Silvergate Capital (SI, $117.03): “The golden gate to the future of finance”

By: Matthew

O’Brien, AIM Student at Marquette University

Summary

Silvergate

Capital, Inc. (NYSE:SI) provides financial infrastructure solutions

and services to participants of the digital currency industry. They operate

through commercial and institutional clients and operate in the United States

- Cryptocurrencies

increased in relevance allows Silvergate Capital to maximize its potential.

- Silvergate’s

proprietary “Silvergate Exchange Network” (SEN) contains no fees which is

beneficial to asset managers and hedge funds placing large orders.

- Silvergate

Capital’s stock moves with crypto, placing inherent risk on the asset as

cryptocurrency is volatile.

Key

points: Silvergate Capital is well positioned for tremendous growth

over the next 10-15 years. Cryptocurrency, specifically blockchain technology,

has shown many advantages over traditional finance, and gen Z and millennials

are ready to adopt its wide scale usage. Silvergate owns a network called the

“Silvergate Exchange Network” which allows fee free usage for all clients while

allowing users of the network to exchange 24/7. One downside with

cryptocurrency are its expenses that come with its use, and Silvergate

mitigates this downside.

Silvergate Capital is showing its

commitment to cryptocurrency adoption through acquisitions such as Diem, a

cryptocurrency venture backed by Mark Zuckerberg and Meta Platforms. Silvergate

Capital purchased Diem for $200 million and is looking to partner with them to

create a USD stablecoin to allow for a better means of payment and transfers

for SEN users. Federal lawmakers have expressed concern over its adoption as it

may pose a threat to global financial stability.

Silvergate Capital is constantly

finding ways to increase cost efficiency while maximizing shareholder value. They

operate as both a services and solutions firm, meaning they take place in

traditional finance activities such as cash management while also owning

efficient networks that have proven to be better than traditional transfers.

What

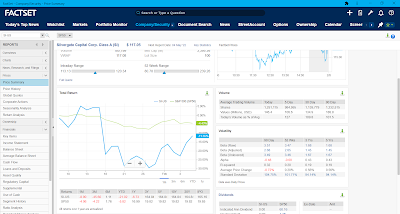

has the stock done lately? The stock is down only 5% in the past month

compared to many high growth flyers that have seen much more significant

losses. SI reached a low of $93.26 and has since rebounded 25.5% to $117.

Cryptocurrency volatility correlates to SI volatility.

Past

Year Performance: In the past year, the stock is down 18.69% and

it’s down 21.43% year to date. Yes, this is a whopping figure, but as I they

say, with risk comes reward. SI is currently trading at $117 after reaching a

peak of $222.13 on 11/3/2021. The stock moves with cryptocurrency which has

shown periods of volatility over the past year but is widely believed and

capable to be transformed into a feasible means of finance.

1 Year Stock Chart vs. Benchmark from FactSet here

Source: FactSet

My

Takeaway

The growing usage of crypto

currency among notable companies such as Tesla, Microsoft, PayPal, etc., are

signs that crypto can become the primary means of payment. I think that for the

next 1-2 years this stock may not see excessively great returns, but I think

with the increased relevance of cryptocurrency, it will only take time until SI

becomes a leading bank in the fintech industry.

1 Month Stock Chart from FactSet here

Source: FactSet