Customers Bancorp, Inc. (CUBI, $56.68): “CUBI, the company that operates in 2030”

By: Matthew

O’Brien, AIM Student at Marquette University

Summary

• Customers Bancorp, INC. (NYSE:CUBI) provides financial products and

services such as mortgage and SBA lending for commercial, institutional, and

individual clients in the United States.

• CUBI has capitalized off SBA

loans by being a top 15 lender of PPP loans

• CUBI has began using Customers

Bank Instant Token (CBIT), which provides blockchain-based digital payments in

real time, 24/7/365.

• Management has announced

partnerships with premier cryptocurrency and digital asset institutions such as

Genesis Global Trading and SFOX.

• CUBI is currently trading at

$56.68 near all-time highs of $61.48 as they’ve adapted a digital approach faster

than their peers and capitalized after COVID.

Key

points: Customers Bancorp, Inc. is attempting to hop on the

cryptocurrency trend by creating a proprietary digital payment system that

operates on the blockchain. Doing so would allow clients to always send and

receive USD payments, which would benefit the clients through improved speed

and security and benefits the company through low-cost deposits which can

increase their margin. If customers of CUBI were to adapt this payment system,

it can possibly be used by other businesses in the future.

Prior to the pandemic, CUBI had operated

digitally through online checking and savings accounts. They also operated in

the mortgage and commercial lending space. After COVID’s relief allowed banks

to disburse PPP loans, which are government-secured forgivable loans, in

response to COVID, CUBI aggressively marketed their loan services which gained

them a lot of new customers as the PPP was the first time many people

experienced an emergency loan program. CUBI was top 15 in terms of the amount

of loans disbursed among all banks.

Customers Bancorp announced their

newly added institutional clients that specialize in digital asset classes and

cryptocurrency investment. Customer Bancorp wants to specialize in business-to-business

payment options for commercial real estate, healthcare, insurance, and more

areas in which these clients part take in. Head of digital banking at CUBI

believes the number of cryptocurrency clients will increase over the next few

years and these clients are ready to embrace it. As we’ve seen this last year,

cryptocurrencies are becoming more relevant, and companies are beginning to

adopt them as payment methods and investments. By investing in the

cryptocurrency space early, CUBI is able to get ahead of their customers as

they are more poised for future growth.

CUBI has readily adapted to the

environment that is being digitalized around us. Cryptocurrency is a trending

topic and using a proprietary digital payment system using the blockchain will

allow the company to expand their margins while benefiting their customers. For

these reasons, CUBI has recently reached a new all time high of $61 before

trading at $56.68 as of 12/1 close.

What

has the stock done lately?

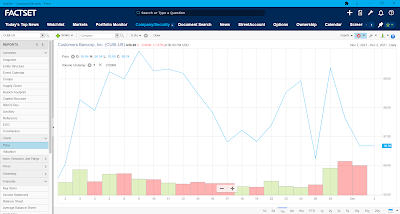

Since the March 2020 lows, CUBI

has rallied from $8.90 to its current near all time high price of $56.68. This

can be contributed to PPP loans along with providing digital services as people

adapted to COVID. The government distributed nearly $1.8 trillion in PPP loans

with CUBI taking advantage of the opportunity. Over the last year, CUBI has

seen steady gains with a recent positive catalyst due to their third quarter

earnings. Investors have recently let the stock consolidate in the range of

$56-61 as there have been no new updates in operations. Because the stock is

hovering near highs, it will take time for investors to decide whether the

stock should go higher or not.

Past

Year Performance: CUBI has increased 218.61% in value over the past

year, however the stock is still under its relative value to competitors. While

CUBI operates at a PE ratio of 7.42, its competitors are operating near a

10.46x price to earnings. CUBI has shown investors they are looking to improve

their value through investment in the future. CUBI (blue line) has deservedly

outperformed the Russell 2000 index (purple line) by a very fair amount. The

past year has shown great strength in the direction CUBI is headed, and if they

continue to invest in the future they will continue to outperform the broader

market.

My

Takeaway

CUBI’s head of digital banking is

willing to invest in growing spaces and take advantage of them as well. I think

that the addition of their cryptocurrency clients show investors they ae not a

traditional bank and are following the fast paced environment we’re in. While

their stock has increased a great amount since its COVID lows of below $9, I

think the fact that they still have a low relative PE ratio justifies a further

increase in their stock price.