By:

Katherine Nozel, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

• Nomad Foods Ltd. (NYSE: NOMD) manufactures and distributes frozen

foods, including fish, vegetables, poultry, side dishes, ready meals, and

desserts through large grocery retailers and supermarkets. The firm operates

under one business segment, yet continues to build a global portfolio,

primarily in Western Europe, through their several integrated acquisition brands.

• NOMD’s sources of

revenue stem from markets including the United Kingdom (26.9% FY19), Italy

(17.7%), Germany (14.3%), France (8.9%), all of which grew organically in Q3.

Other European countries generate the remaining 32.3% of revenue. Since Q1 FY18,

revenue has increased 8.9% to $1,883MM.

• NOMD expected an

adjusted EBITDA between $466MM-$477MM in FY19, and after Q3, confidently narrowed

its previous range to a $471MM-$477MM projection.

• Management is satisfied

with the performance of FY19 thus far, and expects to heighten long-term

shareholder value through NOMD’s strong balance sheet position with over $777MM

of cash and 2.8x leverage as of Q3.

• NOMD could be heading

to new 52-week highs as management excitedly evaluates several potential acquisition

targets that have low risk and high accretion, looking to expand geographic

footprint across Europe.

Key

points:

Analysts were sensitive

towards Nomad Foods Ltd. as Q3 FY19 approached due to recently lumpy trends.

However, NOMD exceeded expectations with +2.5% YOY organic sales growth, from

the core portfolio for the 11th consecutive quarter. Sales are

forecasted to increase as the newly acquired Green Cuisine, a plant-based

brand, plans to expand beyond the United Kingdom in FY20, while enhancing the

brand’s quality and taste.

Additionally, NOMD

continues to prioritize meaningful cost savings and synergies across all

brands; SG&A expenses decreased 80 bps from the prior year. Further, gross

margin increased 110 bps to 29.5% as a result of improved pea supplies,

operational improvement in the Goodfellas brand, and pricing adjustments to

fish prices. According to Wells Fargo Securities, the integration of Aunt

Bessie’s and Goodfellas Pizza, two FY18 acquisitions, will trigger an EBITDA

margin target of 20% in FY21. NOMD strategically aims for double-digit YOY

EBITDA growth with 14% growth last quarter.

NOMD maintains a strong cash

flow position in which robust growth opportunities via additional acquisitions

will provoke an increased stock price. Management’s tone during a Q3 press

release and earnings call suggests an upcoming acquisition. The CEO revealed

that he and management are currently evaluating several potential targets to blend

into the core business that will not be effected by risks of Brexit. NOMD intends

to continue investing heavily in “Must Win Battles,” strengthening core icons

to develop distinctive brands within the portfolio.

What

has the stock done lately?

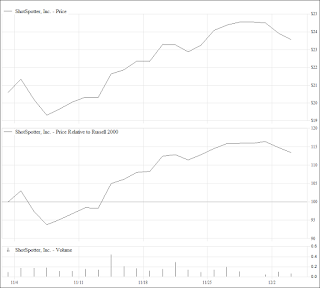

Although NOMD dipped to

$18.89 in October FY19, prices since, have grown steadily to a current price of

$20.71. Although the 52 Week Range of $15.87-$23.06 is slightly volatile,

management’s strong grasp on cost savings, alongside future acquisition

intentions, will improve stock performance moving forward.

1

Month Stock Price Chart

Source:

FactSet

Past

Year Performance:

Over the course of FY19,

NOMD increased 23.89% YTD, outperforming the market in Q2 and Q3. EPS was $0.13

in Q1, rising to $0.24 in Q2, and slumping back down to $0.20 in Q3. Based on

FY19’s performance and recent management’s proposed initiatives, NOMD’s performance

will likely exceed expectations in FY20.

1

Year Price Chart vs. Benchmark

Source:

FactSet

My

Takeaway

NOMD was pitched and

added to the AIM International Fund in January 2018 at a price of $17.15, with

a price target of $20.55. NOMD’s current price has surpassed the initial

analyst’s price target with a current price of $20.71. In January FY18, the

frozen food market in Europe was forecasted to grow at a CAGR of 4%. As demand

increases for convenient food options in a similar fashion to FY18, NOMD will

continue to dominate market share through their strategic initiatives of

geographic expansion and M&A. Over the course of the past year, NOMD has

been advantageous to the AIM International Fund and based on future

projections, will continue to add value. Therefore, I believe we should buy

additional shares of Nomad Foods Ltd. So, NO getting MAD, this is rad!