Euronet Worldwide Inc (EEFT, $118.10): “A Tough Year For Investors”

By: Matt Schlom,

AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

• Euronet Worldwide Incorporated (NASDAQ:EEFT) provides institutions,

companies, and individuals with electronic payment and processing solutions. It

operating segments include electronic payments (EPay), electronic funds

transfer (EFT) processing, and money transfers.

• On March 16th, 2021,

EEFT acquired the Piraeus Bank Merchant Acquiring business of the Greek bank Piraeus

for a total of $360 million.

• On June 3rd, 2021,

EEFT was cleared by the EU Commission to provide ATM outsourcing services to

Latin America.

• Seasonality has influenced the

company’s ability to generate revenues significantly.

• EEFT was founded in 1994 by its

founders Daniel R. Henry and Micheal J. Brown.

Key

points: Euronet Worldwide Incorporated has experienced a slow but steady

rise in its net income between the years ended on December 31, 2011, to

December 31, 2020. EEFT experienced its first decrease in sales growth within

this period between 2019 and 2020 surprisingly considering the surge in electronic

sales occurring during the COVID-19 pandemic. Even more shocking was that

during the same period, EEFT also reported its first net loss in nine years, a

decrease in profitability of approximately -100.98%.

Seasonality has played an

important role in the segments of Euronet Worldwide Inc’s success. The third quarter of the fiscal year is

typically when EEFT electronic funds transfer segment is exposed to its heaviest

demand for dynamic currency conversion. The money transfers market typically sees

its highest levels of demands in May, continuing through the fourth quarter of

the year. Holiday seasons greatly influence the electronic payment and electronic

fund transfer processing segments, with a rise in exposure leading up to the holidays,

and a fall in exposure following the holidays.

Regarding sales, Euronet Worldwide

Inc has seen a 5-year CAGR in sale of 7.0%, which has shown great promise in

the company’s profitability. EEFT has struggled with significant operating

losses, which has greatly affected their abilities to run efficiently.

Furthermore, EEFT has seen a 5-year CAGR in EBITDA of 0.4%, and even more

concerning is their 5-year CAGR in EBIT of -5.6%.

What

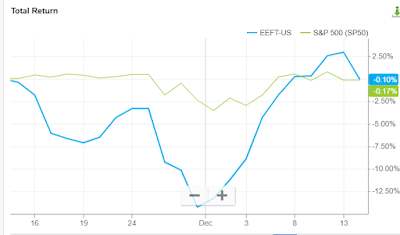

has the stock done lately?

Euronet Worldwide Inc’s share

price performance has been volatile over this past year, in fact, the stock has

seen as overall negative trend that began in June 2021 and has followed this

trend up until the start of December. However, the potential for EEFT’s share

price to rebound is promising with the prevalent use of their services during the

holiday season.

Past

Year Performance: After reaching a yearly

high share price of $164.67 in early March, its price began to dwindle before reaching

a dropping point in mid-June, followed by a negative trend in the share price. The

lowest the price per share reached was $101.37 occuring at the end of November,

which marked a YTD change of -18.51%. Fortunately, the incoming holiday season has

shown promise of a rebound in the EEFT’s price per share.

My

Takeaway

EEFT is a pure growth stock with

a dividend yield and payout ratio of 0%. Granted that the stock has been trending

downwards since mid-June, which can be seen by its share price value dropping by

approximately -19.59%, now would be a perfect time for investors to make an investment

while the price is still low. An investment in EETF also shows high potential

for growth in the future as our economy and our society has become more

accustomed to and fond of the use of electronic payment strategies.