Macquarie

Group Limited (MQG, $139): “Investment Banks and Taxes Loopholes”

By: Nasser

Hyat-Khan, AIM Student at Marquette University

Disclosure:

The AIM Equity Fund currently holds this position. This article was written by

myself, and it expresses my own opinions. I am not receiving compensation, and

I have no business relationship with any company whose stock is mentioned in

this article.

Summary

• Macquarie Group Limited (ASX:MQG) engages in the provision of

banking, financial, advisory, investment, and fund management services. $MQG

operates globally with most of its revenue obtained from Asia/Pacific and North

America.

• Australia’s largest investment

bank is known for investing in energy and infrastructure technologies that

empower innovation for a better future. The green investment team at MQG has

paired up with France’s Engie and U.S. energy company Fluence to build an

energy storage facility in Australia.

• MQG is under heavy pressure

amid leaked emails surrounding an $80 billion German tax scandal.

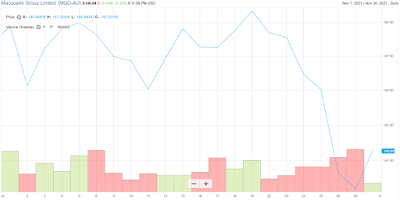

• Share price for MQG has fallen

7% since the news leaked resulting in a drop from all-time highs. This price

action presents a potential buying opportunity for investors.

Key

points: Macquarie Group Ltd. Is in a

predicament where once a company of stable growth now faces the difficulty of

finding the next steps to fix a decade old problem. Australia’s largest

investment bank is facing backlash over an $80 billion dividend scandal from a

German tax scheme.

According to tax authorities it

appeared as though there were two simultaneous owners of shares that did not

have dividend rights. Even foreign investors were eligible to claim tax

reimbursements on shares that they did not own. Macquarie’s involvement in the

scheme in October 2010, included lending money to increase the volume of such

trades. The proposal provided hundreds of millions to overseas funds and in

return MQG would receive up to $30 million for each lending agreement. It is expected

that MQG will take action to make these wrongs right and it is estimated that

the investment bank has paid back $150 million to the German government since

the loophole removal. However, this may pose a buying opportunity if Macquarie

is able to address the situation effectively and in a swift manner.

In addition to the discounted

stock price from legal issues, the battery storage project poses strong upside

for Macquarie that might just cancel out the tax scandal. Macquarie is working

with Engie, a commercial electricity provider, and Fluence, the global leading

energy storage technology provider. This exciting venture known as the

Hazelwood project will be able to store and deliver 150 megawatt-hours of

energy with potential to expand to 1600 MW and supposedly costing less than

$107 million. This project will assist in providing back-up power when needed

during heatwaves and unexpected power outages. The project has an expected

completion date of November 2022.

What

has the stock done lately?

Since news of this scandal

surfaced on November 23, 2021, Macquarie’s stock price has dropped over 7%.

Prior to the news break, MQG was trading at all-time highs at around $150 per

share and had a ~40% return since the beginning of the fiscal year.

Past

Year Performance: MQG has increased over

40% in value over the past year, but since the scandal release the stock is a

bargain for the near-term future. It’s times like these in a growth stock’s

life that give the investor the opportunity to buy shares at a discount with

the expectation that circumstances will return to normal.

My

Takeaway

The German tax scandal that

Macquarie Group Limited has been a part of is a failure in management to

foresee the consequences of their actions and a lack of concern from lawyers

who consulted with MQG. Had the lawyers not brushed the tax loophole under the

table Macquarie would have not been in the position that it is in. The

negativity surrounding this will impact MQG’s future operations for several

years to come. However, this can be a good thing, if Macquarie is more cautious

and learns from its mistakes then the issue will not happen again. Presumably

this will allow the stock price to return to its normal growth rates.

In addition, the green investment

arm of Macquarie is making significant headway in making clean technology more

feasible for consumers and promoting a greener future. If this project is

completed by the expected date and operates to its potential, there is

possibility for strong upside in stock price. Furthermore, Macquarie’s

long-term vision and focusing on funding for high rated ESG company’s shows

promise for future projects the bank may take on in the future. Based on the

price drop from the incident Macquarie is priced at a discount and the

environmentally beneficial projects that it is investing in I give MQG a buy

rating. It is the perfect opportunity to purchase shares of a growing company

at a discount.