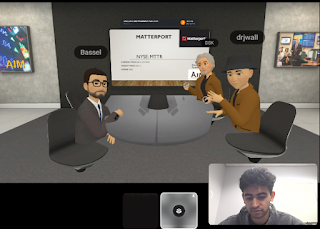

Here is a shortened version of the first video of an equity stock pitch in the metaverse - Marquette's AIM program

Marquette AIM Launches First Student Stock Pitch in the Metaverse

“Well, here we are in the metaverse,” said Dr. David Krause, Marquette AIM program director on Friday, February 11, 2022.

While maybe not as memorable as Alexander Graham Bell’s summoning of his assistant in another room by saying, “Mr. Watson, come here; I want you,” this is how the first AIM program stock pitch began.

Joining Krause in the virtual AIM Metaverse Room (and wearing Oculus Quest VR devices) were Dr. Joe Wall and Bassel Fouad, along with the entire AIM Class of 2023 who added in 2D. Bassel pitched Matterport (ticker: MTTR) as a possible addition to the student managed fund. While admittedly this was experimental and at times the videos were as jittery as a GoPro user on a snowboard, it marked another first for the program.

Krause said, “Kudos to Dr. Wall and Bassel for stepping up. Using Meta’s Workroom for an AIM stock pitch allowed us to show the ability to connect multiple real-time users in remote locations simultaneously. Although this version of the metaverse is still-developing, it revealed the power of virtual reality and offered a glimpse into the future.

Here’s the full video of the first equity stock pitch on the metaverse: https://youtu.be/Nr6MVdDkh_Y

The Third Set of Spring 2022 Marquette AIM Program Student Equity Pitches/Q&A for Friday, February 18th

AIM Class of 2023 Student Equity Presentations Friday, February 18th

The third set of spring AIM equity presentations for the Class of 2023 will be on Friday, February 18th.

Follow the link to access the student equity write-ups.

The 8-minute student

presentations can be viewed every Thursday afternoon on YouTube. Then join us live in person on Friday at 1:00

pm CST in the AIM Room or stream live via the AIM YouTube channel for the

presenter’s Q&A.

If you are unable to attend, you can always view

them via YouTube HERE.

Tuesday, February 15, 2022

Marquette AIM students to begin the data analysis portion of their spring 2022 course

AIM Program Continues to Embrace Use of Big Data Analytics

Students in Marquette’s AIM program learn that investment management is a

process that involves evaluating various opportunities, analyzing large financial

datasets, and making informed decisions about where to invest money. They are presently starting

a section of the course that focuses on a growing part of financial technology

(FinTech) - the use of big data analytics. Although large-scale data analysis has been around for over a decade,

it's still growing.

As more investment analysts use FinTech tools the financial markets will become more efficient, transparent, and even more accessible to all participants. The use of big data and artificial intelligence in this process has helped to improve the efficiency and accuracy of investment decisions.

The use of automation within in investment management is not new. It has

been around for a while; however, major advancements in technology are allows

analysts to utilize huge datasets and artificial intelligence (AI) to conduct more

thorough research. The use of AI in investment management can be traced back to

the 1950s when computers were first used to analyze large datasets.

The advances in financial technology (FinTech) are disrupting the industry making it more accessible and efficient. Analytical tools are used by hedge funds and trading firms to predict future trends in stocks, commodities, currency, and digital assets, such as cryptocurrencies. Automated trading platforms are being used to execute trades at lightning speed with just a click of a button. Robo-investing and the use of automated financial advice platforms have become popular among millennials and those in Generation Z who don't want to spend time managing their finances themselves.

Automated trading software can help investors make better decisions by

analyzing data and finding patterns in real time, while automated advice allows

investors to automate their portfolio management process and receive

personalized recommendations from an algorithm. The use of analytical tools can

help financial record keepers stay up-to-date with all regulations and

requirements, while natural language processing (NLP) helps them analyze

contracts or understand legal documents more quickly and easier than before.

Financial record keeping is now being done using NLP which makes it easier

for humans to read large amounts of data without having to do much of the

traditional manual work. The financial industry is one of the most regulated industries

in the world. Investment managers and other financial professionals are able to

use these technologies to make their operations more efficient in maintaining

compliance with the growing amount of financial regulations.

Since the Financial Crisis of 2007-2008, increased regulations combined with

the high cost of back office operations has made it difficult for legacy

financial companies to adopt new technologies. However, startup FinTechs have

emerged and been able to exploit the advantages offered by this dynamic.

In the AIM program the goal of data analysis is to help determine the future

cash flows of a company based on sentiment analysis and trend analysis. Sentiment

analysis is the process of analyzing tones and emotions as expressed by a firm’s

management in their interviews, financial filings, speeches, public comments,

social media posts, and other such sources. It has been used to help predict trends

in a firm’s revenue and earnings over time.

Predictive analytics is a type of statistical analysis that uses machine

learning and data mining to produce predictions about future events or trends.

It can be used for many purposes besides equity investment analysis including

financial forecasting, risk management, and strategy development. These are

some of the topics covered over the next two weeks in Marquette’s Applied

Investment Management program.

Dr. David Krause is the director of the AIM program and he also teaches

undergraduate and graduate FinTech courses at Marquette University.