SoFi Technologies, Inc. (SOFI,

$16.39): “Another Palihapitiya-Backed Failure?”

By: August Peterson, AIM Student at

Marquette University

Summary

• SoFi

Technologies, Inc. (NASDAQ: SOFI) operates an online platform providing

home loans, personal loans, private student loans and student loan refinancing,

credit cards, investments, insurance products, and other financial services.

• Uncertainty remains persistent as SoFi

has yet to acquire a bank charter and the firm’s largest division of revenue,

personal loans, is heavily exposed to interest rate risk and disruption to the

demand of new loans.

• A stronger balance sheet is evident—the

use of SPAC proceeds to pay down its revolving credit line leaves the firm with

just under $1 billion in cash and $3 billion in debt as of Q3 2021, leaving

SoFi with ample resources to invest in itself.

• SoFi is desperately jumping on its

first-mover advantage to build a financial services monopoly by introducing new

product offerings and creating cross-platform incentives, but to no avail. The

majority of SoFi’s clients still only use a single product or service within

the firm.

Key points: Chamath Palihapitiya, CEO of Social Capital

and the catalyst to SoFi’s SPAC in February of 2021, took an early interest in

the company as a panacea to the problems of our current banking infrastructure

has with meeting the needs of US consumers. These solutions, which Palihapitiya

believes are addressed completely by SoFi, are low to no fees, fair and

transparent lending, and a full suite of products that act as a one-stop-shop

for all financial service needs. Twelve days ago, Palihapitiya sold 15% of his

stake in the company.

Why?

Initially pitched as the fast-growing, one-stop-shop FinTech platform seeking

to benefit from powerful cross-selling advantages and strengthened customer

retention through implicit switching costs, SoFi has yet to prove a sustainable

competitive advantage in the financial services industry. The company’s current

core business model is easily replicable; the majority of SoFi’s revenues are

generated from its lending business (~52% Q3 ’21 revenue), which operates as a

loan-to-distribution model where the company either sells or securitizes its

loans for a gain. Personal loans were the largest driver of Q3 revenue, up 166%

above last year’s total loan originations. SoFi is actively and aggressively

expanding its breadth across new product offerings, but because the company has

demonstrated these offerings can be brought to market quickly, a competitive

advantage cannot be sustained until these offerings are mature and reward

spending catalyzes high customer retention across all products. In short, SoFi

needs to grab its first-mover advantage as a financial services monopoly.

Have

they been? Q3 added 377,000 new members on the SoFi platform, the

second-highest quarterly increase in company history (behind Q2 2021). Membership

is primarily driven by a 178% YoY growth in SoFi Money accounts, which the

company believes is its primary entry point for consumers. Revenue from the

company’s financial services segment is up 290% from last year after

introducing cryptocurrency accounts, credit cards, and other new products.

While these numbers sound bullish, it’s important to focus on what metrics point to an irreplicable business model, which SoFi outlines to be a one-stop-shop for all financial services. The key to building a sticky customer-relationship model is founded on reward spending and cross-platform incentives. SoFi has already been implementing incentive structures; credit cards only offer full reward points if the cardholder has a brokerage, crypto, or cash management account with the company, checking accounts only pay interest if $500+ is deposited monthly, and a .25% rate reduction on qualified loans are offered to existing SoFi clients. Despite these efforts, the majority of SoFi’s clients only use a single product or service with the firm.

What has the stock done

lately?

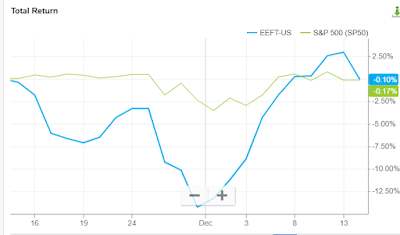

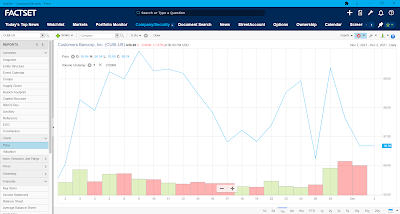

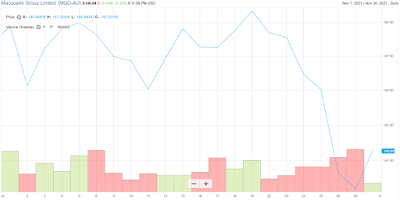

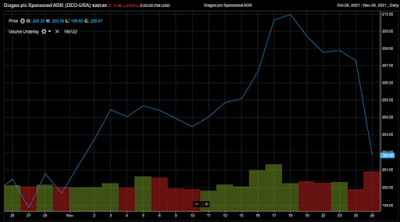

Since being pitched into the AIM small-cap fund, SoFi is down ~13%. In the last six months, the stock has oscillated between $23.89 and $13.75 before settling at around $16 today. The sale of Chamath Palihapitiya’s shares led to a drop in the stock’s price to $17.87 from $20.87 on November 19th, 2021.

Past Year Performance: SoFi is up 56.13% in the last year, catalyzed

by the acquisition of Galileo, which has seen accelerated growth since being

acquired by the firm. Valuations of the company remain unreliable as the

company isn’t expected to be profitable until 2023, according to some estimates,

and free cash flow has yet to be positive.

My Takeaway

SoFi

needs to focus on aggressive marketing and reward spending to justify the high

growth assumptions by 2023 when the street estimates the firm to reach

profitability. Because the firms’ personal loans division operates on an

originate-to-distribute model, meaning the loans made to the company are either

securitized or sold for a gain, the majority of SoFi’s revenue is exposed to

interest rate risk and disruption to the demand of new loans. With the Fed

announcing an interest rate rise in the first half of 2022, fewer consumers and

banks will be willing to demand the same quantity of loanable funds, adversely

affecting SoFi’s revenue. Despite being a high-growth FinTech SPAC with high

expectations for disruption, SoFi still has a lot to prove before it can gain a

sustainable competitive advantage in this industry.