Skyline Champion Corp. (SKY, $75.99): The Sky’s the Limit

Summary

- Skyline Champion

Corp. (NYSE: SKY) provides

homebuilding services in North America. The company builds a wide variety of

homes including modular homes, ADUs, park-model RVs, and buildings.

- SKY has seen increased success as the company has recovered from the Covid-19 pandemic. Sales increased by 63% and net income increased by 189%.

- The affordable homebuilding industry has seen increased demand especially in North American and Canada.

- SKY acquired ScotBilt homes in 2021 to target the mid-south region including Florida, Georgia, Alabama, and the Carolinas.

- For these reasons, SKY could be approaching a new 52 week high as these should increase value for the firm.

Key Points: Skyline Champion Corp has seen increased value over the past year. As the firm recovers from the pandemic, SKY has seen increased success. SKY announced a 62.6% increase in sales and a 189% increase in net income in their latest earnings report. While the firm has been facing supply chain issues, backlog increased to 1.4 billion because of strong demand and slow supply chain. Ultimately these earnings have allowed SKY to increase to a value of 75.99.

Skyline Champion Corp also acquired ScotBilt Homes this past year. This acquisition should allow for SKY to increase its value. ScotBilt targets many mid-south states and should help increase SKY’s sales in the region.

Another driving factor for SKY is the outlook for the industry. This past year there has been robust demand that has led to huge increases in sales for SKY. As many homebuyer groups such as first-time home buyers and people over 55 years continues to grow, SKY will see success. The growth in these groups should increase sales and ultimately increase operating income.

What has the stock

done lately?

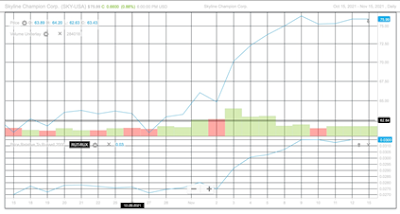

Over the past month SKY has been up 24.17%. This increase can be attributed to SKY’s earnings release on November 2nd. The company reported a 62% increase in net sales and a 189% increase in net income. Besides from this increase, the stock as remained consistent, not steadily increasing or decreasing in value.

Past Year Performance: Over the past year, SKY is up 155.60% in value. The stock now trades at 75.99 compared to 29.73 last year. SKY has seen a steady increase in value as the company recovers from the Covid-19 pandemic with increased sales and income. Look for SKY to continue growing as more homes are sold.

1 Year Stock Chart vs

Benchmark.

My Takeaway:

SKY should continue to increase in value and shareholders should continue to own the stock. As the world has recovered from the pandemic, SKY has seen great results. The increases in sales, income, and backlog has led to an increase in value in SKY. SKY also acquired ScotBilt Homes this past year which has allowed SKY to build more homes in the mid-south region. This combined with “robust demand” should lead to SKY seeing an increase in value as the year wraps up. These three reasons should allow SKY to reach a new 52-week high by the year end.

1 Month Stock Chart.