The CQA Investment Challenge

What is the Chicago Quantitative Alliance (CQA)?

The CQA is a professional organization comprised of leading quantitative investment practitioners. The CQA membership includes investment managers, academics, plan sponsors, consultants, and other investment professionals. The primary goal of the CQA is to facilitate the interchange of ideas between quantitative professionals.

What is the CQA Investment Challenge?

The CQA Investment Challenge is an equity portfolio management competition that offers students the opportunity to learn and apply stock selection and portfolio management skills. The competition exposes students to simulated real life hedge fund techniques. The contest focuses on both return and risk in evaluating the competitor’s skill and success. CQA members are actively involved in the competition as mentors to the participating teams. The competition requires equity research and portfolio management skills.

The CQA is a professional organization comprised of leading quantitative investment practitioners. The CQA membership includes investment managers, academics, plan sponsors, consultants, and other investment professionals. The primary goal of the CQA is to facilitate the interchange of ideas between quantitative professionals.

What is the CQA Investment Challenge?

The CQA Investment Challenge is an equity portfolio management competition that offers students the opportunity to learn and apply stock selection and portfolio management skills. The competition exposes students to simulated real life hedge fund techniques. The contest focuses on both return and risk in evaluating the competitor’s skill and success. CQA members are actively involved in the competition as mentors to the participating teams. The competition requires equity research and portfolio management skills.

How does the Challenge work?

The objective is

to successfully manage an equity long/short market neutral portfolio over the

course of the academic year. The contest runs from mid-October through March.

A team can

consist of undergraduate junior/senior and/or MBA/MS/MFE students. Typically

there are between 3 to 5 members per team. A faculty member is responsible for

selecting and guiding the team.

Each team has a

CQA member serving as a mentor and advisor. The contest utilizes the Stock-Trak

investment simulation platform. The winning team will be determined by the

combination of absolute return, risk adjusted return and an evaluation of a

strategy presentation. The judging criteria will emphasize risk adjusted

returns and the resumes of the winning team members will be circulated to all

CQA members.

|

| Ryan Thern, Ryan Johnston, Andy Reed and Brian Shank |

Why participate - why did Marquette enter a

team?

We love to

compete and it provided a chance to enhance our students’ resumes. The students

gained access to and insights from successful quantitative investment

practitioners and experience first-hand the issues with managing a hedge fund

mandate.

Who was on Marquette’s CQA team?

In October,

Marquette put together a team of finance students to compete in the Chicago

Quantitative Alliance Investment Challenge. The team was comprised of Ryan

Johnston, Andy Reed, Brian Shank, and Ryan Thern; and mentored by finance

instructor Bill Walker.

The team was named: Numen Flumenque Capital Advisors.

The students borrowed Marquette's motto, Numen Flumenque, which means God and the River, which can be seen on the University's crest.

The team consisted of one senior (Ryan Johnston) and three juniors - and the returning students are looking forward to next year's competition.

The CQA Investment Challenge has been designed to encourage

participants to formulate, construct, and execute a quantitatively focused,

equity long/short investment strategy. This is out of the traditional

wheelhouse of the Marquette AIM program’s fundamental focused approach to

securities analysis; so it offered a unique approach to its participants.

When creating

their strategy, the Marquette team identified specific metrics, or better known

as factors like debt to equity, sales growth, volume acceleration, etc. In

total, their model had seven factors and designed a portfolio that would have

approximately 20 holdings and would be updated monthly. After creating the

model, the members ranked the securities and would initiate both long and short

positions, which met their investment thesis. The team would then monitor the

portfolio keeping it within the risk profile of the competition.

The Marquette

team took a differentiated approach focusing on designing a quantitative

strategy that was clean cut and easy to understand, but also identified high

quality companies to invest in.

Final thoughts

Ryan Johnston,

the team’s Portfolio Manager said, “The team really came together and each

member took on a unique role in the portfolio. Even though they had never

experienced a quant strategy, everyone did their homework and really performed

well.” Each member noted the challenge was both an intellectually challenging

and a learning experience.

The Marquette

finance major and the AIM program recognize investors’ demand for quant-focused

strategies and believes these types of experiences help students not only become

very well-rounded but more competitive in their careers.

It was an outstanding experience.

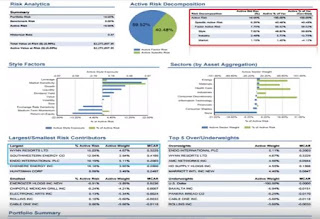

The slides shown below were taken from the team's final report submitted to the CQA. They contain elements of the team's strategy and investment approach. They intend to use a similar approach in next year's competition.