By:

Dominic Maio, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

• Bank of Nova Scotia

(NYSE: BNS) The Bank of Nova Scotia is a multinational bank

headquartered in Toronto, Canada and was founded in 1832. Scotiabank

is one of the big 5 banks of Canada. BNS engages in a wide range of

financial services and products including wealth management, private banking,

commercial banking, investment banking, and capital markets. These services are

primarily offered to retail, commercial, and corporate customers.

• BNS has maintained a

strong capital position over the past five years and continues to operate at a

CET 1 ratio of 11.2% as reported in Q3. The strong ratio can be contributed to

increasing cash flows organically and divestures from current operations.

• BNS’s international

banking segment continues to see growth year over year with a 14% increase in

Q3 to $616 million. The increase is driven by increased loans and acquisitions

in the Pacific Alliance Countries.

• BNS has invested

heavily into FinTech, which is expected to see large growth in the nearby

future. With the company being the industry leader in Canada through the launch

of their mobile banking app, BNS is expected to capture a large portion of the

demand.

• BNS saw a 9.76% CAGR in

Net Income between year ends 2014 and 2018, and with strong growth in 2019 so

far, the number can be expected to grow in the future.

Key

points:

BNS was added to the AIM International Portfolio in

November of 2018 at $53.38 with a price target of $65.57. The investment

thesis placed a forward-looking emphasis on strong capital position. Since the

addition of the company to the portfolio, BNS has capitalized on this area. BNS

has managed to maintain strong capital positioning with a CET 1 capital ratio

of 11.2% an increase of 10 basis points from the prior quarter. This increase

can be contributed to continual growth in cash flows driven by strong internal

capital generation and divestures of current operations. In Q3, BNS

announced the sale of its operations in Puerto Rico and the U.S. Virgin

Islands, which is projected to increase available capital significantly moving

forward. With extra available capital, BNS has been able to increase

dividend yields by 6%, and investments into their international banking

segment. The bank of Nova Scotia expects the CET 1 ratio to remain above 11%

moving forward.

BNS has seen strong growth

in International banking by delivering another quarter of double-digit earnings

growth with adjusted earnings up 14% YoY, offering diverse revenue streams. Acquisitions

have played essential in this segment's growth. BNS has invested heavily in the

Pacific Alliance Countries, with over 6 acquisitions since 2018. The

growth in International Banking has led to an increase in both

Non-Interest Income and Net Interest Income. Net Interest Income has increased

$289 million in Q3, due to an increase in commercial and retail lending in the

Pacific Alliance Countries. Additionally, Non-Interest income was up $189

million driven by global acquisitions in the Dominican Republic and Peru. With

a 5-year net income CAGR of 9.76%, International Banking will continue increasing

EPS through acquisitions, projecting a $0.70 increase by 2021.

Moving forward, BNS looks

to capitalize on the growing movement of FinTech. With FinTech expected to grow

by a forecasted 5-Year CAGR of 22.7%, BNS looks poised to capture the rise in

demand. In Q3, the company was recognized as the industry leader in mobile

banking by J.D. Power and launched a new mobile banking app in Canada. By

capitalizing on this area, BNS should see tremendous growth with a forecasted

5-Year CAGR of 3.32% in net income.

What

has the stock done lately?

Following the Q3 earnings

call, BNS has seen an 11.29% increase in the stock price from $51.48 to $57.83

due to significant growth in the International Banking Segment. In the

last month, BNS’s stock has risen by 1.99% peaking at $58.00. The most recent

increase can be contributed to the integration of the mobile banking app

launched towards the end of Q3, which in the last month has seen tremendous

growth.

Past

Year Performance:

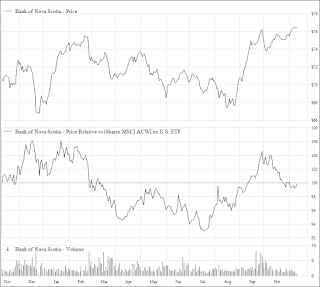

BNS has seen steady growth over the past

year with a 52 week range from $48.34 to $58.22 (November 2018-November 2019).

The low came in December of 2018 due to a downturn in the markets and as a

result of the Q4 earnings call. BNS’s stock has seen an increase of 7.97% over

the past year and shows positive signs of growth. Given a dividend yield of

4.6% and a P/E ratio of 10.05 (2% lower than peers), the stock is still showing

signs of being undervalued as compared to peers.

1

Year Stock Chart vs. Benchmark from FactSet here

Source:

FactSet

My

Takeaway

BNS should remain in the

AIM International Portfolio. After 4 consecutive misses on earnings, BNS

finally got on track in Q3 with an adjusted EPS of $1.88, 2% above consensus.

The company is positioned for growth moving forward due to a strengthened risk

profile from their latest divestures, mobile banking, and through the

integration of several acquisitions in their International Banking Segment. In

addition to mobile banking, International Banking will also drive the company

moving forward, after continual growth in the past five years and 6

acquisitions into the segment since 2018. With the combination of strategic

acquisitions in International Banking, strong capital positioning, and the rise

of FinTech, BNS will maintain strong growth in the foreseeable

future.

1

Month Stock Chart from FactSet

Source:

FactSet