By:

Brook Seifu, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

·

Kennametal

Inc. (NYSE: KMT) is a global industrial technology leader

that focuses on helping customers across the aerospace, earthworks, energy,

general engineering and transportation end markets with precision and

efficiency. KMT offers metalworking and wear applications that includes turning,

milling, hole making, tooling systems and services, as well as specialized wear

components and metallurgical powders. KMT operates in three segments: industrial

accounting (53% of revenues FY19), widia (8% FY19), and infrastructure (39%

FY19). The company was founded in 1938 and is headquartered in Pittsburgh, Pennsylvania.

·

The company has suffered unexpected decline

in organic sales by 11% vs. 10% growth in 2018. This is mainly due to a

slowdown in global market conditions primarily within the transportation, energy

and general engineering end markets.

·

With the introduction of the

simplification and modernization programs, KMT is expecting to reduce future cost

of production and restructure facilities to enhance efficiencies.

·

Investments in R&D is paying off after

KMT showed signs of revival with the new HARVI Ultra 8X, HARVI TE and KOR 5

innovations.

·

Dividends over the past four years has

been fairly constant, and the company has paid its shareholders $0.80 per share.

Key

points:

Management has been

focusing on improving performance throughout KMT’s production and operating

cycle. New program called simplification/modernization has been implemented to cut

costs. Recently, the company ceased a key production facility in Germany and moved

units to a lower-cost facility. In the near future, this restructuring and cost

reduction programs are set to continue and further improve production processes.

KMT’s management believes

there is still untapped growth opportunities in the aerospace and general engineering

areas. This year, KMT released the HARVI Ultra 8X which is used by aerospace customers

for rough milling titanium and offers market-leading metal removal rates. Besides

the positive reactions from the street, this product was among the 2019 R&D

100 awards finalist. In Addition, KMT has introduced the HARVI TE for general engineering

customers and KOR 5 which is offered to aerospace customers.

What

has the stock done lately?

KMT has had a rough year

so far mainly due to a significant decline in sales and economic contraction key

market segments. For the Q1 reported in Nov 4th, the company announced

adjusted EPS of $0.17. On that same day, poor financial performance led the stock

to drop by 8%. During the following day, the stock rallied back, representing a

7% gain. KMT generates revenue through the sale and service of tungsten and

related products. In the second half of this year, the prices of tungsten significantly

dropped from $270 to approximately $200. Following that price drop, KMT’s operating

margin significantly suffered with fixed costs remaining the same.

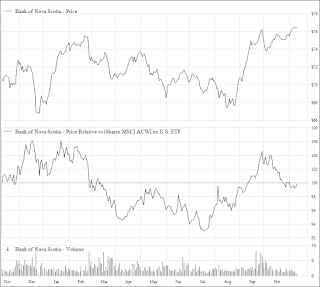

1 Month Stock Chart from FactSet

Source:

FactSet

Past

Year Performance:

Over

the past year (November 2018 – November 2019), KMT’s stock has declined 16% after

dropping to $34.19. As stated earlier, KMT has had all sorts of bumps this year

leading it to a three-year low of $28.83 in August 21st, 2019.

1 Year Stock Chart vs. Benchmark from FactSet

Source:

FactSet

My

Takeaway

Since

KMT was added to the AIM portfolio in April 27th, 2018, the stock is

nowhere close to reach the price target of $50.23. Revenue was projected to

grow by 8% for the current year, instead the company is experiencing negative growth

rates. In addition, positive macro trends were listed as one of its drivers.

However, the macro for major operating areas like energy, transportation and manufacturing

is going the opposite way. Although the company is working towards cost reduction

programs and introducing new products, there is still a quite bumpy road ahead for

KMT. With increasing exposure to business downturn and ongoing trade war with

china the company is even less suitable. By considering major macro and firm

conditions, its recommended KMT should not be held in the AIM portfolio anymore.