Curtiss-Wright Corporation (CW, $117.19): “The ‘Wright’ time to Hold”

By: Dominic Brisson, AIM Student at Marquette University

Disclosure: The AIM Equity Fund currently holds this position. This article was written by myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article.

Summary

• Curtiss-Wright Corporation (NYSE: CW) is a precision component manufacturer that develops products for the aerospace & defense, commercial industrial, and nuclear power generation industries. CW serves the United States where they generate most revenues followed by the UK and China which are the next largest areas served.

• CW continues to press forward with their One Curtiss-Wright Vision, which was implemented in 2013 designed to improve margins through internal restructuring. They continue to maintain their goal of achieving 17% adjusted operating margins and CW finished at 16.3% in FY ’20.

• During FY ’20, CW spent $200MM on share repurchases and they intend to spend an additional $50MM on share repurchases during FY ’21.

• CEO, David Adams, announced in Dec. ‘20 he was stepping down and will remain chairman of the Board. Mr. Adams is being replaced by Lynn Bamford who previously served as President of CW’s Defense and Power segments.

• Curtiss-Wright closed their PacStar acquisition in the 4th quarter of FY ’20 and management expects this to expand their end market exposure to military ground forces spending.

• As a result of the pandemic and headwinds in the aerospace & defense industry, CW exhibited a YoY revenue decrease of ~3.9% and project revenues rebounding toward $2.5B in FY ’21.

• In FY ’20, CW announced they were changing their reporting segments from Commercial/Industrial, Defense, and Power to Aerospace & Industrial, Defense Electronics, and Naval & Power.

Key points: In FY ’20, Curtiss-Wright’s adjusted operating margin was 16.3% which represented a 20 bps decrease from FY ’19. CW’s adjusted operating margin decreases were attributable to commercial industrial market challenges related to the COVID-19 pandemic. Despite small margin decreases, CW was able to navigate the pandemic challenges successfully as their One Curtiss-Wright Vision’s restructuring and cost cutting initiatives helped them to sustain their competitive adjusted operating margins of 16%+. Looking ahead to FY ‘21, with more favorable long-term trends, CW believes their Aerospace & Industrial segments profitability will improve reaching FY ’19 levels at 16.5%+ adjusted operating margins. In addition, CW expects to see margin improvement in their Naval & Power segment as they reap the benefits of prior year restructuring savings and the wrapping up of their CAP 1000 program.

Curtiss-Wright continues to be a strong winner due to their leading operational performance and they have generously rewarded shareholders through share buybacks. In FY ‘20, CW repurchased $200MM of their outstanding shares, of which $150MM were opportunistic buybacks. In FY ‘21, CW plans to use $50MM for share repurchases and under their current board approved buyback program they can repurchase up to $200MM during FY ‘21. CW’s FY ’20 share repurchases reflect management’s confidence in their businesses strength as they capitalized on 2020 COVID-19 mispricing.

This past December, CW’s CEO David Adams announced he would be stepping down after 7 years in a planned departure. With Adams stepping down, in accordance with Curtiss-Wright’s succession plan, Lynn Bamford will replace him and step away from her current role as President of CW’s Defense Electronics and Naval & Power Generation segments. Lynn brings immense experience to the role having served in multiple leadership positions with Curtiss-Wright for over 30 years and recently as President of their Defense & Power segment since Jan ‘20.

In the 4th quarter of FY ‘20, CW finished closing their acquisition of PacStar communications for $400MM which develops battlefield communications hardware and software for US Army ground forces. Given PacStar’s offerings are aligned with US Army modernization initiatives, CW’s management expects this business to experience mid-high single digit revenue growth under their leadership into FY ’21.

Lastly, CW recently announced the changing of their reporting segments to simplify their story. Under this new structure, CW is now reporting under Aerospace & Industrial, Defense Electronics, and Naval & Power. CW sought to adjust their segments, to better reflect the end markets served. One example of this is with CW’s new structure, their valve business is housed under their Naval & Power segment given its sales are highly dependent on the Naval industry.

What has the stock done lately?

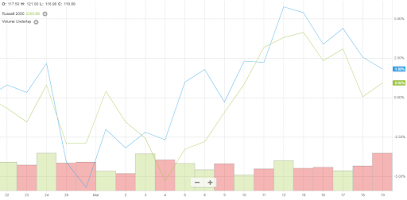

The past 3 months have been very volatile for Curtiss-Wright and its stock has seen minor swings up and down. From January 19, 2021 to January 27, 2021 Curtiss-Wright saw a significant decline of 11.5% as growth and momentum stocks outperformed during this time. Since that plummet, CW has improved but suffered a 7% decline from February 24, 2021 to February 25, 2021 as the market reacted to their FY ’20 results. However, since the FY ’20 release the company’s shares have bounced back and CW remains below its 52 week high.

Past Year Performance: CW has increased 44.48% in value over the past year. Much of CW’s gain occurred with the broader market in early November in response to the positive vaccine news regarding Pfizer and Moderna’s vaccines which was a positive catalyst for aerospace & defense as well as industrial companies.

Source: FactSet

My Takeaway

Since being pitched in November ’20, CW has had relatively stagnant performance in the AIM Small Cap Equity Fund. CW was added to the portfolio at $111.83 a share on November 23 and continues to remain below its price target of $135.62. As a value added contributor to the military, CW is positioned to continue growing as defense budgets grow domestically and abroad while CW aligns their offerings with the DoD’s modernization initiatives to remain competitive. CW’s NTM forward P/E currently is at 16.7 and they have historically been above 19 during years prior to the pandemic, indicating it is still undervalued. Furthermore, I believe CW’s new reporting segments will give investors greater clarity into their end markets which may act as a catalyst for P/E re-rating as investors begin to appreciate the growing percentage of CW’s revenues coming from Military spending. For these reasons, it is recommended CW’s stake be held in the portfolio as the investment thesis continues to play out.

Source: FactSet