Fabrinet (FN, $120.97): “Fabrinet Creator of New Chips”

By: Kevin

Igoe, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation for

it and I have no business relationship with any company whose stock is

mentioned in this article.

Summary

• Fabrinet. (NYSE: FN) is an international information technology

company that engages in the provision of optical packaging and electronic

manufacturing services to original equipment manufacturers.

• Fabrinet receives Cisco 2021

EMS partner of the year award for battling through a challenging operational

and commercial climate through 2021 while continuing to perform tremendously

and be a good partner.

• Fabrinet selected by Aeva to produce

the worlds first 4D LiDAR Chip Module using automated driving and beyond using

silicon photonics technology.

• Recently hit a new 52 week high

of $122.53 on November 8, 2021.

• Subject to risks of current ongoing

U.S. China Trade dispute which could have negative effect on 2022 financial

conditions and operating results.

Key

points:

CEO Seamus Grady announced their

Covid-19 vaccination program for Thailand employees has been a great success

and now almost 99% of employees have been vaccinated. This is important because in July 2021 this

effort went underway as many facilities were forced to shut down due to

outbreaks increasing their cost of revenue for the year.

Fabrinet President and COO

recently sold recently sold 2.5 million of his Fabrinet stock decreasing their

holding size by roughly 29%. This is

making shareholders cautious but there is no need to worry because Fabrinet is

increasingly growing profits year over year.

Fabrinet plans to emphasis their

growth strategy more moving forward as a firm their growth strategy includes strengthening

their presence in the optical communications market, continuing to expand their

customized optics and glass vertical integrations, and evaluating strategic

acquisitions.

Moving forward they plan to continue

to establish New Product Introduction (NPI) centers to generate and transfer

new business to their Thailand operations.

Like the recently opened NPI in Silicon Valley they want to expand these

to help generate more business to be available for transfers to Thailand.

What has the stock done lately?

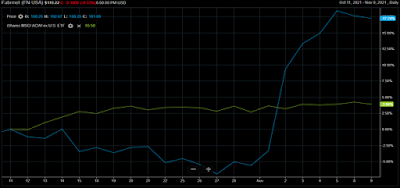

Throughout the last month

Fabrinet has increased an impressive 17.24% being up $17.53 coming towards the

end of 2021. Which was in part due to

announcements made in the FY 21 Q4 earning reports such as revenue of 509.6

million was earned which was more than forecasted for this quarter also their

non-GAAP EPS was $1.31 above their forecasted numbers for this quarter.

Past Year Performance: Fabrinet

has increased 53.65% in value over the past year. Up a total of $41.70 due to major increases

in revenues, gross profit, and operating income respectively going up by 237.5

million, 35.3 million, and 33.4 million.

Proving to shareholders Fabrinet is continually growing on a year-over-year

basis.

My

Takeaway

This new opportunity for Fabrinet

to help Aeva manufacture the worlds first 4D LiDAR chip module shows

shareholders they hold the ability to tap into this new market ahead of their

competitors. Aeva’s decision to use

Fabrinet to help produce these also emphasizes how Fabrinet is ahead of its

competitors in respect to their deep expertise in silicon photonics integrated

devices and advanced optical systems.