National Vision Holdings, Inc. (EYE, $38.97)

By:

Grace McCrea, AIM Student at Marquette University

Disclosure: The AIM

Small-Cap Equity Fund currently holds this position. This

article was written by myself, and it expresses my own opinions. I am not

receiving compensation for it, and I have no business relationship with any

company whose stock is mentioned in this article.

Summary

● National

Vision Holdings, Inc. (NYSE: EYE) specializes in the

sale of optical products, specifically eye care and eyewear. The majority (91%)

of revenue is generated from the Owned & Host segment, which contains sales

from the eyeglass companies that EYE works with. The remaining revenue comes

from the Legacy segment, which processes

inventory and lab services.

● Just a few weeks ago, on April 11,

2022, EYE added Joe VanDette to their company as Chief Marketing Officer. He

has previous experience at Smart & Final (grocery), as well as at Toys ‘R

Us (clothing and toy retailer) in positions involving marketing, analytics, and

strategy.

● In an investor presentation released in

March 2022, EYE emphasized that their store count has been increasing at a CAGR

of 7% for 16 years. Although their new store success rate is a very impressive

97%, a comment about their commitment to e-commerce would have been beneficial.

In order to accommodate younger generations who prefer online shopping, it will

be necessary for EYE to focus on improving their experiential platform in the

digital space.

Key Points: Although

EYE has been committed to Corporate Social Responsibility (CSR) for over 30

years, they began a special dedication to CSR in 2021, which started with an

Impact Report. In order to evaluate their historical commitment to CSR, EYE

organized a strategic assessment and a sustainability assessment.

To

begin these assessments, EYE identified their most prevalent environmental

impact locations throughout the business. This helped clarify focus areas of

CSR that need improvement at National Vision Holdings. Finally, management

created a governance structure, lived out in the Board of Directors, to

prioritize CSR initiatives.

In

addition to this commitment towards CSR, EYE has an advantage in the market as

a whole, which is important for their future success. According to management,

EYE currently has 965 locations throughout the country, which only represents

about 31% of the total available market. The other 69% of the market represents

extreme growth potential for National Vision Holdings, Inc.

What has the stock

done lately?

The

overall markets saw a rough start to 2022, and recent macroeconomic issues like

the conflict between Russia and Ukraine have not helped. However, in their

Q4FY21 earnings call on Feb 28, 2022, EYE reported a 4.46% increase in revenue,

signifying that they beat earnings. This is significant for many reasons, but

primarily because it marks the first year that EYE brought in net revenues

greater than $2 billion. Even with this positive news, EYE has reported a YTD

return of -21.57%. This is likely due the company’s struggle to report

pre-pandemic same store sales growth.

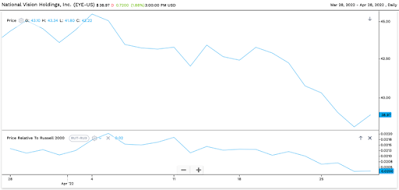

Past Year Performance: EYE’s

performance over the past year has been quite volatile, resulting in a 52-week

return of -26.47%. As shown below, as of April 28, 2022, the stock is rather

cheap and trading near its 52-week low of $34.70.

My Takeaway

EYE’s

dedication to CSR is impressive. Commitment to corporate social responsibility

and/or environmental social governance is currently a majority of investor's

priority and preference. It’s really important to know what investors, as well

as customers, want. With this in mind, I would like to see a stronger

commitment to their customers through e-commerce. With one of their closest

competitors being Warby Parker, who is known for offering an exceptional online

experience for “trying on” glasses, EYE must commit to the younger generations

who prefer to shop this way.