Trex Company Inc. (TREX, $132.49): “No Splinters in This Trex”

By: Michael

O’Donnell, AIM Student at Marquette University

Summary

• Trex Company Inc. (NYSE: TREX) is the world’s largest manufacturer

of composite decking products. These wood-alternative products are made up of

95% recycled materials such as plastics and reclaimed wood. Trex is separated

in two reportable segments: Residential (94% of FY20 revenue) and Commercial

(6%). Residential is responsible for decking, fencing, outdoor furniture, etc.

Whereas Commercial provides architectural and aluminum railing and staging

equipment.

• Trex is continuing to see

exceptional growth in the top and bottom line.

• Management expects composite to

control 24-25% of the total decking market.

• Construction of a 3rd

production site will begin in 2022 in Little Rock, Ar.

• Trex has received lots of

recognition in 2021.

Key

points: When Trex reported Q3 2021 earnings investors were impressed.

Revenue and Net Income were up 45% and 73% YOY, respectively. Gross margins

were 150bps better than Q3 of 2020. This improvement is impressive considering

that management noted they faced 750bps of pressures due to inflation, higher

transportation costs, and labor shortages. Gross margins are expected to

improve in Q4 as price increases will be applied to their products.

Today lumber prices are almost 2x

greater than prior pandemic levels. This has allowed composite to gain substantial

ground in the $4.1 billion total decking market. In 2020 composite held about

22% of the market with wood holding the remainder. By the end of this year, it

is projected that composite will hold 24-25%. Each percentage gain represents

more than $50 million in composite sales. This storm of higher lumber costs,

decreased maintenance costs, and positive environmental effect is greatly

helping composite gain share in this market.

To capitalize on this gain in

market share, Trex will be starting production on a third plant in Little Rock,

AR. This move gives the company greater proximity to raw materials and access

to a strong labor market. Trex also invested a combined $200 million in their Nevada

and Virginia sites to increase capacity.

In 2021, Trex has received lots

of recognition such as: America’s Most Trusted Outdoor Decking Brand, one of

America’s Best Mid-Size Companies by Forbes, Greenest Decking, and many others.

These awards speak to their strong management team, great products, as well as their

focus on how they treat our environment.

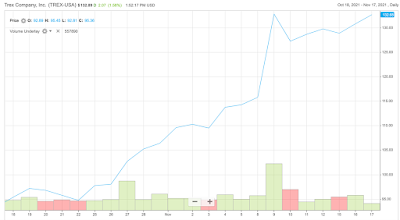

What

has the stock done lately?

Since

the Q3 Earnings Report on November 8th, Trex share price has

increased by 14.36%. In mid-October shares were hovering above $90 due to RSI

levels being around 28. This overselling was not due to any news stories.

Past

Year Performance:

Trex has increased 81.87% over

the past year. If management is correct about gross margins being able to hit

north of 40% in 2022 as well as the increase in revenues, the share price will

continue to outperform the Russell 2000.

My

Takeaway

Trex’s management has continued

to put up strong numbers in times of inflationary and transportation pressures

as well as labor shortages. This ability and their investments in production

have shown that they are poised to capture even more of the total decking

market. I believe that Trex will continue to grow for the foreseeable future,

and it is in the best interest of the AIM Small Cap Portfolio to hold this

investment.