By:

Arsh K. Salwan, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary:

• MercadoLibre, Inc. (NASDAQ: MELI) is a company located in Latin

America that operates in the e-commerce area. MercadoLibre is a marketplace

platform where consumers can buy and sell products.

• MELI offers six

e-commerce services: Marketplace, Classified Services, Payments, Advertising,

Online Webstores and Shipping. The company is broken down into two segments:

Marketplace (60% of revenue) and Non-Marketplace (40%).

• MercadoLibre has had a

solid revenue stream with a 3-year CAGR of 28.96% and is expected to continue

to grow.

• The company launched

their same-day delivery tool in late August, MercadoEnvios Flex. This will

allow independent carriers to pick up and deliver products within the same day

to customers.

• MELI officially

launched their QR-code payment tool. Management believes that 25% of Brazillian

smartphones carry at least one of MercadoLibre’s apps which will be compatible

with the new QR feature.

• The stock price has

increased by 9.71% YTD.

Key

points:

Within the last couple of years, MercardoLibre has

emerged as one of the world’s many e-commerce giants. With the revenue primarily

coming from Brazil (59.5% as of FY17), Argentina (25.7%), and Mexico (6.2%),

the company has capitalized on the emerging markets. 2017 was considered to be

MercardoLibre’s breakout year, reporting 65.57% YoY revenue growth. Most of this growth was credited to the

increase in users in MercadoLibre’s mobile phone applications.

The good news for MELI is

that growth has continued: YoY growth was 17.18% and 5.95% in Q1 and Q2 of

2018, respectively. The bad news for MELI is that expenses grew at a very large

amount, resulting in negative Operating Income for Q1 and Q2 of -29.42 and

-28.24, respectively. Because of the

recent poor performance, MELI missed earnings in Q4 2017, Q1 2018, and Q2 2018.

The company attributed these results to abrupt changes in the cost structure

due to their free shipping offering that was in rapid expansion.

Some of the risks that

MercadoLibre faces are regulation changes from the government, increased

control of tax collection, currency risks, and increased competition. Along

with these risks, the company faces shipping cost risks. Over the past two

quarters, two events had significant impact of cost of goods sold: a price hike

from a postal partner and a strike called by truckers during the second

quarter.

On the bright side, the

company can capitalize on future growth by way of product launches such as the

new QR features, and geographic expansion. In Q2 2018, the company announced

YoY growth of 71% in Mexico, 51% in Colombia, 42% in Chile, and 84% in Uruguay.

Management also expects their MercadoPago payment service to benefit from the

overall increase in marketplace volume.

What

has the stock done lately?

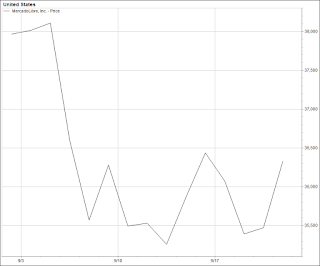

MercadoLibre has had a

tough previous couple of quarters resulting in lower than expected earnings in

the last three quarters. MELI announced earnings on August 8th 2018

for Q2 2018, from August 9th-20th, the stock price

dropped ~17%. Since then, the price is up around 11%.

Past

Year Performance:

MELI’s stock price has increased 9.71% YTD,

however, the stock should be watched closely due to the recent volatility. For

example, on March 9th 2018, the share price reached $413.94, 14.5%

above where it currently sits. The price has fluctuated since the end of August

but shows signs of stability.

Source:

FactSet

My

Takeaway:

With MercardoLibre’s

historic growth, it has been a great story and interesting company to study.

Recent tax increases, currency fluctuations, and increased shipping costs have

drawn eyes to the company as these have caused the missed earnings expectations

in the previous 3 quarters. Something to watch, however, is the impact of the the

same day shipping program as well as the newly introduced QR code functions. Due

to these factors, I recommend a hold position on MELI. It will be interesting

to see how the company performs in Q3.

Source:

FactSet