By:

Sean Halverson, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary:

• Standex International Corp. (NYSE: SXI) operates as a manufacturer

of a variety of products and services for diverse commercial and industrial

markets. The majority (68.3%) of their revenues come from the United States.

• SXI has announced their

decision to sell off their Cooking Solutions business in spite of declining

sales and to reposition the company.

• At the quarter to date,

the stock price for SXI has experienced a 29.49% decrease which has caused

serious questioning of the company.

• The stock struggled

through the end of October because of concerns surrounding a potential slowing

of first quarter fiscal 2019 sales in Electronics, the company’s fastest

growing segment.

• Tariffs have beaten

down the Hydraulics business which has put serious pricing pressures on certain

areas of the segment.

Key

points:

In February of 2019, Standex International Corp. is

going to be selling off their Cooking Solutions business in addition to

acquiring two new companies, Agile Magnetics and Tenibac-Graphion. This is a

movement by management to further develop their Engraving and Electronics

segment. A driver behind the “modest” organic sales growth (2.4%) for Engraving

was because of a low profitable plant in Virginia. The company has recently

sold off the plant which declined sales for the segment, but was seen as a

strategic choice to better the company in the long run.

As tariffs rise with

imports from China, Standex International Corp. is going to see even more

struggles with trying to generate positive sales growth within their Hydraulics

segment. The reason being that almost half of the cylinders they are importing

are from China. The segment accounts for only 5.5% of total revenues for SXI;

however, the segment will continue to be a drag on the company if tariffs

remain unchanged.

There are expectations

that SXI is planning to repurchase $100 million of the shares outstanding. Additionally,

SXI has dedicated resources to making sure their shareholders are content; for

example, they have paid consecutive quarterly dividends since 1964. Management

believes that holding onto their shareholders is more important than canceling

the dividend to drive stronger growth.

What

has the stock done lately?

Since the acquisitions of

both Agile Magnetics and Tenibac-Graphion, the stock has still not experienced

positive growth. At October 26, 2018 the stock price was at a healthy $96.55.

After earnings were released, the stock has violently dropped to new a low for

the year. It has continued to decrease with no significant positive growth.

Past

Year Performance:

SXI has seen ~15% increase in sales and

~30% increase in EBIT between June of 2017 and June of 2018. However, net

income has decreased ~21% and its after-tax Return on Assets has declined from

5.98% to 4.11%.

Source:

FactSet

My

Takeaway:

Although Standex

International Corp. has seen sales growth from the end of 2017 and two new

acquisitions to the company, it has not been representative in the value of the

stock. The company appears to be creating value by divesting off slower pieces

of its operations but the shareholder has suffered regardless of improvements

to company’s business model. Even with hopeful expectations in 2019 with their

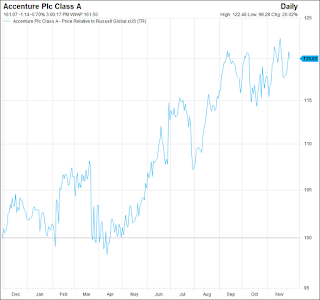

Electronics segment, the stock has been a nightmare. With regards to Relative

Returns (9mos) to the Russell 2000, SXI has underperformed at a frightening -19.06%.

It is time to reconsider if the company is actually creating value for its business.

Source:

FactSet