LendingClub (LC, $18.76): “Banking on Strong Fundamentals”

By: Anwar

Ahmed, AIM Student at Marquette University

Summary

LendingClub

Corp. (NYSE:LC) Is a digital lender leveraging cutting edge machine

learning technology to offer a full suite of banking products including

personal loans, auto loans, checking accounts, and investment solutions.

- LC

posted a record net income of $29.1M and EPS of $0.27 in 4Q21 beating consensus

by 23.85%.

- Share

price fell sharply after earnings release due to management forecasting slower

growth rates in 2022.

- The

company closed out the year with record setting results of $818.6M in

revenue (up 157% YoY) and net income of $18.6M compared to a net loss in

2020.

- LendingClub

earned a perfect score from the Human Rights Campaign Foundation’s corporate

equality index and is recognized by Bloomberg’s gender quality index for their

commitment to diversity and inclusion in the workplace.

Key

points: 2021 was a crucial year for LendingClub as their focus was integrating

the Radius Bank acquisition completed back in February. The company underwent a

business model transformation. Their stellar FY21 results show the vertically

integrated bank/loan marketplace business model is a key driver of

profitability. Compared to preacquisition 4Q19, LC generated an additional

$73.7M of revenue and $28.9M of net income on the same loan origination volume

in 4Q21. These results confirmed managements perspective on the value

proposition of integrating a bank business model.

LC continues to focus on interest

income as a key top line driver. Net interest income grew 27% QoQ while non-interest

revenue stayed relatively flat. This was primarily driven by a 36% QoQ increase

in their customer loan portfolio. The recurring and predictable nature of interest

income archives stability in earnings and is crucial for the company to scale.

Their proprietary AI origination process has reduced loan losses 21% below pre-pandemic

levels and continues to be a key competitive advantage.

LendingClub’s new business model

also provides greater operating leverage that allows exponential profitability from

scalability and growth. Total non-interest expenses have fallen from 136% of

revenue in 4Q20 to 72% of revenue in 4Q21. Compensation expense has also steadily

fallen as a % of revenue from 70% to 30% over the same period. This indicates

that LC’s growth is creating exponential value for shareholders and is being

accomplished organically. Over the same period, net interest margin expanded

from 0.7% to 7.6%. This has greatly improved overall company fundamentals.

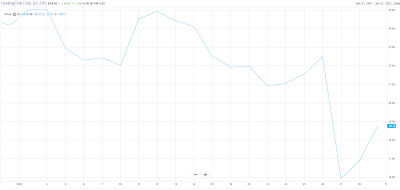

What

has the stock done lately?

Since the start of 2022, LC stock

has declined 24.99% despite announcing strong financial results. This is primarily

attributed to management forecasting slower growth in 2022 due to macroeconomic

factors and the rising interest rate environment. General market conditions

have contributed to the declining price as January saw the largest decline in

stock prices since 2020.

Past

Year Performance:

Over the past year, LC has risen

an impressive 66.90% from the complete business model overhaul. Over the same

period, the S&P 500 rose 19.65% and the Russell 2000 index declined 4.60%.

My

Takeaway

LendingClub’s FY21 results serve

as a proof of concept of their ability to successfully operate in the digital

banking space. Their strong earnings growth, growing customer base, and overall

financial strength make them an attractive investment opportunity. LC combines

the growth and technology of a fintech with the profitability of a bank. With the

banking business model, they have reduced business model risk with a strong growth

narrative. Despite LC’s recent underwhelming stock performance, it has a sound

long term strategy to deliver value to its customers and shareholders.