Stitch Fix Inc. (SFIX, $29.06): “SFIX suits perfeclty”

By: Luca Cardamone, AIM Student at Marquette University

Disclosure: The AIM Equity Fund currently holds this position. This article was written by myself, and it expresses my own opinions. I am not receiving compensation for it and I have no business relationship with any company whose stock is mentioned in this article.

Summary

• Stitch Fix Inc. (NASDAQ: SFIX, $29.06) Stitch Fix Inc. is an online personal styling service that delivers customs outfits to men, women, and kids. The company operates in the United States and internationally in the United Kingdom. Besides, SFIX is 100% digital and sells its products through its Website and mobile app. The company was founded in 2011 and is headquartered in San Francisco, CA.

• SFIX utilizes algorithms, data science, and stylist’s expertise to match the size, budget, and style desired by the customers.

• SFIX charges clients for each Fix. A fix is Stitch Fix-branded box that contains a complete custom outfit with accessories. The company also offers an annual Style pass that allows unlimited styling for the year for $49.

• SFIX is benefitting from the growing expansion of e-commerce that continues to take market share from brick and mortar retails. The company business model embraces this trend and looks to get ahead of the competition by “personalizing” the shopping experience with personalized shopping advice.

• SFIX is approaching its 52-week high and being one of the biggest COVID beneficiaries could be an important catalyst.

Key points: Stitch Fix is the world’s leading online personal styling service. SFIX is innovating the online shopping experience with a mix of algorithms and stylist’s expertise. These characteristics are helping people to save time buying clothes and to find their best styles. With the COVID-19 pandemic and consumers shifting their purchasing behavior online, the company business model has kept a strong client engagement. According to the Q2 2020 report from the U.S. Census Bureau, U.S. retail e-commerce reached $211.5 billion, up 31.8% from the first quarter. Besides, online penetration for clothing in the US and UK has increased at a CAGR of 17% in the past 5 years.

Throughout the years, SFIX has grown its client base by increasing the number of active users. Active clients are now 3.4 million which represents a 9% YoY growth. In addition, the company has strong client retention that is continuing to drive revenues and demand. SFIX’s business model is capital effective and highly scalable, and, in my opinion, it has plenty of room to grow, especially in today’s settings. The company has constantly improved since its first days and management expects to generate positive free-cash-flow in Q4. In addition to the growing performances, the company is strengthening its balance sheet. In June, SFIX closed a $90 million revolving credit facility. The company will also gradually decrease its SG&A expenses that along with sustained revenue growth will increase operating margins.

The company is in a great position to capitalize on growing trends. Not only SFIX is tacking advantage of e-commerce but it is improving the online experience by offering an interactive model that engages with customers. SFIX’s data science advantage is one of the company’s most important competitive advantages as competitors are unable to match the personalized and fun shopping experience. Finally, as people’s shopping habits are changing and moving towards digital channels SFIX’s model will not be affected by future COVID-19 related issues and is in a great position to keep growing.

What has the stock done lately?

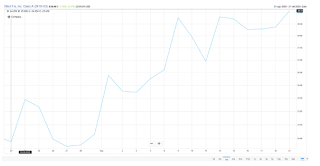

SFIX was incorporated into the AIM small-cap equity fund on January 31st, 2020. The stock was purchased at the price of $22.74 and since then it increased to 29.06$ below its price target of $31.39. Since its addition, SFIX contributed to the small-cap portfolio with a 25% upside. After reaching a 52-week high of $30.44 in February 2020 the stock sank 60% hitting its 52-week low, during the COVID-19 pandemic in March. Since April, the stock has appreciated over 145% due to its unique business model and positive earnings results.

Past Year Performance: Since last year, SFIX has increased ~30% in value. Sales in Q3 were $372 million which results in a 9% decrease YoY. The decrease can be attributed to the COVID-19 pandemic panic and the reduced expenses on advertising. The company relies on consumer spending and the more conservative customer’s approach affected SFIX’s revenues. Even though the company had less advertising it was able to grow its active customers that are now 3.4 million, a 9% growth YoY. In conclusion, in early June the company strengthened its liquidity position and its balance sheet by closing a $90 million revolving credit facility.

Source: FactSet

My Takeaway

With the stock relying on customer engagement and online spending, I believe SFIX has more growth in store for the AIM small-cap equity fund. With the US retail e-commerce increasing more than 30% from the first quarter, and 45% YoY, SFIX is in a great position to take advantage of the post-pandemic spending behavior. The stock has almost completely recovered from the March market crash and is less than 10% down from its 52-week high. Besides, during March, the company did a great job keeping a strong client engagement and momentum that kept a constant and healthy demand. One of the main risks for this company, being 100% online, is the possibility of a data breach. However, I believe that management is doing an outstanding job hiring talented web engineers and constantly improving the data science department. In conclusion, I believe that SFIX’s business model can give its best during this period and can benefit from consumers shifting their purchasing behavior online. Besides, the competent management team, and the strong financial position are reasons why I rate this stock a hold.

Source: FactSet