By:

Nicholas Arco, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

• Paycom Software, Inc. (NYSE:PAYC) is a provider of cloud-based

human capital management (HCM) software solutions. The SaaS platform provides

customers with all the functionality they need to manage an employment life

cycle from recruitment to retirement.

• PAYC recently reported

earnings in which they outpaced their own guidance for fiscal ’18.

• The company continues

its high growth rate paired with a high recurring revenue rate that has

continuously pushed the stock past price targets from the street.

• PAYC is continuing its

expansion throughout the United States as it continues to open new sales offices.

• PAYC recently

introduced new technology that will help enable employees to access important

HR information with ease.

Key

points:

On February 5, PAYC reported their 2018 fiscal year

earnings, in which they beat revenue guidance by about $6 million. They also reported

higher than expected adjusted EBITDA—$240.9 million versus an estimated $235

million—which represented about a 30% year-over-year increase. The stocked popped

on this news, jumping 9% since the report date meaning this information is now

priced in. Nonetheless, investors can remain confident that the company’s

business model is still firing on all cylinders.

In each of the last 4

years, the company’s revenues have grown between 30-48%. Additionally,

year-over-year growth numbers have ranged between 53% and 265% on the bottom

line, making it one of the most profitable cloud payroll companies in the

market. This presents investors with a rare combination of top line growth and profitability. PAYC also offers

investors significant visibility into their top line as they have maintained a

~98% recurring revenue rate over that last 4 years.

In 2018, PAYC opened 4

new sales offices in Rochester, Salt Lake City, Columbus, and San Diego,

bringing its total to 51. The company plans to open between 10 and 14 additional

sales offices in the next 2 years as part of its growth strategy. Paycom has

offices in 35 of the 50 largest statistical metropolitan areas in the US, yet

only 5 of these areas have more than one sales team servicing them. By

expanding their reach, they should be able to more effectively and efficiently

attack their estimated $22.5B total addressable market.

As the US workforce

becomes increasingly more mobile, the functionality of HCM software will need

to advance with it. PAYC realized this and introduced its redesigned Employee

Self-Service Desktop and Mobile applications. These applications can be

accessed through the App Store and Google Play which makes for easy access to

HR information, allowing employees to stay up-to-date. The technology is two-fold

as it also allows employers to engage their workforce through trainings,

surveys, and performance goals and reviews.

What

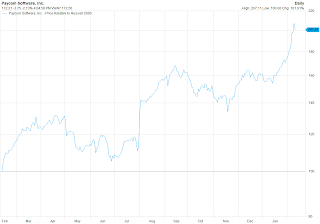

has the stock done lately?

Paycom’s stock has

performed well lately. As previously noted, the stock rose ~8% in the 24 hours

following the company’s last earnings report. Since then the stock has leveled

out a bit, now trading around $172. Investors can be confident that the solid

earnings report is now priced in.

Past

Year Performance:

PAYC has increased 103.77% year-over-year.

Overall, the market has been strong in 2019, but PAYC has performed especially well

year-to-date, rising over 40%. In contrast, the S&P 500 is only up about 8%

in the new year.

Source:

FactSet

My

Takeaway:

PAYC continues to perform

well in the cloud-based software solutions space. The company has had historically

high revenue growth, and with such a large addressable market and aggressive

growth strategy, they look poised to continue their strong run. As if high revenue

growth rates aren’t enough, PAYC also has high recurring revenue rates that can

give investors a sense of confidence in the top line. Finally, PAYC has

recently introduced new technology that will keep them relevant as we see a

continued shift in large enterprises towards cloud-computing and a technologically-savvy,

mobile workforce. That being said, PAYC has flown upward, more than doubling in

the last 14 months, providing significant alpha to its investors. However, this

rapid growth will most likely slow, perhaps leaving this as a hold for the time

being.

Source:

FactSet