The AIM Class of 2017 Has Generated Strong Equity Returns (about 25% and 40% respectively for the AIM Small Cap and International Equity Funds)

The students in the AIM Class of 2017 began managing the three Marquette student-managed funds at the beginning of April 2016 - their one year management period ends of 3/31/2017. The three portfolios have produced strong returns despite a volatile investment environment (i.e. Brexit, US elections, etc.).

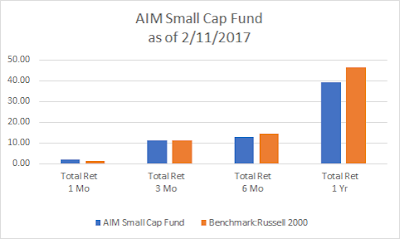

The returns for the AIM International Equity Fund have exceeded the benchmark (Russell Global Ex-US Index). While the AIM Small Cap Equity Fund returns have slightly lagged the benchmark (Russell 2000 Index), they rank in the top 50th of all active small cap equity managers.

Both of the funds are managed as 'sector neutral' - meaning that the student-managers do not take sector or industry risk - instead they seek to earn above average returns through pure stock selection. Bear in mind that the students approach their investment responsibility as long-term investors.

The time period the students focus upon is a 3-5 year window - so while their short-term performance can lag at times, most of their investment drivers generally take several years to fully play out. Therefore, the students are learning to avoid looking too closely at the short-term results and continue to focus on whether the companies in the portfolio are meeting the students' long-term investment drivers.

The student-managers are also challenged since they inherit all of the AIM Funds from the previous class - which is why we require the seniors to mentor the juniors during the period of the portfolio handout (the end of March each school year). The opportunity for students in the AIM program to manage real funds continues to be one of the most important elements in the student learning process. We are thankful that Marquette University provides this opportunity to the students, who take their role as analysts and portfolio managers seriously.