Diageo plc Sponsored ADR (DEO, $201.81): “Raise a glass to Diageo”

Disclosure: The AIM Equity Fund currently holds this position. This article was written by myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article.

Summary

- Diageo plc is a multinational producer and distributor of alcoholic beverages. With over 200 brands under ownership including Smirnoff, Captain Morgan and Guinness, Diageo’s products are consumed in over 180 countries.

- The company is the second largest distiller in the world and still able to act swiftly and adapt to business interruptions, posting June ’20 Net Income of $1.774 billion during a global pandemic.

- Diageo owns a 34% stake in competitor LVMH Moët Hennessy's (OTCPK:LVMHF)

- Large diversification of brands places Diageo in a strong position to adapt to secular trends and changing consumer needs, versus competitors who are highly dependent a singular alcohol type.

- Highly adaptive business model allows Diageo to divest brands from their portfolio that fall outside of consumer favor.

- The firm regularly purchases emerging brands with high consumer demand such as their recent acquisition of actor Ryan Reynold’s Aviation Gin.

- Alcohol consumption globally continues to rise, increasing 70% from 20.9 billion liters in 1990 to 35.7 billion in 2017.

- The global alcoholic beverages market is expected to grow at a CAGR of 8% between 2021-2025 and reach $735.83 billion.

Key Points:

As alcohol consumption across the globe continues to rise, with the alcoholic beverages industry set to reach $735.83 billion by 2025, Diageo is poised to capitalize on a consistent increase in demand with its 200 plus brands that cover the full spectrum of alcoholic drinks from beer to whiskey, vodka to wine. With beverages on sale in over 180 countries, and distilleries in more than 140 sites tactically situated across the globe, Diageo can navigate its way past a maelstrom of supply chain issues that many other rival companies are plagued with. The company utilized the flexibility of such a diverse and sprawling network of distilleries during the Covid-19 pandemic, shifting resources to countries that were less affected by the virus to keep up with demand. Resultingly, the firm recorded a June ’20 net income of $1.774 billion, which is a stark contrast to close competitor Anheuser-Busch (BUD) who recorded a Dec ’20 Net Income of $-650 million.

With over 200 brands under ownership, Diageo is largely unaffected by shifting secular changes as consumer trends for certain types of alcohol change regularly. The company moves hastily when reacting to consumer preferences, selling 19 lower end spirit brands for $550 million as drinkers choose more premium alcohol. Furthermore, a recent acquisition of Aviation American Gin brand, Astral Tequila, and TKYU Sake for $335 million indicates the firm is constantly looking to expand and take over competitors that are performing strongly.

It should be noted that Diageo currently has a debt ratio of 70%. However, the impact of the Covid-19 pandemic degraded the company’s ability to address this debt and the firm had no amortization power left for the most recent fiscal year. While Covid restrictions remain for many bars and establishments where Diageo’s alcohol is sold, profits will continue to lag behind pre pandemic figures, and the company’s inability to pay off debt will linger. With the emergence of the Omicron variant, many countries are again showing signs of shutting down, meaning pre pandemic financials are unlikely to be reached until the pandemic is over for good.

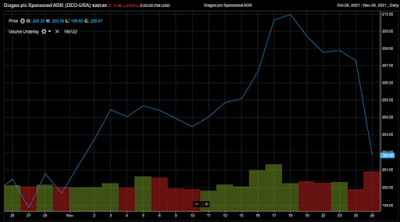

What has the stock done lately?

Jun ’21 sales figures of $17.13 billion are an all-time high for the company, up 15.7% YoY, while Net Income reached $3.579 billion, up 101% YoY. Net Income needs to increase just 14.3 percent to reach pre pandemic figures. The stock price climbed 5.2% this month to an all-time high of $210.15 thanks to strong financials and the promising global recovery from Covid-19. However, since recent talks of a new emerging Omicron strain, the price has since slipped back 3.9% to $201.81. developments of the emerging Covid strain will be the major driving factor behind and further changes in the stock’s price for the near future.

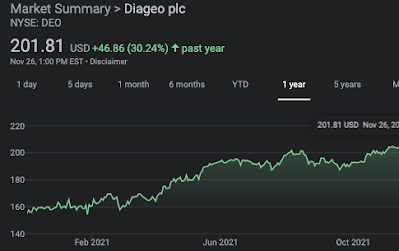

Past Year Performance:

Over the past 52 weeks, the price range for Diageo was $153.67 to $210.15. Diageo experience their 52-week and all-time high in mid-November after announcing a new $75 million malt whiskey distillery in the US and announcing plans to increase total beverage alcohol market share by 50% from 4% in 2020 to 6% by 2030. Diageo’s capital markets day on the 16th of November saw CEO Ivan Menezes announce expected organic growth of at least 16% in the first half of fiscal year 22.

My Takeaway:

I believe Diageo’s impressive ability to generate large

net income even during the midst of a pandemic combined with its 200 plus brand

portfolio and multinational presence puts it in a very favorable position

against any competitor in the industry. I believe Diageo’s revenues have grown slowly

in recent years, signs that the company operates with a stable business model

as opposed to a growth stock. I believe this stock is a definite hold under

current market conditions, with the street maintaining a target price of $222.68.

It would be wise to pay attention to the growing concern over the omicron virus

and the possibility of further major business interruptions that we saw back in

March of 2020.